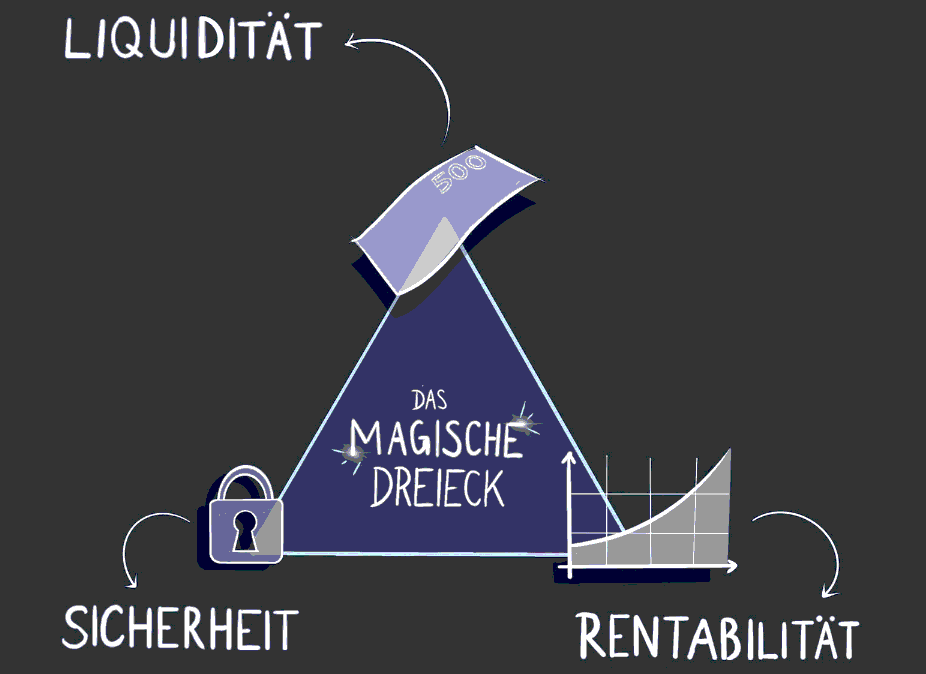

The magic triangle of investment

The magic triangle of investing is a useful tool for assessing and comparing different types of investments such as shares or real estate or bonds at a glance. The three aspects of the magic triangle of investment include

- The liquidity of an investment: How quickly can an investment be converted into a monetary unit such as euros or USD? Is this easily possible or is there a lengthy process behind it, such as when selling a rare work of art?

- The return on an investment: What is the amount in euros or USD that an investment “earns” each year? For a savings account this is the interest, for a share the price gain and the dividends.

- The security of an investment: Is there an increased risk that an investment will lose its value after a certain period of time? Speculative cryptocurrencies could be mentioned here – i.e. small fringe projects outside of Bitcoin and Etherium, which may have a great idea but are not profitable in the end and the coin therefore no longer has any value.

These three aspects are also known as the three investment criteria. Definition: Investment explained simply:

The magic triangle of investment: liquidity, security and profitability.

So you don’t need any “magic” properties to understand the concept of the magic triangle of investing. Common sense is enough to demystify it. If you know how to use it, you may save yourself a lot of headaches. Because when it comes to investing, the motto is: if you know exactly what you expect from your investment from the outset, you won’t be unpleasantly surprised. The magic triangle of investment helps with such considerations with its easy-to-imagine, visual representation and quickly gives an impression of a type of investment.

But theory aside, let’s take a look at different investment options and how they relate to the magic triangle of investing. Because whether it’s a few thousand euros to invest or a wealthy investor asking themselves the question “What’s the best way to invest 1 million euros?” – the principles are similar.

Magical triangle of investment: examples

Which investments can we analyze using the magic triangle of investing? In principle, this is possible with all forms of investment. In this guide, we have selected the following four types of investment and analyzed them for you using the magic triangle:

- Shares

- Bitcoin/crypto

- Real estate

- Bonds/savings books

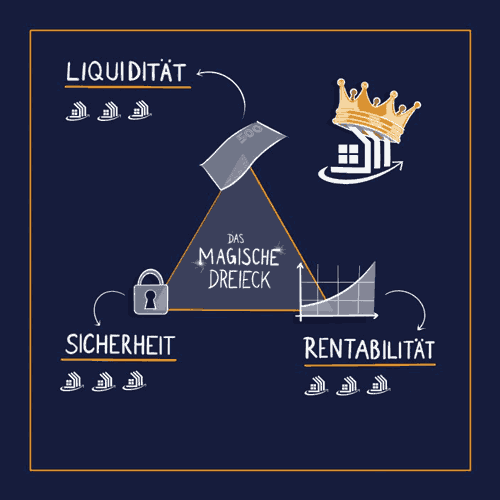

The magic triangle of real estate investment

Real estate and the magic triangle.

Return: 3/3

Low interest rates, low housing supply and favorable demographics have been making real estate investors’ eyes light up for years. The increases in the value of real estate – sometimes in the double-digit percentage range per year – make it easy to forget the otherwise depressing negative interest rate environment. The return on equity of investment properties is generally well over 20% (more than twice as high as that of shares!) and is even higher if the property price is fully financed. In addition, the properties sometimes generate a positive cash flow after interest and repayments from day one. It doesn’t get any better than that!

Security: 3/3

When it comes to security, investment properties come out on top – keyword: concrete gold. Thanks to low interest rates, real estate has had a run for decades without a drop in value. But even before the phase of low interest rates from around 2008, an investment property was already a safe investment for decades, always retaining a material value in times of crisis. Even wartime could not affect the valuation in the long term. A big plus point!

Liquidity: 3/3

At first glance, a rented property as a capital investment may not look like an investment that can be easily exchanged for cash. But far from it:

- With a debt-financed property, the investor’s liquidity is protected from the outset. If only the ancillary purchase costs are included in the purchase of the investment property and the purchase price is financed via a bank loan, only a small amount of equity is tied up. Quite different from shares or a savings account.

- If a real estate investor does need liquidity quickly, a mortgage can be drawn down on the investment property at any time. This is possible in just a few days and provides immediate liquidity.

- If a large amount is required, there is no way around an early sale. However, when choosing a positively developing location and buying a property at a comparatively low price, an investment property is in high demand on the market in the event of an urgent sale. A sale can be completed in just a few weeks.

Magical triangle of the savings book investment

Passbook and the magic triangle.

Return: 1/3

You would actually have to give 0 out of 3 stars at this point, because the return on a savings book is virtually non-existent. Investors can count themselves lucky if the interest rate is over 0% and not negative.

Safety: 3/3

No interest, but quick liquidation and a high degree of security: at least you can rely on the savings book when it comes to security.

Liquidity: 3/3

A savings book can usually be liquidated quickly. As an investor, you can therefore access the funds quite quickly. However, it remains to be seen why you should go to the trouble of setting up a savings account if there is no interest anyway.

Magic triangle of investing and Bitcoin

The magic triangle and Bitcoin.

Return: 3/3

The average annual increase in the value of Bitcoin is just over 400%. An incredible figure, but one that investors have to pay for with lower security and high volatility. Thanks to Decentralized Finance (DeFi), cryptocurrencies such as Bitcoin and Ethereum now even generate interest when they are lent or staked, for example.

Security: 1/3

Security and Bitcoin in one sentence – difficult. It is difficult to assume that Bitcoin will one day be worth 0 euros per Bitcoin. If you ask a random person in the pedestrian zone today whether they would buy 100 Bitcoin for 10 euros – the answer is almost certainly yes. Bitcoin is established and still has significant potential to increase in value in the long term.

But the ride on the way there is wild and characterized by massive price fluctuations. An attack on the Bitcoin network, which could jeopardize security, is not impossible, but it would be extremely costly. Government regulations or bans are more likely, making Bitcoin a rather unsafe investment overall.

Liquidity: 3/3

Bitcoin can be traded 24 hours a day, 365 days a year. The market capitalization and trading volumes are now so high that the maximum number of stars can definitely be awarded here.

The magic triangle of investing: conflicting goals

A Ferrari may be fast, but it doesn’t come cheap. A lot of horsepower and a high purchase price go hand in hand. A Fiat 500 has little horsepower and costs little.

One can speak of a so-called conflict of objectives. If one value is high, the other cannot be just as high. A high level of security in an investment never goes hand in hand with an outstanding return. Otherwise everyone would invest in this investment, which would lead to falling returns. The market therefore always finds its equilibrium. This is known as conflicting objectives.

Conflicting goals of profitability and security

Profitability and security relate to each other like the horsepower of a car and its purchase price. An investment cannot be “bomb-proof” and extremely profitable at the same time. Example: In times of negative interest rates on bank deposits, a 10% return can only be achieved in conjunction with a high level of uncertainty. This can be “windy” ship bonds or risky shares or share options. The risk of total loss increases with higher returns.

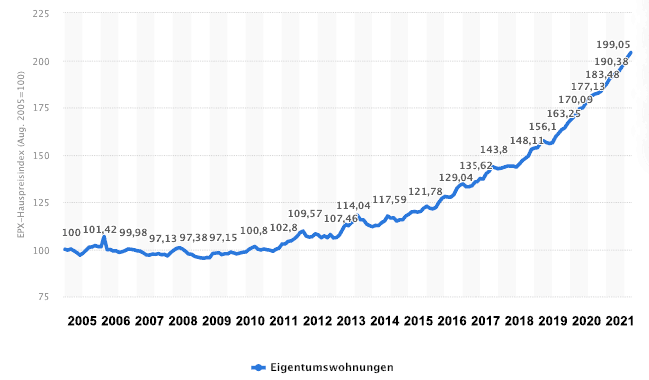

The closest thing is real estate: real estate is quite profitable if a high proportion of the purchase price is covered by a bank loan. On the other hand, they are relatively safe – it is not for nothing that they have always been referred to as “concrete gold”. The performance of real estate in recent years speaks for itself. But even before the boom since 2010, real estate was extremely stable in value and a good way to hedge against inflation.

The performance of real estate in Germany is considerable.

Conflicting goals of liquidity and profitability

Can an investment be convertible into cash at any time and generate a high return at the same time? A very rare case. It is much more likely to be the other way around: the longer the fixed term of an investment, the worse the chances of getting the tied-up money out early. Cryptocurrencies offer high profitability and very good liquidity. However, investors pay for this with low security and – what’s more – high volatility.

Conclusion: The magic triangle of investing and how you can use it

The key insight is that there is simply no such thing as a one-size-fits-all investment. Even if many shady “advisors” make fantastic promises where investments fulfill all the criteria of the magic triangle of investment – this is not realistic. And certainly not sustainable – because the market regulates imbalances itself over time.

Anyone looking for a sustainable investment should pay attention to the following points:

- The fairy tale of the perfect investment with high liquidity, profitability and security does not exist. Only real estate as a capital investment fulfills many criteria, but sometimes compromises have to be made in terms of liquidity

- If there is no ONE perfect investment, then the logical conclusion is: don’t put all of your available equity into one and the same investment.

- Diversification is the magic word: if you combine several types of investment, you spread your risk and fulfill each of the criteria of the magic triangle when all investments are added together.

- Example: An investor buys an investment property with debt leverage (high security + profitability, but discounts in liquidity); in addition, he invests in an equity portfolio (e.g. a broadly diversified ETF), which has less security, but can be sold on the market at any time and meets the liquidity requirements well. Finally, a very risky component could be integrated, but one that offers great potential for high profits (e.g. a crypto investment).

- The allocation to the various forms of investment then varies from person to person.