What is Cash Flow? Calculating the “flow of cash” in real estate

The term cash flow is probably widely known, but it is usually associated with a company’s balance sheet. However, real estate also has a cash flow and this is crucial for investors, as it is a significant indicator of the profitability of a real estate investment.

But what exactly is the cash flow of real estate, what influences it and how is it actually calculated? The cash flow of real estate is undoubtedly a basic key figure for every property as an investment and should therefore be examined more closely.

Definition of cash flow for real estate

The cash flow compares income and expenses incurred in connection with a rented property. If income exceeds expenditure, this is referred to as a positive cash flow. If expenses are higher, the cash flow is negative. Cash flow properties are characterized by a positive cash flow.

The famous book “Rich Dad Poor Dad Cashflow Quadrant” by Robert T. Kiyosaki is about striving for a positive cash flow. He describes how there are basically four quadrants in which income is generated. On the left-hand side are employees and the self-employed.

They exchange money for time and are on the side of active income. Entrepreneurs and investors operate on the right-hand side. An entrepreneur makes other people work for him, an investor makes money work for him. Keyword: Building passive income.

The big difference between these two groups is that entrepreneurs and investors on the right-hand side of the quadrant make themselves independent of their own limited working hours. This is the key to cash flow. However, it is not that difficult to operate in several fields. Employees or the self-employed can also be active as investors and generate a positive cash flow.

A well-maintained property without a maintenance backlog will sooner or later become a money-printing machine once the loan has been repaid.

Many people may think: “I don’t have the money to invest in a property.” This is where the leverage comes into play. The aim here is to bring in as little equity as possible and only as much as necessary. With a financing comparison, you can find the best conditions and finance your property through a bank. Your tenant then helps you to pay off the loan on your property with their rent payments, so to speak.

The only thing to note is that it must be a property with a positive cash flow. If you would like to know where you can find such cash flow properties, you are welcome to take a look at our existing properties. We have already done the math for you.

Why is real estate cash flow so important?

The cash flows generated by the property are essential. Monetary efficiency indicators play a major role for investors, as the cash flow of a property says a lot about its value.

Calculating cash flow with real estate

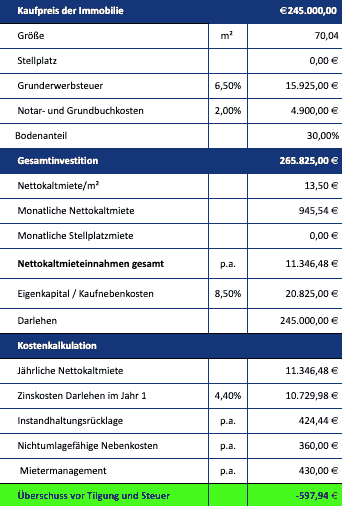

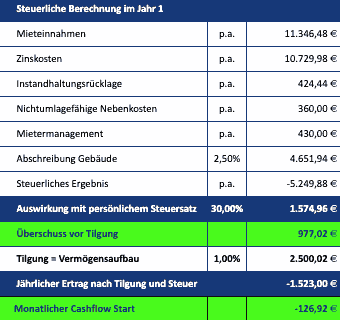

How is real estate cash flow calculated? Put simply, expenses are deducted from income. If there is money left over, the cash flow is positive. The return on real estate can be calculated at the same time. First of all, it is important to know what expenses are actually incurred. Basically, the expenses can be broken down into the ancillary purchase costs (land transfer tax and notary and land register costs), the loan costs (interest and repayment), the maintenance costs or reserve and the administration costs.

The real estate transfer tax varies from state to state. On average, however, it is around 3.5%. For notary and land registry fees, you can expect to pay around 1.7% of the purchase price. Unfortunately, these costs are non-negotiable, as both notaries and land registries are subject to a fixed scale of fees. These costs are ancillary purchase costs that are added to the purchase price when calculating the cash flow and are therefore part of the total investment.

Other costs such as maintenance, administration, repayments and interest, on the other hand, are variable and can still be structured somewhat by the buyer. When it comes to administration costs in particular, it depends on whether the buyer wants to take care of the administrative tasks themselves or whether they prefer to hand them over. The less work involved with the property, the higher the administration costs incurred and the lower the cash flow.

The expenses are now compared with the rental income. The difference represents your monthly income – provided it is a surplus and therefore a positive cash flow.

Cashflow calculation

An example of a cash flow calculation could look like this

Sample calculation of an investment property with cash flow

Positive cash flow from real estate

A property that has a positive cash flow will regularly bring you money. This is not the case with every real estate investment, as there are also a large number of negative cash flow properties that investors have to pay for month after month. However, there are a few things you can do to achieve a positive cash flow.

For example, there are items in our example calculation above that are variable. The interest rate and repayment are negotiable and something can often be done about the administration costs. On the other hand, the rental income should be as high as possible. This depends not only on the condition of the property, but also on the location. We will be happy to advise you on this and provide you with financing on the best possible terms.

Cashflow durch Immobilien

As mentioned above, there are many people who think they do not have the necessary capital to become a real estate investor. And they often lack the necessary knowledge to choose a lucrative property.

But we see time and again that our clients are surprised at how easy it is to find their first property. And in most cases, it doesn’t stop at one property, as a second and third real estate investment is quickly sought. And so many of our clients are already generating a considerable passive income with their cash flow yield properties.

What is a good cash flow?

This question gives the impression of being easy to answer: But it is not that simple. The changing times are unavoidable. The parameters are changing and new opportunities are opening up. It is now important to buy a property at the right price. Bringing in a little more equity can also have a positive effect on the expected cash flow.

Imagine you are buying an apartment that is currently rented out at slightly below market value. The slightly lower price is due to the fact that the current tenant is an 80-year-old pensioner who has lived in the apartment for 20 years without a rent increase. The cash flow of this apartment probably does not look good at all. Low rental income is offset by high negative cash flows.

After two years, your tenant passes away at the age of 82. What is sad from a human point of view, however, now enables you as the owner to re-let the apartment at standard market conditions. Suddenly, the unchanged expenses, mainly for interest payments and repayment of the loan, are offset by significantly higher rental income. The cash flow changes radically and is “suddenly” clearly positive!

As you can see: Cash flow only says something about the ACTUAL STATUS of your property’s cash flows. “What is a good cash flow?” – this question must therefore be classified and answered taking into account the current and future framework conditions.

Depending on the investor’s time horizon, a negative cash flow can therefore be tolerated for a certain period of time in some cases, as long as the investment in an apartment pays off in the future. Other clients want a positive cash flow from day one. We can realize both wishes, as we develop properties ourselves and therefore our clients’ individual needs are our top priority.