Debt capital leverage: The leverage effect on investment properties

The leverage effect is a means of significantly changing the outcome of something. Debt leverage is the leverage effect of a loan on an investment. When it comes to real estate as an investment, the real estate loan is a lever. The investor works with this borrowed money and earns more than the loan costs him. Debt financing therefore acts as leverage as it significantly increases the “return on equity” result.

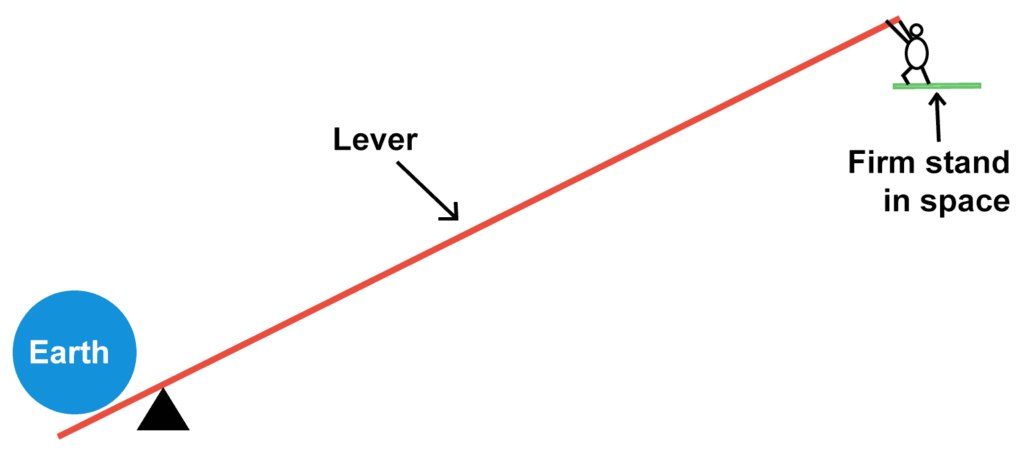

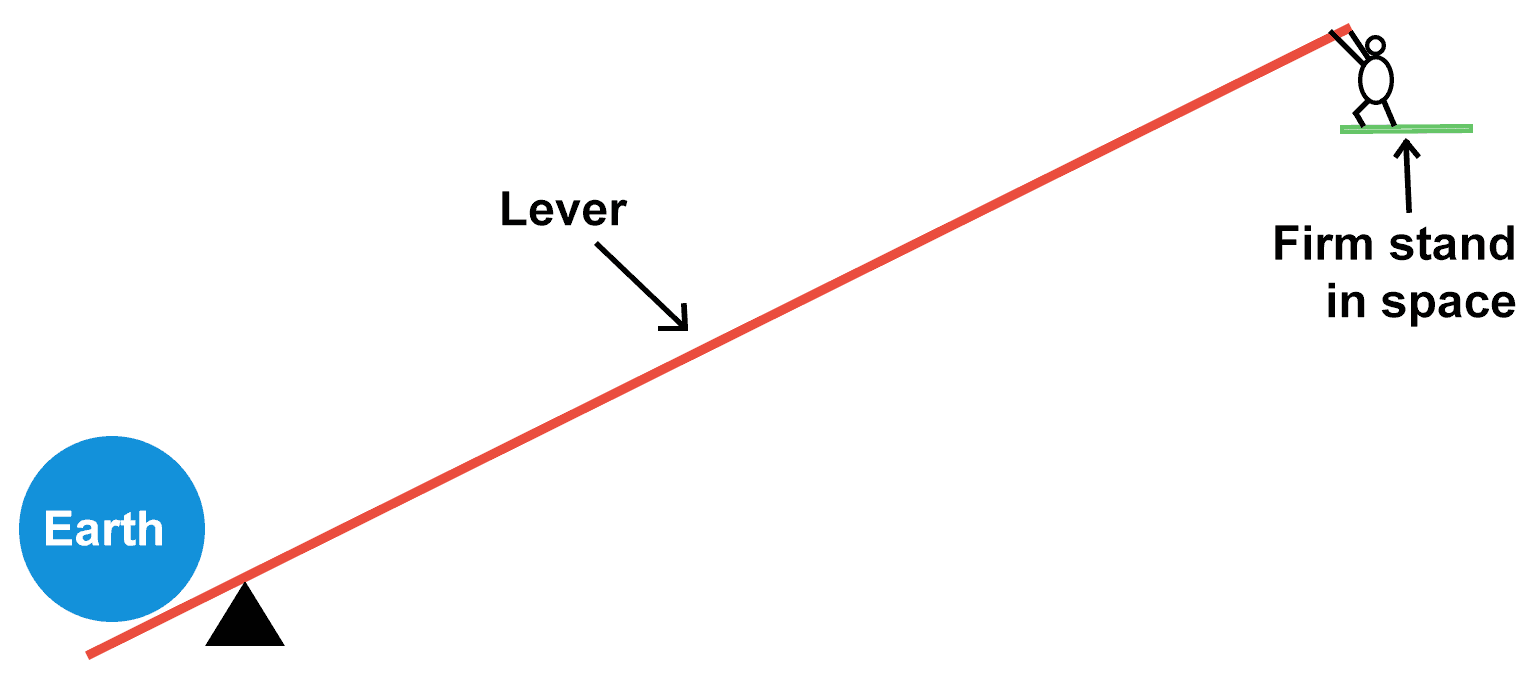

Give me a place to stand and I’ll move the earth

With the above quote, which is also reproduced in variations such as “Give me a stick that is long enough and I will unhinge the world”, Archimedes already pointed out the “leverage effect”.

In fact, a single person could lift the entire globe out of its orbit, provided the lever was long enough and you had a solid footing and something like a rock (in this case, more like a huge mountain) to position and redirect the lever:

We also know the leverage effect from everyday life: the longer the wrench, the greater the force transmission to the screw due to the leverage.

Debt capital leverage as a return booster

Debt capital leverage is also available to private investors, especially in real estate. In principle, investments in stocks and the like can also be leveraged.

However, this is a risky playing field for professionals that is usually closed to private investors.

As an average consumer, it is much easier for you to get a loan for a property than a Lombard loan for movable items such as stocks.

Therefore, debt capital leverage is one of the main arguments for investing in real estate. Finally, debt leverage increases the crucial return on equity.

Debt capital leverage is available to almost everyone when buying real estate, as banks readily accept real estate as security.

It is a tried and tested system as the stability of value of properties in good locations has been sufficiently proven.

Risks of leverage

Leveraging always means danger. The temptation is to maximize the return with as much leverage as possible.

In the case of a real estate investment, this would mean using as little or, at best, no capital as possible.

Instead, from a return perspective, one would aim for 130 percent financing, in which not only the additional purchase costs but also extensive renovations would be financed.

This would mean that the leverage would be as high as possible and the return on equity would theoretically be increased to the maximum.

But apart from the fact that banks would only accept 130 percent financing if the creditworthiness was outstanding, such financing carries the risk that repayment will be at risk as soon as the market situation or the investor’s personal circumstances change.

Always use debt capital leverage in real estate

Leveraging with third-party capital is highly recommended for investment properties. Even if there is enough capital to buy a property without a loan, you should consciously take out a loan.

With 300,000 euros in capital, investors should buy 10 properties with 30,000 euros in equity each instead of 1 property without any credit. The financial world, the real estate market, the legal situation and the tax system provide this.

Debt financing leverage is a tried and tested means of investing in real estate, giving this asset class a leading position alongside or above ETFs.