Investing money for children: Which investments for children and grandchildren?

As parents or grandparents, few things are as close to our hearts as our children. An important aspect of this is the financial security we want to provide for our children. What options are there for saving for children or grandchildren? And which of these is the best investment in 2024, especially with regard to long-term wealth accumulation and the current interest rate turnaround? Investing money for children is an important decision that should be made early on.

Saving for children – what should you look out for? Before you decide on a specific form of investment or a combination of two or three forms of investment (keyword diversification), you should be clear about the goal you want to pursue.

- What do you want to save for? What is the size of the savings target?

- Should the money be saved for a fixed date or should it be available at any time?

- Do you want to invest a large sum once or save or invest smaller amounts each month?

- Who should save? You alone or together with family members, godparents, etc.? Should the child be able to help save later on?

You should first get an overview of these points so that you can choose the right investment for your child, grandchild, or godchild.

A comparison of investments for children

In the following, we will show you what options there are for investing money for children. We rate each type of investment according to three criteria:

- The return you can expect when investing money for children

- The security

- The investment horizon you should plan for

Children’s savings account

The children’s savings account is probably the classic form of investment. However, due to the comparatively low interest rates, it is not suitable for larger sums of money. However, it is perfect for paying in pocket money or small gifts of money, and every child should have their own savings account. This way, they can learn how to handle money at an early age. Many advisors recommend opening the savings account directly in the child’s name. The main advantage of this is that the money really belongs to the child.

Until the child is 18 years old, you will receive a power of attorney for the children’s savings account and can only dispose of the money if you can prove that the money is being used for the child. This scenario also has a tax advantage, as the capital saved does not affect your tax-free allowance. On the other hand, an existing credit balance could have a negative impact later on if the child wants to apply for BAföG in the future and their assets exceed 15,000 euros. However, if you open the savings account in your name, there is a risk that you could use the money for yourself in the event of a financial shortfall.

As far as returns are concerned, the children’s savings book can hardly score any points. In the long term, the money in the children’s savings account will be worth less, as inflation is higher than the interest rate. However, it is suitable for short-term savings goals such as a new bike or a games console. If the entire savings balance is needed, the savings book must be terminated at most banks. The notice period is usually 30 days.

Interest income: ⭐ (1/5)

Security: ⭐⭐⭐⭐⭐ (5/5)

Time horizon: Short term

Call money for children

Due to fears of a recession in 2024 and rising inflation, key interest rates were increased from summer 2022. Interest rates quadrupled within a year. Interest-bearing investments such as call money or fixed-term deposit accounts emerge as winners and therefore enjoy greater attention from investors again. However, an overnight money account still does not lead to long-term wealth accumulation. The prevailing inflation in Germany is still very high and this has a negative impact on call money in the long term: It loses value. Like a savings account, call money is a short-term form of investment and is only suitable for smaller amounts or if the child wants to save money themselves.

A call money account offers great flexibility, as there is no minimum savings amount or fixed savings plan. The money is also available daily. Thanks to deposit protection, the call money account is protected against losses and is therefore a very secure form of investment. Interest rates vary from bank to bank, but you can currently (as of December 2023) expect an average interest rate of 0.10 % to 3.6 %. You should compare providers thoroughly before opening a call money account for your child in order to get the best conditions.

Interest yield: ⭐⭐ (2/5)

Security: ⭐⭐⭐⭐⭐ (5/5)

Time horizon: Short term

Fixed-term deposit for children

Fixed-term deposits should be considered if there is a larger savings goal and the savings amount should be available at a fixed time. Classic examples of this are a driving license for an 18th birthday or a car. Fixed-term deposits earn significantly more interest than a children’s savings account or an overnight deposit account. However, fixed-term deposits are tied for a fixed period of time and are therefore not available. Interest rates increase with the term, which means that the longer the term, the higher the interest.

Fixed-term deposits have also benefited from interest rate increases since 2022. The average interest rate is currently (as of December 2023) up to 4.2%. However, the value of the money you invest in a fixed-term deposit account is at risk in the long term due to the consequences of high inflation. With a fixed-term deposit, you usually invest a one-off amount that works for you or your child over the years. It is therefore not suitable for saving smaller amounts on a regular basis.

Interest income: ⭐⭐ (2/5)

Security: ⭐⭐⭐⭐⭐ (5/5)

Time horizon: Medium-term

ETF savings plan for children

A sensible and long-term investment for children could be fund or ETF savings plans. The interest rate is significantly higher than with the forms of investment mentioned above. However, the risk of suffering a loss is also higher. Both funds and ETFs are savings plans that can be set up with a monthly payment of 25 to 50 euros. However, you must always be aware that the performance of these savings plans is dependent on the stock market. This does not always have to be a bad thing. For example, if you have set up a monthly savings installment of 30 euros, you will buy shares at this price. If the market is at a low, you buy more shares as prices are lower. And vice versa. In the long term, the ratio usually evens out, but not always.

With many savings plans, it is also possible to make special payments. This is a good idea for larger gifts of money, for example for a communion. Generally speaking, ETF savings plans are cheaper than funds, as there are no management fees. Setting up an ETF savings plan for children is an attractive alternative to a children’s savings account. The required custody account can also be opened directly in the child’s name. Grandparents or godparents can also set up a savings plan for their offspring. On average, a return on equity of 6 to 8 % can be achieved on the stock market. However, you need patience to achieve this and must not be put off by short-term price fluctuations. However, as fund savings or an ETF savings plan for children is generally a long-term investment, you can look forward to an attractive return for your children.

Interest yield: ⭐⭐⭐⭐ (3.5/5)

Security: ⭐⭐⭐⭐ (2.5/5)

Time horizon: Long-term

Buying real estate for a child

Investing in a property is also a medium to long-term investment that works with a low monthly outlay. If you rent out the property you have purchased, your monthly financial outlay will be between approx. 100 and 300 euros. This form of investment is perfect for providing your offspring with a permanent and, above all, substantial income without neglecting the issue of security.

Savings plan for children

Your child turns 18 and starts their own life with a paid-off or almost paid-off property. No other investment offers these advantages. This means that your child will achieve a regular rental return and will therefore be starting out under completely different conditions than others. Most financial investments for children are designed to ensure that the offspring receive a saved amount at a certain time. However, the child itself hardly learns anything about handling money in this way.

You can use the example of real estate to teach your offspring about money. Your son or daughter will learn what it means to generate passive income and become financially independent of their own labor (keyword: hamster wheel). Your child will either decide to continue to benefit from the monthly rental income or sell the property for a profit – and at this point (ten-year period) certainly also tax-free. Ultimately, the value of the property can increase significantly over the years, resulting in a very attractive sale price.

If you teach your child about investing early on, he or she could buy a larger property after selling the property and rent it out. After another ten years, this approach could be repeated. Your offspring can develop into a great real estate investor, investing in several properties and becoming financially free. And all because you made the decision to do something for your child’s future and invest a minimal monthly amount. The return on equity for rented apartments is usually 6 to 20% initially.

Interest income: ⭐⭐⭐⭐ (4.5/5)

Security: ⭐⭐⭐⭐ (4/5)

Time horizon: Medium to long term

Saving for children – what should you look out for?

To make sure you are really doing something good for your child, you should pay attention to a few things when investing money for children:

-

Remember that low-interest investments are eaten up by inflation. These are good for the short term, but are not a long-term solution. And especially when it comes to your child’s future, you should plan for the long term.

-

Regardless of whether the investment for children is real estate or savings plans: A small monthly amount is enough to build up considerable wealth in the long term. Regularity is important!

-

Protect your child from themselves. What does that mean? We were all 18 years old once and we all had a lot on our minds. If your child is given full access to his or her account or deposit at the age of 18, there is of course always the risk that the savings will be “knocked on the head”. Against this background too, a property offers more security than a bank account or custody account.

-

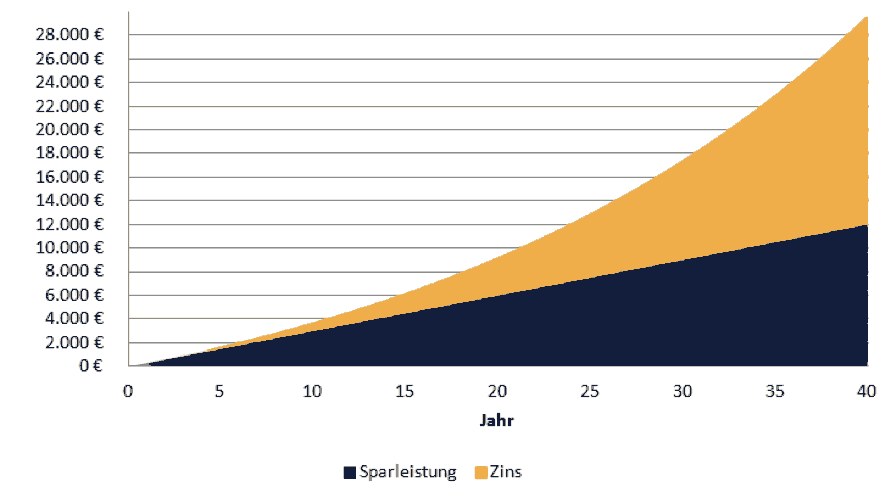

Benefit from the compound interest effect. Albert Einstein described it as the eighth wonder of the world. Why is it so powerful? For example, if you invest 30 euros per month at an interest rate of 5%, after one year you will already have 360 euros plus 18 euros in interest. The capital saved has therefore already increased to 378 euros. The interest increases your savings amount year after year, on which you receive interest again. The following chart illustrates this well.

The most important pillars of asset accumulation for children include starting as early as possible, transparency and an individually assessed mix of security and high returns. You know best what is ultimately the right decision for you and your child or grandchild and how to act in your child’s best interests. However, diversification is certainly also very important when investing money for children in order to act responsibly and in a future-oriented manner in the long term.