Investment comparison 2024: Best investments right now

The most important facts in brief: ETFs and real estate are recommended for long-term investment horizons. Call money, fixed-term deposits and selected savings accounts are suitable for short-term investments. Despite the European deposit guarantee, cautious investors should limit themselves to banks based in Western and Northern Europe.

More and more people want to take their money matters into their own hands. This trend is also reflected in our non-representative survey, which we conducted with 1004 people:

The clear majority of respondents want to take the topic of investing money into their own hands (survey via appinio.com)

Pay off debts first

It makes sense to take care of your own finances and wealth accumulation, but debts on your current account or from consumer loans should be paid off first, as the debt interest that is saved is usually higher than the savings interest that could be earned with the same money. This does not apply to debt interest that is incurred as part of an investment, especially not for real estate loans.

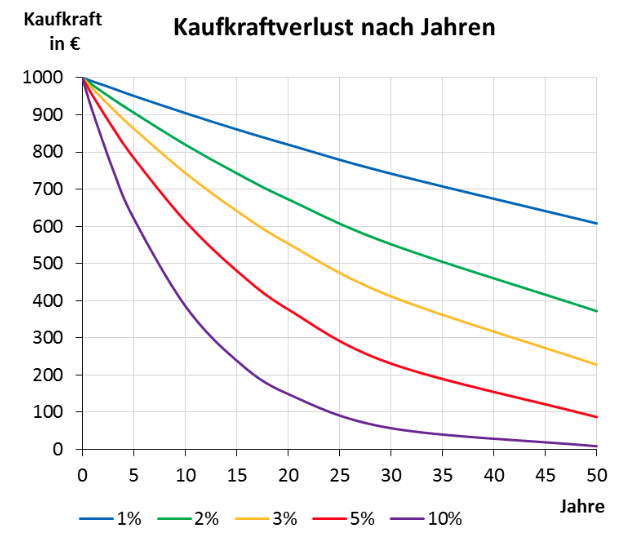

Inflation reduces the real return

The ECB is aiming for inflation of 2%, as this is regarded as a state of price stability for reasons of economic theory. The constant loss of purchasing power is therefore not a system error, but intentional. Since 1994, the inflation rate in Germany has been between 0 and 2.5%. But from February to September 2023, it was consistently almost 9%. These percentage points must be deducted from the nominal return on an investment in order to obtain the real interest rate.

Inflation noticeably weakens purchasing power:

(1, 2, 3, 5 and 10% inflation is assumed here, source: johannes-strommer)

Investment opportunities from a consumer perspective

In your opinion, which of the following products are best suited for wealth accumulation?

This question was answered as follows in the Sparkassenverband’s Wealth Barometer 2021:

| 20212020 | |

| Shares | 2523 |

| Investment funds | 2220 |

| Savings book | 2022 |

| Property for rent | 1919 |

| Property for own use | 1821 |

| Lifeinsurance | 1817 |

| Building loan agreement | 1718 |

| Pensioninsurance | 1617 |

| Daily allowance | 1516 |

| Precious metals | 1314 |

| Fixed-term deposit | 1011 |

| Company pension scheme | 1010 |

| Real estate funds | 88 |

| Fixed interest. Securities | 89 |

| Cryptocurrencies | 73 |

| Riester pension | 44 |

| Rürup pension | 11 |

As can be seen from the table, shares, investment funds, crypto and life insurance rose in favor among investors from 2020 to 2021. Rented property as an investment maintained fourth place. Savings accounts, building society savings contracts, pension insurance, overnight money, fixed-term deposits and fixed-interest securities declined in popularity. The fact that overnight money and fixed-term deposits are losing popularity will certainly no longer apply in 2024, when interest rates are higher. In fact, another study by Commerzbank & Quirion from 2021 and 2023 shows a different picture. However, this study combines call deposit accounts, fixed-term deposit accounts and term deposit accounts. This survey also differs significantly from the savings bank study in other respects. The real estate asset class is also missing. This was apparently not surveyed.

| 20232021 | |

| Daily money, time deposit, fixed-term deposit | 6558 |

| Shares | 4951 |

| ETFs, ETCs | 4134 |

| Funds | 4043 |

| Savings book | 3333 |

| Precious metals | 1820 |

| Bonds | 1615 |

| Crypto | 1618 |

| Commodities | 76 |

| Derivatives | 77 |

| Art & Co. | 55 |

How others invest their money is interesting and can help in the decision-making process. However, it is clear from the two surveys cited that the figures can differ significantly. In particular, the high level of support for crypto in the Commerzbank survey indicates a non-representative respondent base.

Best investment at the moment

Which investment is currently the best? The following comparison includes eleven types of investment.

Savings account

The out-of-fashion savings account, which nowadays is more of a virtual savings account – without a savings book to touch – does not have to hide behind overnight money and fixed-term deposits when it comes to interest rates. Savings account offers are often positioned between fixed-term deposits and call money: shorter notice periods, e.g. 30 days, than for fixed-term deposits and higher interest rates than for existing customers with call money.

Current savings account offers with at least 2%

As of 5.04.2024:

- akf bank: 3%, 6-week notice period, monthly interest credited

- GEFA BANK: 3%, 3-month notice period (however, €2,000 can be withdrawn monthly), annual interest credit

- MMV Bank: 2.25%, 3-month notice period (but €2,000 can be withdrawn per month), interest credited annually

- Volkswagen Financial Services: 2%, 30-day notice period, interest credited annually

Daily money account

Call money is also safe and earns roughly the same interest as a savings account. However, there is no notice period for call money. The money is therefore available “daily”. As with fixed-term deposits, banks often offer new customers better conditions than existing customers.

Current call money offers

As at 5.04.2024. Smaller, unknown banks and offers that only apply to new customers were not taken into account

- Comdirect: 3% for 6 months up to EUR 1 million, also for existing customers but only for “newly transferred money” (the money in question must not have been held at Commerzbank, comdirect or onvista in the last 6 months), interest credited annually.

- Bank of Scotland: 2.5% for new and existing customers, no term, interest credited annually

Fixed deposit account

Fixed-term deposits are also safe, but the money is invested for a fixed term and is not available during this time. A two-pronged approach provides some flexibility: A smaller amount for emergencies as call money and the larger remainder as fixed-term deposits with different terms. To park money temporarily, overnight and fixed-term deposit accounts are generally recommended.

Current fixed-term deposit offers

As of 10.04.2024

- Bank of Scotland: 3.4% for 1 year, 3.0 for 2 years, 2.75% for 3 years, 100 to 500,000 EUR.

- Volkswagen Financial Services: 3.4% for 1 year, EUR 2,500 to unlimited.

- Renault Bank direkt: 3.35% for 1 year, 3.3% for 2 years, 3.2% for 3 years, 3.1% for 4 years, EUR 2,500 to unlimited.

Real estate

Rented property, also known as yield property, investment property, yield property or Zinshaus (Austria), is considered safe and profitable. Financing with bank loans creates leverage. This increases the return on this investment mathematically and therefore in real terms: as less own funds have to be used, the decisive return on equity increases.

Bonds

Bonds are also securities. With the help of bonds, a government or company borrows money from investors and repays this money plus interest at the end of a fixed term. Even though bonds are comparatively safe, there is still a risk of corporate insolvency or government bankruptcy. Germany is unlikely to go bankrupt, but this cannot be ruled out for many other countries, including industrialized nations. Bonds are usually more profitable than fixed-term deposits.

Funds

A fund company takes the money of several investors and invests it in a bundle in various assets. In this way, the fund company pursues the goal of broad diversification. There are different types of funds, such as equity funds, real estate funds, bond funds or mixed funds. As this form of investment does not put all its eggs in one basket, the risk of loss is lower than with individual shares. Funds are actively managed by the fund company and can achieve an acceptable return.

ETF

ETFs (Exchange Traded Funds) are basically also funds. However, ETFs are not actively managed, as is the case with traditional equity funds. This means that fees, which reduce the return, are very low for ETFs. ETFs simply track share indices such as the DAX or the S&P 500 and do not try to outperform shares by constantly buying and selling them. ETFs therefore heed the witty stock market adage “back and forth empties your pockets”.

ETFs are a profitable and safe investment and are neck-and-neck with real estate investments in this respect. However, ETFs are beaten by real estate in terms of tax structuring, leverage and, last but not least, social factors such as housing creation and regional value creation. With an ETF that tracks the famous MSCI World share index, the investor primarily supports very large US corporations such as Apple & Co.

ETFs on the MSCI World have achieved a remarkable average return of 9 percent per year for 50 years. However, there have long been voices criticizing the strong focus of the MSCI World on US companies. Aren’t investors missing out on the huge growth potential in emerging markets? What about China? One could argue that the MSCI World’s success proves it right. The question remains as to whether the strong performance of recent decades, which has been based on the economic dominance of the USA, can simply be continued.

Bitcoin

Among the cryptocurrencies, Bitcoin stands out as the most reputable, and yet Bitcoin is also very insecure. Bitcoin is questionable:

- Bitcoin is always at risk of a price collapse following government intervention. States, in particular the USA and the EU, can greatly hinder the conversion of Bitcoin back into dollars and euros.

- The Bitcoin core code is constantly being further developed by several hundred people in the open source process, which makes Bitcoin opaque and unpredictable.

- Data other than just payment information, such as images, can also be loaded into the Bitcoin blockchain. This causes useless storage and bandwidth consumption. Once uploaded to the blockchain by any person, images, like everything else, can never be removed.

- The Bitcoin world is generally very turbulent, with many opaque players. For example, users must make sure to buy the wallet for bitcoins directly from the manufacturer to rule out the possibility that the intermediary has injected malicious code into the device that steals the bitcoins.

Gold

Often maligned by financial experts, gold is better than its reputation, although no one should invest their entire assets in gold, if only to spread the risk.

- One criticism of gold is that there is no intrinsic performance. But even with shares, it ultimately comes down to demand. The demand for shares and gold may be motivated differently on the surface; at the end of the day, investors are speculating on rising prices in both cases.

- People have been fascinated by gold for 7,000 years now, and there is no end in sight. Especially in the global South, where the population is also growing, the demand for gold is unbroken.

- Disasters and conflicts drive the price of gold temporarily, but a more lasting price driver was the 2008 financial crisis, which showed everyone that an investment in the system of fiat money (roughly: paper money) and shares alone may not be safe enough.

Gold can offset losses from other forms of investment as a portfolio addition in times of crisis. The price of gold is lower for larger gold bars than for mini bars and coins. However, smaller units are more flexible in times of crisis. However, some experts reject such a post-apocalypse scenario, in which tiny pieces of gold serve as a means of payment, as unrealistic.

Gold can be purchased for up to EUR 1,999.99 in cash and against a nameless receipt. The cash receipt should be kept for presentation to the insurance company in the event of loss.

Valuable investments – assets you can touch

The term investment usually refers to investing in real estate or investing money on a somewhat larger scale, while investment refers to investing money in tangible, usually rare assets, such as luxury watches, antiques, art or wine. The term investment usually refers to fixed-term deposits, overnight money or shares.

When it comes to investments, a personal connection to the type of investment often plays a role. Luxury watches are considered an investment with zero or negative returns. However, in addition to the economic benefits, investors may also derive additional emotional and social benefits from the investment; they can touch and use them on a daily basis and discuss them with like-minded people.

Investing money in investments as described above is usually not profitable unless the investor is an expert in the field or has access to particularly attractive properties.

Return versus risk

Choosing the best investment requires weighing up the three factors of return, security and investment horizon. The more profitable an investment is, the riskier it usually is. However, being too cautious is not a solution either, as this leads to assets shrinking in real terms. After all, a positive real return must at least compensate for inflation. Only after the loss in value due to inflation has been offset do savers achieve a real increase in value. Fixed-term deposits, call money and savings accounts are not profitable, but rather ways of parking money that are reasonably protected against inflation.

Comparison of financial investments

In summary, an overview of the advantages and disadvantages, returns and risk of the various investment options.

| Interest income | Security | |

|---|---|---|

| Savings book |

1/5

|

5/5

|

| Daily money |

2/5

|

5/5

|

| Fixed-term deposit |

2/5

|

5/5

|

| Property |

4/5

|

4/5

|

| Shares |

4/5

|

2/5

|

| Bonds |

3/5

|

3/5

|

| Funds |

3/5

|

3/5

|

| ETFs |

4/5

|

3/5

|

| Bitcoin |

4/5

|

1/5

|

| Gold |

2/5

|

3/5

|

| Valuable investments |

1/5

|

3/5

|

Investment horizon

Alongside return and risk, the investment horizon is a very important factor when choosing the right form of investment. The investment horizon is the period of time estimated by the investor at the time of investment over which the money should remain invested without interruption and will not be needed.

The investment horizon: an important factor for investments

The longer the investment horizon, the more likely potentially riskier investments such as individual shares are to be considered.

| Short term (available daily: 0-5 years) | Medium term (5 years) | Long term (10 years or longer) | |

|---|---|---|---|

| Savings account | X | X | X |

| Daily allowance | X | ||

| Fixed-term deposit | X | ||

| Real estate | X | X | |

| Shares | X | X | |

| Bonds | X | X | |

| Funds | X | X | |

| ETFs | X | X | |

| Bitcoin | X | X | X |

| Gold | X | X | X |

| Valuable investments | X | X |

Investing money with small amounts

It is possible to invest money profitably and securely even with small monthly amounts:

-

Monthly savings plan:

A fixed amount is paid into an account or custody account every month by standing order. There are many savings plans for putting smaller amounts into advanced asset classes such as ETFs each month.

-

Rented property as an investment:

Investing in rented property is also possible without high monthly costs: the apartment is rented out so that the tenant ultimately pays a large part of the financing and other costs.

Investing money for children

Children can naturally invest money for the very long term. This allows for riskier investments such as individual shares.

-

Shares, funds & ETFs as investments for children

Shares, funds and ETFs are suitable for long-term investment horizons despite their volatility.

-

Rented property as an investment for children

Particularly when the property is transferred to the child in the form of a gift or inheritance, the property plays out the special position granted to it by policy.

-

Investment under your own name or that of the child

While investing in your own name is less complicated, the exemption limit for investment income of EUR 1,000 per year, which children also have, does not apply.

-

More about investing for children

You can find more information on this topic at Investing money for children

Investment summary 2023 / 2024

Risk, return and investment horizon are important factors for a personal investment strategy. If social aspects are also important, real estate scores particularly well with the creation of living space and regional value creation.

- Investment horizon: If you plan for generations, you can also take more risk.

- Security: How secure is the institution, company or state to which the money is entrusted?

- Return: What beats inflation and generates the best return without being reckless?

The combination of capital appreciation and rental income, tax planning options, leverage and high security makes real estate an attractive form of investment for investors who have tens of thousands of euros at their disposal. Good ETFs, such as ETFs on the MSCI World, also achieve good returns and are recommended both for risk diversification and for additional flexibility.

The “cluster risk” that is occasionally invoked for real estate is nothing more than a somewhat dramatically exaggerated description of the generally known and only logical default risk that arises when savers do not diversify and instead put their entire assets into a single form of investment and possibly also into a single asset, such as a single share or a single property. We have always recommended risk minimization through diversification and by no means deny the benefits of ETFs, call money and fixed-term deposits. An investment in real estate cannot be made with hundreds or a few thousand euros. However, if you have a few tens of thousands of euros to invest, have money invested elsewhere and want to bequeath or give away your assets one day, a professionally selected property is a very recommendable investment.

The experts at Meine-Renditeimmobilie will be happy to share more insights into the profitability, security and tax benefits of property as an investment in a non-binding consultation. With Meine-Renditeimmobilie’s tried-and-tested step-by-step system, highly profitable, secure real estate investments are possible from a net income of just €2,500 per month. This does not involve real estate funds or other constructs, but the classic purchase of your own, sometimes small or very small, investment property with land register entry, notary and everything that goes with it.