How much money do you need to become financially independent?

Achieving financial freedom is the dream of many people. Those who are financially free …

- no longer has to work to earn a living

- does not have to worry about his pension

- has made many correct financial decisions in life

- However, he also has a great responsibility to himself to preserve and, at best, increase his wealth.

No longer having to work, being able to fulfill all your wishes … That does sound like a dream. But for many, this dream remains just that: a dream. The good news, however, is that becoming financially independent is not as difficult as most people think. In this article, we show you various ways to achieve financial independence that are achievable for everyone with discipline.

Financial independence definition

If you are financially free or independent, you no longer have to work to achieve the standard of living you want.There are various ways to achieve this. However, a popular state nowadays is to be able to live of the income from your investments. What does that mean in concrete terms? The income from your investments is high enough to pay all your costs without having to touch your actual capital.

It is important to note that the point at which this state is reached is highly individual. The question is how you define your own standard of living and how much money you need to be able to afford it.

Financial freedom calculator

Test our financial freedom calculator now and find out where your limit to financial independence lies:

When are you financially independent?

EUR 500,000 in assets, EUR 1 million in assets, EUR 5 million in assets – when have you actually reached the status of financial freedom?

- That depends entirely on how the assets are invested. Those with investment skills may be able to generate substantial income streams from assets of just EUR 500,000, which will free them up financially.

- Others invest their money less efficiently and do not even have enough passive income from an investment of EUR 2 million to live on.

In principle, however, it can be said that financial independence is achieved when it is possible to live off the income from one’s investments. A thrifty person who lives modestly can of course achieve financial independence more quickly than someone with exorbitant fixed costs.

Almost anyone can achieve financial freedom, provided they have the necessary discipline.

Financial independence is not just about having a lot of money. Rather, it is about leading a truly free life and no longer having to diminish the capital you have built up. You create a goose that lays golden eggs, so to speak. And they do this day after day, week after week, year after year.

To calculate how big your goose needs to be or how much money you need for financial freedom, you first need to do a budget calculation and determine your costs. What are your current costs? What costs do you expect in the future and what purchases would you like to make?

You can use this to create your own financial freedom calculator. Multiply the total of all costs by 150 and you will get the approximate value that you need to invest in order to be able to live off the income.

How can I become financially independent?

You can only become financially independent if you start generating passive income. The key to financial freedom is not to work more and harder, but to make more and more money work for you. If you are currently still employed but want to become financially independent as soon as possible, you should start by saving some money and then investing it so that you have regular income.

By building up passive income and steadily increasing it over time, you lay the foundation for your financial independence. No matter what stage of life you are currently in, the process of achieving financial independence is almost always the same.

Step by step to financial freedom

-

Analyze the actual situation:

How much income is currently available? How much of it goes towards covering fixed costs? How much is left over at the end of the month? Can I invest or have I already invested? Have certain reserves been set aside or are there still obligations such as outstanding loans that need to be paid off? Get a precise overview of your current financial situation so that you know where you currently stand and where you want to be in the future.

-

Define goals:

What does financial freedom mean to you? What exactly do you want your life to look like? Will you continue in your job because you love it, but on your own terms? Perhaps it’s just a desire to work less so that you have more time for your family. Or do you want to be completely free from your current job and no longer earn your income through traditional work in the future? These questions will largely define the direction in which you want to go.

-

Securing and increasing money:

Before you invest money, you should build up reserves. After all, you never know what unforeseen events may occur. If the worst comes to the worst, you should at least not have to worry about how to deal with them financially.

Once this part is covered, it’s time to get down to business: generating passive income to give you financial independence. The range of options for this is huge, and implementation is highly individual. However, there are, of course, some classics that are key to successful wealth accumulation with passive income streams.

The best way to achieve financial independence is through real estate and shares. However, there are no limits to your own creativity, which can also contribute to your personal success.

Financial freedom with real estate

Financial freedom: Real estate has been an important part of the investment strategy of many well-known investors and private individuals throughout their careers.

Hardly any other capital investment is as perfect for building up a passive income as a well-positioned real estate portfolio. You can increase your passive income further and further through regular purchases and thus become financially free through real estate.

Example: One of our customers clearly formulated his personal goal during the initial meeting: After 10 years, he wanted to achieve a positive monthly cash flow of €2,500. Together, we designed an investment strategy for him so that he could achieve this goal with his real estate portfolio. To achieve this, the client invested around €125,000 in equity at the start. The client initially asked himself the question: “How can I become financially independent?” We worked out the answer to this question together and turned it into reality.

The big advantage of this is that you do not have to build up considerable assets to invest in real estate. An investment is already possible from an investment amount of 5,000 euros. Of course, the principle also works with 100,000 euros.

Becoming financially independent with an investment property

However, there is one thing to bear in mind when investing in real estate: The concept is based on the fact that you purchase a property – financed by a bank – and rent it out. In this way, the tenant helps to pay off the loan you have taken out. You can become financially free with real estate if you own and rent out several properties.

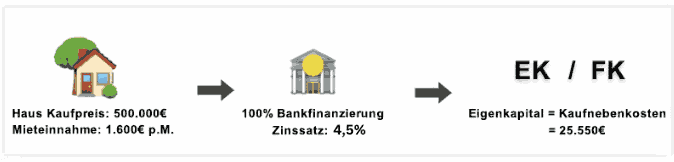

Buy a house and rent it out: How does it work? (Own illustration, as of August 2023)

How many properties until you are financially free? We can’t say that across the board. It very much depends on how high your monthly costs are and what lifestyle you have or are aiming for. Other factors include the amount of rental income and the location of the property. A well-located apartment building will generate a higher rental income than a small apartment in an economically weak area.

Financial freedom at the age of 30

Is it possible to be financially free at the age of 30? Of course, anything is possible. However, these are more likely to be exceptional cases. It is more likely to set the course at the age of 30 and make an initial investment in real estate or shares in order to create a long-term life in which money no longer has to be exchanged for working hours. Knowledge is power, but applied knowledge leads to success. Make the most of your opportunities, educate yourself so that you can make the right decisions for you.

Conclusion

We have presented the two most efficient ways for you to build up your financial independence. There are, of course, other ways. But to achieve financial freedom as quickly and securely as possible, there is no way around real estate.

Realize that the dream of financial independence does not have to remain a dream. Take the first step towards a financially free life by making your first real estate investment. We will be happy to support you!