Wohin mit dem Geld: Wie lege ich eine Million Euro am besten an?

Wie lege ich 1 Million Euro am besten an? Wer sich in der glücklichen Lage befindet, sich diese Frage zu stellen, dürfte wissen, dass es diverse Anlagestrategien gibt. Bei dieser Größenordnung müssen wirklich sämtliche Umstände und Bedingungen beleuchtet werden. Wer aktuell 5.000, 10.000, 20.000, 50.000, 100.000 oder 1 Million Euro anlegen möchte, sollte sich gut informieren. Es gibt zahlreiche Möglichkeiten, diese Situation geschickt für die eigenen Sparziele zu nutzen.

§ Rechtlicher Hinweis: Dieser Artikel dient der Information und stellt lediglich unsere Einschätzung der verschiedenen Anlagemöglichkeiten dar. Bei unseren Erläuterungen handelt es sich ausdrücklich nicht um Anlageempfehlungen.

1 Million Euro anlegen

Welche Möglichkeiten gibt es, 1 Million anzulegen? Grundsätzlich sollten Investoren bei der anhaltend hohen Inflation den Blick auf Sachwerte lenken.

| Aktieninvestment 1 Mio. EUR | Immobilieninvestment ohne Fremdkapital | Immobilieninvestment mit Fremdkapital 1 Mio. EUR | Sparbuch 1 Mio. EUR | Tagesgeld * | |

| Rendite auf das eingesetzte Kapital Ca. -10 | – +10% p.a. | Ca. 4-5,5% p.a. (je nach Standort) | Ca. 6-15% p.a. (Je nach Höhe des Fremdkapitals und Standort) | Ca. 1,50% p.a. | Ca. 3,0 – 3,2 % p.a. |

|---|---|---|---|---|---|

| Sicherheit | Bei langem Anlagehorizont: Relativ sicher | Relativ sicher | Relativ sicher | Bis 100.000€ pro Bankeinlage garantiert | Bis 100.000€ pro Bankeinlage garantiert |

| Schwankungsanfälligkeit | Hoch (z.B. Corona-Schock => -30%) | Gering | Gering | Keine | Keine |

| Liquidität | Relativ hoch | Mittel- bis langfristiger Anlagehorizont notwendig | Mittel- bis langfristiger Anlagehorizont notwendig | Relativ hoch | Hoch |

Festgeldangebote im Stil von „6 Monate lang, nur für Neukunden …“ haben wir ebenso wenig berücksichtigt wie Angebote von in Deutschland praktisch unbekannten, kleinen Banken.

➡️ Sie sehen: Das Sparbuch ist in allen Bewertungskategorien vorne – nur nicht bei der Rendite. Und die ist natürlich für viele das mitentscheidende Kriterium.

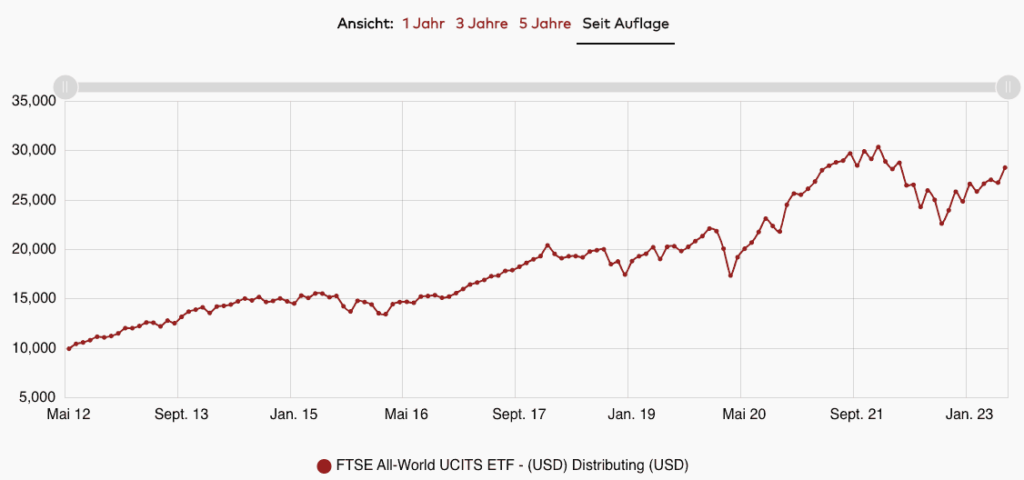

➡️ Weiter zu den Aktieninvestments, möglicherweise auch breit gestreut in Form eines oder mehrerer ETFs. Anzumerken ist, dass die Schwankungsanfälligkeit bei Aktieninvestments recht hoch ist. Der Anleger muss in manchen Marktphasen lange warten, bis der mögliche Turbo der Aktienmärkte (wieder) zündet. Ist eine Million Euro in Aktien angelegt und der Markt ist rückläufig, so ist das Kapital zunächst gebunden (sofern der Anleger nicht mit Verlusten verkaufen möchte).

Blickt man zum Beispiel auf die Entwicklung des MSCI World zwischen 2014 bis 2016, so standen nach 2 Jahren Haltedauer 0% Performance zu Buche:

Bei Aktieninvestments müssen Anleger immer wieder “Sitzfleisch” haben, um flache oder negative Marktphasen aussitzen zu können (Quelle: Vanguard)

➡️ Eine vermietete Eigentumswohnung (Renditeimmobilie), die mit 1 Million € Eigenkapital gekauft wird, erwirtschaftet je nach Standort und Mieteinnahme im Normalfall zwischen 4 und 5,5% Rendite. Das sind pro Jahr zwischen 40.000 und 55.000 Euro vor Kosten und Steuern. Dank der recht hohen Sicherheit und geringen Schwankungsanfälligkeit kann ein Anleger, der so 1 Million Euro investiert, mit diesem Cashflow relativ sicher rechnen.

➡️ Die sinnvollste Möglichkeit, in eine Immobilie zu investieren, ist die Nutzung von Fremdkapital. So kann ein Anleger in Immobilien nicht nur 1 Mio. anlegen, sondern – zum Beispiel bei 50% Fremdkapitaleinsatz – ein Immobilienvolumen von 2 Millionen Euro erwerben. Auf der Kostenseite addieren sich Zinskosten sowie die Tilgung des Darlehens zu den restlichen Ausgaben. Bei einer oder mehreren Immobilien im Wert von 2 Millionen Euro liegen die Mieteinnahmen dementsprechend deutlich höher, in unserem Beispiel bei 80.000 bis 110.000 Euro. Davon werden die Nebenkosten sowie Zins und Tilgung abgezogen. Es bleibt ein Betrag übrig, der dem Anlieger einige Annehmlichkeiten ermöglicht.

Schauen wir uns kurz die aktuelle Situation an. Steigende Zinsen und hohe Inflation sorgen dafür, dass sich Ihr Vermögen stetig verringert. Das konterkariert die Sparziele von Anlegern massiv, und Sie fragen sich: In was investieren?

Aber lassen Sie uns mit einem positiven Blick in die Zukunft blicken, denn – wie immer – kommt es darauf an, wie man mit den Umständen umgeht. Ihr Geld nun unter dem Kopfkissen zu horten oder auf der Bank zu lassen, kann keine Lösung sein. Gerade in diesen Zeiten sollten Sie Ihr Geld auf keinen Fall liegen lassen.

Anlagemöglichkeiten Übersicht

Wenn Sie sich fragen, wie und wo Sie Ihr Geld aktuell richtig anlegen können, sollten Sie gewisse Kriterien im Auge behalten. In unserer aktuellen Einschätzung betrachten wir die folgenden Kriterien:

- Rendite

- Sicherheit

- Flexibilität

- Komplexität

- Zukunftschancen

- Grünes Gewissen

- Passende Lebensphase

- Steuern sparen

Bei der Rendite handelt es sich um den Ertrag, den Sie mit Ihrer Kapitalanlage erzielen. Die Rendite steht im engen Zusammenhang mit dem Kriterium Sicherheit. Wählen Sie eine sichere Geldanlage, hält sich die Höhe der Rendite üblicherweise in Grenzen. Wollen Sie eine möglichst hohe Rendite erzielen, dürfen Sie nicht zu sehr auf Sicherheit setzen. Eine hohe Rendite ist meistens auch mit einem hohen Risiko verbunden.

Was die Flexibilität angeht, so beziehen wir uns auf die Verfügbarkeit Ihres Vermögens. Was heißt das? Nun, eine Aktie können Sie innerhalb von wenigen Sekunden verkaufen, aber auch nicht in allen Marktsituationen. Wenn Sie Ihr Vermögen in Festgeld anlegen, ist es für einen bestimmten Zeitraum nicht verfügbar. Das bedeutet, dass Sie sich bei Ihrer Überlegung, wie Sie Ihr Geld investieren, darüber im Klaren sein sollten, ob Sie in absehbarer Zeit auf das Geld zurückgreifen wollen oder nicht.

Die Komplexität sollte auch stets berücksichtigt werden, denn nicht jede Anlageform eignet sich für Anfänger. Wenn Sie bisher noch keine Erfahrungen mit Geldanlagen gemacht haben, dann sollten Sie auf zu komplexe Finanzprodukte lieber verzichten oder sich zumindest schrittweise herantasten beziehungsweise beraten lassen.

Um die Rendite, Flexibilität und Sicherheit einzustufen, eignet sich das magische Dreieck der Geldanlage. Des Weiteren achten wir auf die Zukunftschancen der einzelnen Anlageformen. Welche Geldanlage wird voraussichtlich auch in der Zukunft noch Gewinn abwerfen?

Das grüne Gewissen kam vor allem in den letzten Jahren immer häufiger auf die Liste der Anforderungen einer geeigneten Kapitalanlage. Die Menschen leben bewusster und nachhaltiger und erwarten eben diese Eigenschaften auch von Ihren Finanzprodukten. Welche Anlagemöglichkeit für Sie die richtige ist, hängt außerdem stark mit Ihrer aktuellen Lebensphase zusammen.

Sind Sie Student? Haben Sie Kinder? Sind Sie verheiratet? In welchem Lebensabschnitt befinden Sie sich gerade? Und für wie lange möchten Sie Ihr Geld anlegen? Wenn Sie Ihr Leben noch vor sich haben, ergibt es beispielsweise Sinn, langfristig zu denken und monatlich kleinere Beträge anzulegen.

Als letztes Kriterium beleuchten wir den steuerlichen Aspekt einer Geldanlage. Wo gibt es Optionen, Steuern zu sparen (zum Beispiel mit Immobilien)? Wir konzentrieren uns bei unserer Einschätzung auf die gängigsten Anlageformen: Tagesgeld/Festgeld, Staatsanleihen, Aktien/Fonds/ETFs, Gold und Immobilien.

Je nach Höhe des verfügbaren Kapitals kommen unterschiedliche Investmentarten beziehungsweise Portfoliomischungen in Frage. Nachfolgend zeigen wir auf, mit welcher Summe Sie welche Möglichkeiten haben.

5.000 Euro anlegen

In was investieren, wenn ich 5.000 Euro anlegen möchte?

Immobilien:

Für viele überraschend: Mit 5.000 Euro ist ein Investment in eine Immobilie als Kapitalanlage möglich. Die Idee dabei: Eine Wohnung in einer Lage kaufen, die gute Vermietbarkeit sicherstellt, und den Kaufpreis mittels eines Bankdarlehens abdecken. Die 5.000 Euro werden für die Kaufnebenkosten verwendet. Mit den monatlichen Mieteinnahmen wird das Bankdarlehen Stück für Stück zurückbezahlt und die Zinsen zu einem großen Teil bedient.

Eine kleine monatliche Investition ist meist jedoch notwendig. Später, wenn der Kredit abbezahlt ist, entsteht ein attraktiver monatlicher Cashflow in Höhe der Mieteinnahme – natürlich gilt es auch hier weiterhin die Kosten davon abzuziehen. Fraglos eine der besten Geldanlagen momentan, wenn man 5.000 Euro Eigenkapital zur Verfügung hat. Risiko (“Betongold”) und Eigenkapitaleinsatz (Einsatz von Fremdkapital) sind dabei gering.

Bewertung: ⭐⭐⭐⭐ (4/5)

Staatsanleihen:

Staatsanleihen bieten inzwischen wieder etwas attraktivere Zinssätze. Darüber hinaus hätten Sie eine „sichere“ Position in Ihrem Portfolio, bei Staatsanleihen spricht man nämlich auch vom „risikofreien Zinssatz“. Dass dieser Zinssatz allerdings gar nicht wirklich risikofrei ist, zeigt das Beispiel der Schuldenobergrenze in Amerika.

Die Grenze wurde in der ersten Jahreshälfte 2023 einmal mehr überschritten, woraufhin ein neuer Kompromiss gefunden werden musste, um eine Staatspleite zu verhindern. Es wurde sich darauf geeinigt, dass die Schuldenobergrenze bis 2025 ausgesetzt werden kann, sofern im selben Zeitraum die Staatsausgaben reduziert werden. Eine ähnliche Situation gab es auch im Jahre 2021.

Bewertung: ⭐⭐ (2/5)

Aktien/Fonds/ETFs:

Aktien, Fonds und ETFs können geeignete Anlageformen sein. Allerdings kann es sinnvoller sein, einen Sparplan einzurichten und kein Einmalinvestment zu tätigen. Auf diese Weise lässt es sich vermeiden, zu einem teuren Einstiegszeitpunkt zu kaufen. Eventuell wäre der Erwerb einer Immobilie in Kombination mit einem Aktien- oder ETF-Sparplan denkbar.

Bewertung: ⭐⭐⭐⭐ (4/5)

Gold:

Grundsätzlich ist Gold sehr gut als Bestandteil eines Portfolios geeignet.

Bewertung: ⭐⭐⭐ (3/5)

Tagesgeld/Festgeld:

Ein Investment in Tages- oder Festgeld kann sich aktuell lohnen, da die Zinsen wieder etwas gestiegen sind. Jedoch sind diese noch immer eher gering. Das Tagesgeldkonto punktet dazu beim Thema Flexibilität, da Ihr Geld täglich verfügbar ist. Auch Ihr Festgeldkonto können Sie unter Umständen schon vor Ende der Laufzeit kündigen und sich das Geld auszahlen lassen. Allerdings ist eine solche Vorgehensweise mit hohen Kosten und Zinsverlust verbunden.

Bewertung: ⭐⭐⭐ (3/5)

10.000 Euro anlegen

Welche Möglichkeiten gibt es, 10.000 Euro anzulegen?

Immobilien:

Ein Immobilieninvestment lohnt sich umso mehr, wenn es mit dieser Anlagehöhe getätigt wird. Bei dieser Summe stehen bereits mehr Immobilien zur Verfügung, die erworben werden können. Immobilien sind bei 10.000 Euro zur Verfügung stehendem Kapital also ein wichtiger Teil der Antwort auf die Frage: In was investieren?

Bewertung: ⭐⭐⭐⭐⭐ (5/5)

Staatsanleihen:

Bei 10.000 Euro stellen Staatsanleihen eine mögliche Beimischung des Investments dar. Außerdem erleben wir aktuell die Zinserhöhung, was zu steigenden Renditen bei den Staatsanleihen führt.

Bewertung: ⭐⭐ (2/5)

Aktien/Fonds/ETFs:

Einen Teil des Portfolios in Aktien oder Fonds anzulegen, kann Sinn ergeben – je nach eigener Anlagestrategie und -horizont.

Bewertung: ⭐⭐⭐ (3/5)

Gold:

Auch bei dieser Anlageklasse ist es empfehlenswert, Gold mit einer anderen Investition zu kombinieren.

Bewertung: ⭐⭐⭐(3/5)

Tagesgeld/Festgeld:

Die beiden Geldanlagen sind für die Sicherheit des Geldes bekannt. Bis zu 100.000 Euro pro Bank können staatlich abgesichert werden. Der weitere Vorteil kann in der hohen Flexibilität liegen, allerdings kann dies beim Festgeld weitere Kosten verursachen.

Bewertung: ⭐⭐⭐ (3/5)

20.000 Euro anlegen

20.000 Euro anlegen – in was investieren?

Immobilien:

20.000 Euro können ein perfektes Budget darstellen, um ein nachhaltiges Immobilieninvestment in eine oder mehrere Immobilien umzusetzen. Genau wie bei einem Kapital von 10.000 Euro sollte das Eigenkapital in Höhe von 20.000 Euro für die Kaufnebenkosten eingesetzt werden. Mit dem Unterschied, dass Sie dafür gegebenenfalls auch mehrere Immobilien oder eine Wohnung an einem A-Standort erwerben können.

Der Kaufpreis wird wieder über eine Bank finanziert und Ihre Mieter zahlen den Kredit für Sie zurück. Wichtig ist, einen günstigen Kredit abzuschließen. Hier empfiehlt es sich, einen Finanzierungsvergleich durchzuführen. Diese Art des Investments kann einen Hauptbestandteil Ihrer Altersvorsorge ausmachen.

Bewertung: ⭐⭐⭐⭐⭐ (5/5)

Staatsanleihen:

Bei einer Anlagesumme in Höhe von 20.000 Euro gelten Staatsanleihen in der Regel als ein gewisser Sicherheitsanker.

Bewertung: ⭐⭐ (2/5)

Aktien/Fonds/ETFs:

In diesem Fall lohnt sich eine sogenannte Asset Allocation für passive Privatanleger. Hier geht es um ein diversifiziertes Portfolio, das gut für langfristige Anlagehorizonten geeignet ist.

Bewertung: ⭐⭐ (2/5)

Gold:

Prinzipiell kann eine Beimischung von Gold in das Investmentportfolio bei 20.000 Euro ein sinnvoller Schachzug sein.

Bewertung: ⭐⭐⭐(3/5)

Tagesgeld/Festgeld:

In dieser Anlageklasse kann es sein, dass sich Ihr Geld nicht so vermehrt, wie Sie es sich wünschen. Aber Sie können flexibel auf Ihr Geld zugreifen. Die beiden Anlagearten können Sie als finanzielle Rücklage nutzen. Mindestens zwei bis drei Nettogehälter sollten auf Ihrem Konto liegen. Sowohl Tages- als auch Festgeld bieten eher geringe Zinsen. Es gibt daher deutlich bessere Alternativen, um Ihr Geld renditeorientiert anzulegen.

Bewertung: ⭐⭐⭐ (3/5)

30.000 Euro anlegen

Wie sieht die Geldanlage bei 30.000 Euro aus?

Immobilien:

Bei 30.000 Euro können Sie zunächst wie mit 20.000 Euro verfahren. Das bedeutet: Kauf einer oder mehrerer Immobilien, die über eine Bank finanziert werden.

Bewertung: ⭐⭐⭐⭐⭐ (5/5)

Staatsanleihen:

Wer in dieser Anlageklasse (30.000 Euro) einen sicheren Hafen sucht, kann in Staatsanleihen fündig werden.

Bewertung: ⭐⭐ (2/5)

Aktien/Fonds/ETFs:

Aktien können sinnvoll sein. Allerdings muss der Anleger sehr risikobereit sein. Es kann sich anbieten, das Investment in Aktien mit dem Erwerb einer Immobilie zu kombinieren. Auf diese Weise bietet die Immobilie Sicherheit und der Anleger kann einen Teil seines Geldes risikoreich in Aktien investieren. Wer hingegen kein Risiko eingehen will, wird sein Immobilieninvestment vermutlich eher mit Staatsanleihen oder Gold kombinieren.

Bewertung: ⭐⭐ (2/5)

Gold:

Gold eignet sich gut als kleiner Bestandteil des Investments. Das restliche Vermögen können Sie in Immobilien investieren.

Bewertung: ⭐⭐⭐ (3/5)

Tagesgeld/Festgeld:

Obwohl Sie geringe Zinsen bei Tages- oder Festgeld haben, steht Ihnen Ihr Geld flexibel zur Verfügung.

Bewertung: ⭐⭐⭐ (3/5)

50.000 Euro anlegen

Wie können 50.000 Euro lukrativ angelegt werden?

Immobilien:

Mit 50.000 Euro kann ein Anleger ein immobilienbetontes Portfolio aufbauen, das durch weitere Bausteine ergänzt werden kann. So können Sie beispielsweise 2/3 des Vermögens in Immobilien investieren. Die Vorgehensweise ist die gleiche wie bei den oben beschriebenen 30.000 Euro. Das andere Drittel kann sinnvoll auf die weiteren Anlagestrategien aufgeteilt werden.

Bewertung: ⭐⭐⭐⭐⭐ (5/5)

Staatsanleihen:

Staatsanleihen sind als Alternative zu Gold für die Integration in ein Mischportfolio denkbar.

Bewertung: ⭐⭐ (2/5)

Aktien/Fonds/ETFs:

Hier kann sich eine Beimischung in das Portfolio eines Anlegers anbieten, der über ein mittleres bis hohes Risikoprofil verfügt.

Bewertung: ⭐⭐⭐ (3/5)

Gold:

Wie Staatsanleihen stellt auch Gold eine sichere Komponente eines Mischportfolios dar.

Bewertung: ⭐⭐⭐ (3/5)

Tagesgeld/Festgeld:

Sie erhalten als Kapitalanleger zwar niedrige Zinsen bei dieser Anlageform, dafür ist Ihr Geld sicher auf dem Konto angelegt.

Bewertung: ⭐⭐⭐ (3/5)

100.000 Euro anlegen

Mit 100.000 Euro können Sie ein diversifiziertes Portfolio erstellen, mit einem Fokus auf Immobilien.

Immobilien:

Mit 100.000 Euro ist es möglich, mehrere Immobilien als Kapitalanlage zu erwerben. Diese Immobilien sind die Basis eines diversifizierten Portfolios, das entweder stark durch Gold und/oder Staatsanleihen abgesichert wird oder einen risikoorientierten Bestandteil in Form von Aktien und ETFs enthält.

Bewertung: ⭐⭐⭐⭐⭐ (5/5)

Staatsanleihen:

Wie oben bereits erwähnt, können Staatsanleihen als Absicherung des Portfolios dienen.

Bewertung: ⭐⭐⭐ (3/5)

Aktien/Fonds/ETFs:

Für risikoaverse Anleger ist es wohl keine sinnvolle Option, das Portfolio mit Aktien zu befüllen. Bei mittlerem Risikoprofil kann eine Beimischung von Aktien oder ETFs clever sein, wenn das Immobilienportfolio außerdem durch Gold und/oder Anleihen abgesichert ist.

Bewertung: ⭐⭐⭐ (3/5)

Gold:

Gold kann eine gute Alternative zu Staatsanleihen sein, um das Portfolio abzusichern. Gold weist ebenso einen hohen Sicherheitsgrad auf, allerdings hält sich die Rendite in Grenzen. Die Unabhängigkeit von Krisen macht Gold als sicheren Anker für schwere Zeiten attraktiv. Wenn Gold gekauft wird, dann möglicherweise bestenfalls nicht als Zertifikat oder Ähnliches, sondern als „echtes“ Gold in Form von Münzen oder Barren. Diese haben im Krisenfall einen echten Wert und können als Tauschobjekt verwendet werden.

Bewertung: ⭐⭐⭐ (3/5)

Tagesgeld/Festgeld:

Ihr Investment ist in dieser Anlageklasse sicher. Wollen Sie einen kleinen Teil des Investments sehr flexibel entnehmen, dann kann das Tagesgeldkonto eine Option sein.

Bewertung: ⭐⭐⭐ (3/5)

200.000 Euro anlegen

Welche Möglichkeiten gibt es, 200.000 Euro anzulegen? Bei einem Eigenkapitaleinsatz von 200.000 Euro bietet sich ein Investmentportfolio an, das einen starken Fokus auf Immobilien legt, dabei aber sichere Bestandteile wie Staatsanleihen/Unternehmensanleihen und/oder Gold integriert. Also ganz konkret: In was investieren bei 200.000 Euro Kapital?

Immobilien:

Ein großer Teil des Portfolios kann auf vermieteten Immobilien basieren. Das bedeutet: Passives Einkommen aufbauen. In dieser Anlageklasse können bis zu zehn Immobilien gekauft werden, da der Eigenkapitaleinsatz je nach Standort und Größe der Immobilie bei 8.000 bis 12.000 Euro liegt und damit relativ gering ist.

Um ein Klumpenrisiko zu vermeiden, können Sie das Konzept des virtuellen Mehrfamilienhauses nutzen. Dieses Konzept funktioniert wie folgt: Es werden deutschlandweit verschiedene Wohnungen gekauft, die zentral und günstig verwaltet werden. Dieses Konzept funktioniert wie ein Investment in ein Mehrfamilienhaus mit mehreren Wohnungen. Außerdem profitiert der Anleger von dem Vorteil der Streuung, da sich die Immobilien an verschiedenen Standorten befinden.

Sollte ein Standort entgegen der Erwartung eine schwache wirtschaftliche Entwicklungsrichtung einschlagen, so ist das Gesamt-Immobilienportfolio dank der Streuung sehr gut abgesichert. Der Vorteil gegenüber dem Erwerb eines herkömmlichen Mehrparteienhauses liegt vor allem darin, dass sich die einzelnen Wohnungen an verschiedenen deutschen Standorten befinden.

Zudem können Sie mit Immobilien Steuerspareffekte realisieren, die in solch einer Größenordnung stark ins Gewicht fallen können und damit einen weiteren Vorteil gegenüber anderen Investmentarten bieten. In Kombination mit steuersparenden Konzepten wie einer vermögensverwaltenden GmbH können Immobilien den Schlüssel zur finanziellen Unabhängigkeit darstellen.

Bewertung: ⭐⭐⭐⭐⭐ (5/5)

Staatsanleihen:

Staatsanleihen können auch in dieser Anlageklasse als absichernde Portfoliobestandteil dienen.

Bewertung: ⭐⭐⭐ (3/5)

Aktien/Fonds/ETFs:

Natürlich kann auch hier ein Teil des Vermögens in Aktien oder ETFs investiert werden. Allerdings ist in diesem Zusammenhang kein Fremdkapitalhebel üblich, wie es zum Beispiel bei Immobilien der Fall ist. Das bedeutet, dass lediglich das eingesetzte Eigenkapital für den Anleger arbeitet, was zu einer Schmälerung der Rendite führt – bei relativ hohem Risiko.

Bewertung: ⭐⭐⭐ (3/5)

Gold:

Ein Goldinvestment kann hier zur Absicherung des Portfolios eingesetzt werden.

Bewertung: ⭐⭐⭐ (3/5)

Tagesgeld/Festgeld:

Durch diese Anlageklasse haben Sie als Investor eine gute Möglichkeit, Ihr Geld sicher aufzubewahren und darauf flexibel zugreifen. Allerdings ist die Rendite eher schwach hier.

Bewertung: ⭐⭐⭐ (3/5)

500.000 Euro anlegen

Sie haben 500.000 Euro – doch in was investieren? Grundsätzlich liegt auch hier ein immobilien-gewichtetes, diversifiziertes Portfolio mit angewandten Steuerspareffekten auf der Hand.

Immobilien:

Es kann für Anleger eine große Herausforderung sein, sich über einen Zeitraum von mehreren Monaten oder Jahren ein Immobilienportfolio aufzubauen, das diversifiziert ist und kein Klumpenrisiko darstellt.

Aus diesem Grund haben wir das Konzept des sogenannten virtuellen Mehrfamilienhauses entwickelt. Dieses Konzept verbindet die Vorteile, die viele kleine Investments in einzelne Wohnungen an verschiedenen Standorten haben, und die Vorteile eines zentralen Investments in ein größeres Objekt, das über viele Wohnungen an einem Ort verfügt.

Bei einem großen Objekt erfolgen Sondereigentums- und Mietverwaltung zentral. Allerdings gibt es in einem solchen Fall ein Klumpenrisiko, da sich alle Wohnungen an einem Standort befinden. Mit Hilfe des virtuellen Mehrfamilienhauses kann ein Anleger von mehreren deutschlandweiten Top-Regionen profitieren und gleichzeitig auf eine zentrale Verwaltung zurückgreifen.

Gegenüber einem Investment in Aktien oder ETFs können Anleger außerdem Steuervorteile ausschöpfen. Zum einen besteht die Möglichkeit, die Immobilie nach zehn Jahren steuerfrei zu verkaufen. Zum anderen kann eine denkmalgeschützte Immobilie Steuervorteile mit sich bringen, indem große Summen der Renovierungskosten von der Steuer abgesetzt werden können.

Bewertung: ⭐⭐⭐⭐⭐ (5/5)

Staatsanleihen:

Anleger, die kein großes Risiko eingehen wollen, können Staatsanleihen als sicheren Baustein in ihr Portfolio mit aufnehmen. Dieser Baustein kann durch Gold entweder ergänzt oder ersetzt werden.

Bewertung: ⭐⭐⭐ (3/5)

Aktien/Fonds/ETFs:

Bei Aktien handelt es sich – wie bei Immobilien – um Sachwerte. Diese Anlageform bietet Ihnen auch eine renditestarke Investition.

Bewertung: ⭐⭐⭐ (3/5)

Gold:

Sowohl Gold als auch Staatsanleihen dienen der Absicherung des Portfolios. Beide Anlageformen können als sichere Bausteine, aber auch miteinander kombiniert werden.

Bewertung: ⭐⭐⭐ (3/5)

Tagesgeld/Festgeld:

Wie bereits weiter oben erwähnt, verfügt diese Anlageklasse über Flexibilität und Sicherheit. Außerdem bieten die beiden Anlagearten eine Möglichkeit für liquide Rücklagen – so können beispielsweise zwei bis drei Netto-Monatsgehälter hier liegen bleiben.

Bewertung: ⭐⭐⭐ (3/5)

Fazit und Ausblick

Wie kann man Geld richtig anlegen? Das hängt maßgeblich von drei Bedingungen ab:

- Von der Höhe des zur Verfügung stehenden Kapitals,

- dem Sicherheitsbedürfnis des Anlegers sowie

- den Anforderungen an die Liquidität der Anlage.

Eine Immobilie als Kapitalanlage stellt bereits ab einem Betrag von 5.000 Euro – in manchen Fällen aber auch erst ab einem Betrag von 10.000 Euro – ein nachhaltiges Investment mit starken Renditen dar. Steht ein deutlich höheres Eigenkapital zur Verfügung, spielt die Absicherung des Portfolios durch Anleihen oder Gold eine große Rolle.

Ob eine zusätzliche Diversifizierung durch Aktien oder ETFs angebracht ist, hängt immer vom persönlichen Risikoprofil des Anlegers ab. Grundsätzlich hat sich in den letzten Jahrzehnten aber herausgestellt, dass sich eine Immobilie aufgrund des möglichen Fremdkapitalhebels und den nicht unerheblichen Steuerersparnissen als die bessere Alternative erweisen kann.

Zusammenfassend kann man sagen, dass es im Jahr 2023 nach wie vor einige Anlagestrategien gibt, um sein Erspartes gewinnbringend und mit tragbarem Risiko anzulegen.