How does inflation affect the real estate market?

The essentials in brief: Inflation increases the rents along with other prices. Tenants pay more rent and thus balance out the decreased value of money. The real estate investor’s return is not hurt and this is why real estate is considered a good hedge against inflation. As an added benefit, real estate assets are far less volatile than shares.

What does inflation mean? Inflation means that your money loses its previous purchasing power and loses value. There can be various reasons for this. We have already seen rising inflation during the coronavirus crisis, when the economy slumped sharply. The effects of this are still being felt: supply chain problems and increased production costs for goods and commodities. Today, there are further restrictions due to the war in Ukraine, which are driving high inflation. These include rising commodity, energy and food prices.

The central banks print new money, which ultimately leads to the existing money having less value, regardless of its form (cash or bank deposits). Current inflation in Germany is as follows:

| january 2023 | 8,7 % |

|---|---|

| February 2023 | 8,7 % |

| March 2023 | 7,4 % |

| April 2023 | 7,2 % |

| May 2023 | 6,1 % |

| June 2023 | 6,4 % |

| July 2023 | 6,2 % |

| August 2023 | 6,1 % |

| September 2023 | 4,5 % |

| Oktober 2023 | 3,8 % |

| November 2023 | 3,2 % |

| December 2023 | 3,7 % |

| January 2024 | 2,9 % |

| February 2024 | 2,9 % |

Source: Federal Statistical Office

Inflation therefore mainly affects monetary assets. But what about tangible assets? First of all, we must note that not all tangible assets are the same. In our article on shares vs. real estate, we have already discussed the topic of real estate asset inflation. Both shares and real estate are tangible assets.

In principle, shares offer protection against inflation, but as the stock market is subject to very strong fluctuations, investing in securities is a speculative affair. A property can compensate for a rising inflation rate by increasing rental income at the same time, so that security-loving investors could concentrate more on investment properties.

This makes you independent of inflation. In the long term, real estate investors generally enjoy a significant increase in value. But how is it that some assets increase in value and others lose? The secret lies not in the spice, but in the scarcity of a good. Scarce goods are goods whose resources are limited. These include gold, oil, real estate, etc.

Resources cannot be exhausted and multiplied indefinitely, so that a higher price can be achieved than for free goods, which are available indefinitely. An increasing amount of money is distributed over the same amount of goods as before the increase in the money supply. The consequence: rising values of goods such as real estate and shares.

Corona virus and real estate

The coronavirus plunged the whole world into a crisis at the beginning of 2020. Many people have had to tremble over their assets or have already suffered major losses. The situation is much more relaxed for property owners. Although the coronavirus crisis triggered a brief period of restraint in some cases, demand for investment properties was very high again after just a few months.

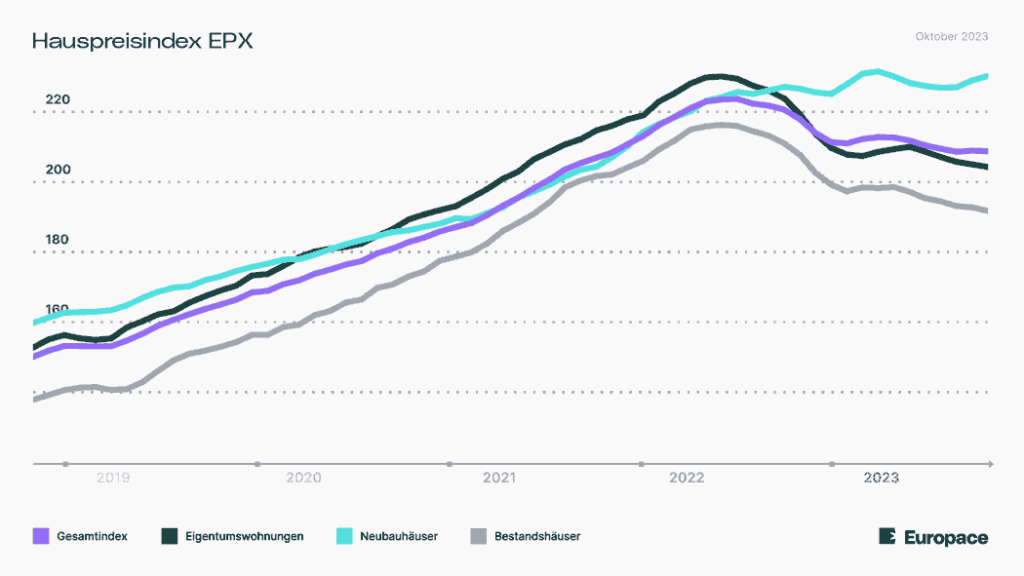

In good locations, the price level has remained completely unchanged or has even risen compared to pre-crisis levels. The following chart clearly shows that the trend has continued unabated even after coronavirus, with prices continuing to rise. However, a slight decline in property prices has been observed since mid-2022, especially for existing properties. This is due to the ECB’s turnaround in interest rates and the resulting rise in financing rates, among other factors.

Real estate and inflation: increasing price effect for residential real estate until mid-2022, slight price decline thereafter, change in percent. (Source: Europace, as at October 2023)

Ukraine war and real estate

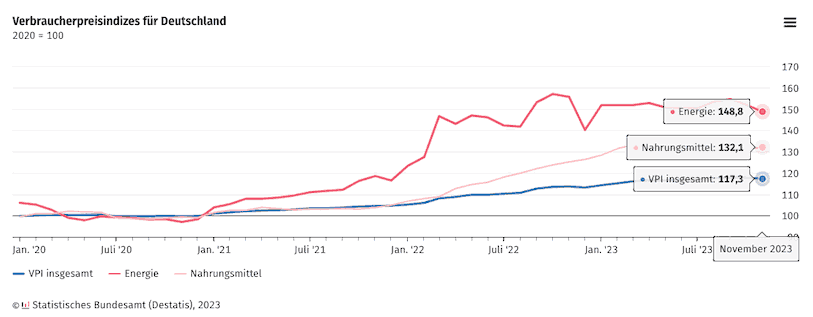

After the war in Ukraine broke out on February 24, 2022, we can observe dramatic humanitarian and economic consequences all over the world. Millions of people from Ukraine are on the run. The supply bottlenecks already caused by the coronavirus pandemic have become even more acute. Energy prices have become extremely expensive. In addition, there is a shortage of goods in various areas – including wheat. This has led to a significant rise in food prices, as can be seen in the chart:

Since 2020, energy costs have risen disproportionately by 48.8% and food by 32.1%. Overall consumer prices in November 2023 are 17.3% higher than in 2020.

As mentioned, the inflation rate in Germany rose by 3.8% in October 2023 compared to the same month last year. Despite all these events, however, there is no cause for concern in the real estate market. Although interest rates have risen, we are still in a historically low interest rate phase in Europe. Real estate is generally a safe investment for investors, even in times of crisis. As tangible assets, they offer good protection against inflation.

What happens to real estate during inflation?

Debt is bad. Many of us have grown up with this “knowledge”. However, you have to differentiate between good and bad debt, especially when it comes to real estate. For example, buying an investment property usually only makes sense if you use the leverage. In practice, this means that you take out a bank loan to purchase your property. However, the monthly loan installments are not paid by you, but (indirectly) by your tenants.

Why is it good to have inflation for a real estate loan? What happens to a real estate loan during inflation? In principle, prices rise during inflation, which also affects the interest rates for new loans (high inflation = rising interest rates for new loans). However, rental prices also rise – albeit with a time lag. In this scenario, the tenant would therefore cover the additional costs of the loan through the increased rent.

In addition – and this is the great advantage of leveraged real estate during inflation – you can pay off the loan much more easily, because the loan amount does not change, while the rental income can increase. However, it is important to note that interest rates on loans are also higher today. Nevertheless, it may be possible to repay the loan more quickly through higher rental income, for example through unscheduled repayments.

Is real estate a good hedge against inflation?

Whether real estate offers protection against inflation depends very much on how you use the property. Many Germans want to fulfill their dream of owning their own home. They buy a property, live in it and pass the house or apartment on to their children at some point. During inflation, however, this scenario develops negatively, as both the interest on loans and the maintenance costs increase. The owner therefore has to pay extra.

If you purchase a property as an investment, the situation is different. As described above, rents also increase, which is why you don’t have to worry about inflation. Only an investment property offers you this security.

No other investment option is likely to protect you as well against inflation and build wealth at the same time – thanks to investment properties. The cash in your safe is losing more and more purchasing power. Stock markets collapse or move sideways. Speculative objects such as art or cars represent a high risk even without inflation.

Deflation effects of real estate

Supply and demand determine the price of a good (the principle of the free market economy). If supply is greater than demand, prices fall. This is referred to as deflation. Deflation therefore also affects real estate, as it falls in value. If many properties are on offer but only a few are in demand, prices fall. The price level for rents, salaries and goods also falls.

Der aufgenommene Kredit muss allerdings zu den alten Konditionen abbezahlt werden, was für Hausbesitzer eine besondere Herausforderung darstellen kann und nicht immer möglich ist. Somit kein günstiges Szenario für Renditeimmobilien. Eine deflationäre Situation wollen Staaten und Zentralbanken aber um jeden Preis vermeiden.

n this regard Japan is a good example:In order to combat deflation since 1990 (triggered by the bursting of the financial bubble), the Japanese central bank is counteracting this with massive orgies of money printing. The target is an inflation rate of 2%. If a similar crisis were to hit Germany, the measures would look very similar. A good starting position for the owner of an investment property.

Japanese asset price bubble

How far do prices fall in the event of deflation? We can answer this question using Japan as an example. Japan has been struggling with deflation since the 1990s. When the financial bubble burst, prices plummeted. The Japanese Nikkei share index collapsed, real estate loans could no longer be repaid and many banks had to file for insolvency.

The labor market was also affected and unemployment rose enormously. The Japanese government tried to revive the economy by taking on new government debt – but without success. The share index fell from around 40,000 to 16,000 points.

Many properties were suddenly only worth half their original purchase price. Thanks to the measures taken by the central bank, however, the deflationary tendencies have been kept in check – real estate is currently increasing in value again significantly and is no longer so far removed from the values of 1990.

Inflation money: When today’s money is worth nothing tomorrow.

Hyperinflation in the Weimar Republic 1923

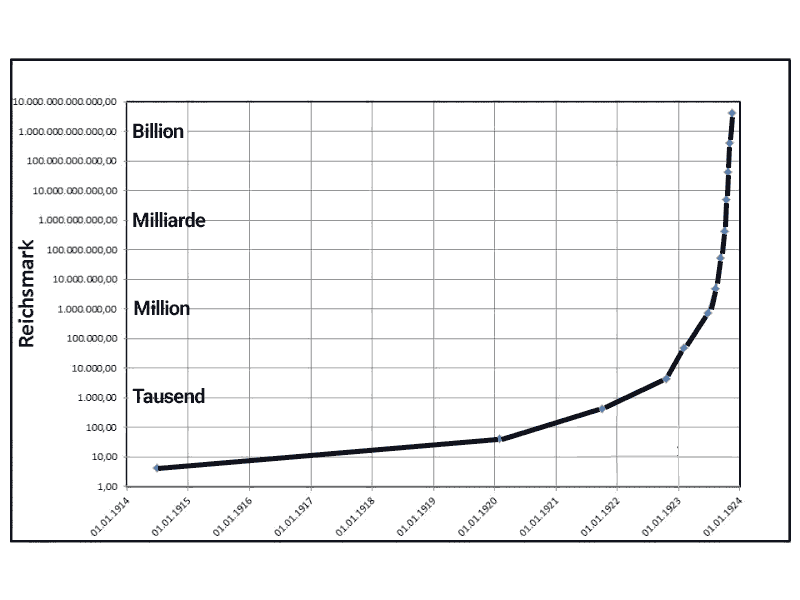

Germany experienced the exact opposite in 1923 – namely hyperinflation. In hyperinflation, the price level rises extremely quickly, by at least 50% per month (that would be a full 13,000% per year!).

Back then, people transported their money in wheelbarrows to exchange it for goods as quickly as possible, as money was losing value day by day. While an egg still cost 7 pfennigs in 1912, its value rose to 2.1 million paper marks in September 1923, to 227 million in October and finally to 320 billion in November. By that time, one US dollar was worth 4,210,500,000,000 German Papiermark.

The government then decided on a currency reform in the same month, as a result of which all assets and debts became worthless from one day to the next. Anyone who owns an investment property at such a time is completely protected from the devastating effects of hyperinflation.

Hyperinflation in Germany: hundreds became trillions.

Who benefited from inflation in 1923?

The main winner of hyperinflation was the government, as it was able to pay off its large debts with a worthless currency. Other winners were resourceful entrepreneurs who took out loans and invested in real assets.

Conclusion and outlook

In 2022, we had to deal with high inflation rates. The coronavirus pandemic, the war in Ukraine, the energy crisis and the rise in inflation have left their mark on the entire global economy. What happens next?

For the year 2023, researchers expect an inflation rate of 6.32% overall. The forecasts have therefore already been reduced and it is assumed that inflation will fall more sharply than originally assumed. Energy and food prices will remain high. Business prices will increase even more, according to the ifo Institute. As gross domestic product (GDP) contracted for two consecutive quarters Q4 2022 & Q1 2023, Germany was in a technical recession. Economists are of the opinion that the German economy could decline this year.

Stronger inflation of several percentage points is therefore a scenario that has already occurred – against which investors in investment properties are protected. In addition to a possible increase in value, future rental income in particular is protected against inflation. Secure investments help people to get through these times unscathed.