Nearly 12% inflation by the end of 2022: Inflation rate outlook for 2024

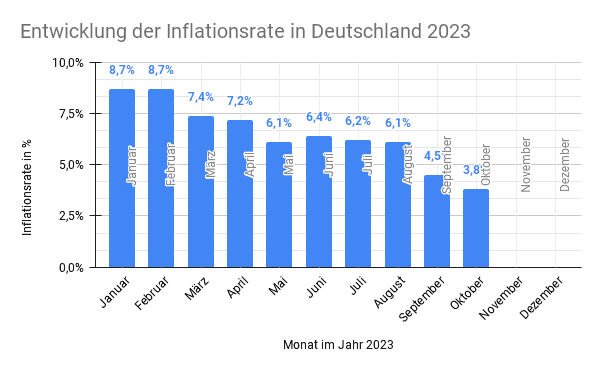

We have been seeing rising inflation rates since 2022. This important topic is on the minds of many people who are asking themselves the following questions: How can I protect my money from inflation? What will inflation look like in Germany in 2023? Inflation fears have been stoked in the media for some time. The October 2023 inflation report is as follows: The inflation rate compared to the same month last year was +3.8 percent.

(Source: own illustration)

The main causes of inflation are the loose monetary policy of the central banks, the long-term effects of the coronavirus crisis, the energy crisis and the war in Ukraine. Many people are afraid of currency devaluation. But are these concerns justified in the long term?

Should we be worried about rising inflation rates? What options are there to protect your money from inflation? When will prices go down again? In this article, we take an objective, realistic look at

- the inflation situation in 2024,

- the consequences of possible longer-term inflation,

- weigh up the likelihood of further monetary devaluation in 2023,

- show which is the best investment at the moment and should be in your portfolio in 2024

- and provide a brief overview of the 2024 inflation forecast .

Initial situation: triggers of current inflation

Loose monetary policy has been in place since the 2008 financial crisis at the latest, when banks had to be rescued and states responded with economic stimulus programs and cash injections at every turn in order to avert an even deeper crisis and return to previous growth figures. The spectre of inflation was already haunting the media in 2008 and unsettled many people.

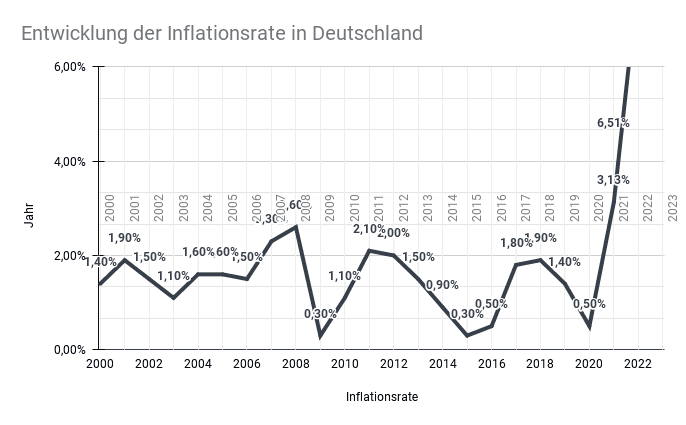

In retrospect, however, these fears were unfounded: From 2008 to 2020, the inflation rate in Germany was always between a low 0.3% and 2.6%.

(Source: own illustration)

But how is it possible that the fears and negative expectations described (high inflation or even hyperinflation) were so far removed from reality? And is the situation in 2008 comparable to the situation today, in which countries are taking on more and more debt to finance emergency aid and economic stimulus programs? We answer these questions in this article.

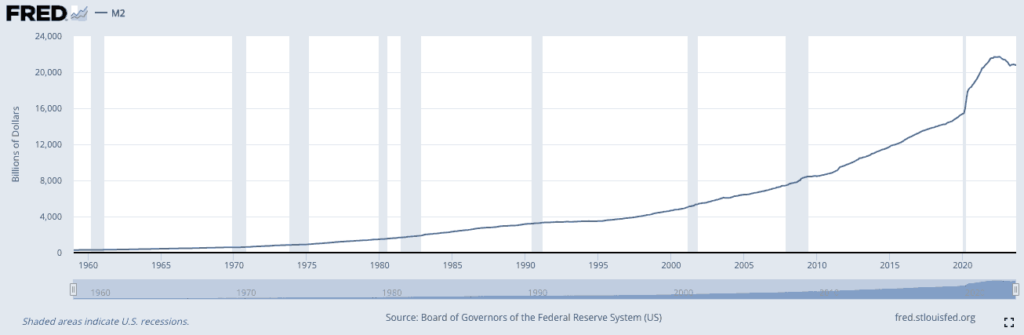

In the USA, for example, a staggering 25% of the total money supply (measured in M2) was printed in 2020, as the following chart shows:

The money supply increased drastically not only in the USA thanks to massive government support for companies and households due to corona (source: FED).

The authority responsible for Europe, the European Central Bank, increased the euro money supply (M2) by almost 11% in the period from January to December 2020. A slightly lower figure than in the US, but still well above the long-term average of just over 6% (period 2010-2020).

This means that the money supply has increased significantly and we are now seeing inflation. An increased money supply with a constant quantity of goods almost inevitably leads to a devaluation of money.

The fact is: as you can see from the following table, inflation rates have exploded from 1.0% in January 2021 to as much as 10.4% in October 2022 – these figures are in each case compared to the same month of the previous year. The figures have been falling again since November 2022 (source: Federal Statistical Office).

Inflation table 2021-2023:

| January 2021 | +1,6% |

| February 2021 | +1,6% |

| March 2021 | +2,0% |

| April 2021 | +2,1% |

| May 2021 | +2,4% |

| June 2021 | +2,1% |

| July 2021 | +3,1% |

| August 2021 | +3,4% |

| September 2021 | +4,1% |

| October 2021 | +4,6% |

| November 2021 | +6,0% |

| December 2021 | +5,7% |

| January 2022 | +5,1% |

| February 2022 | +5,5% |

| March 2022 | +7,6% |

| April 2022 | +7,8% |

| May 2022 | +8,7% |

| June 2022 | +8,2% |

| July 2022 | +8,5% |

| August 2022 | +8,8% |

| September 2022 | +10,9% |

| October 2022 | +11,6% |

| November 2022 | +11,3% |

| December 2022 | +9,6% |

| January 2023 | +9,2% |

| February 2023 | +9,3% |

| March 2023 | +7,8% |

| April 2023 | +7,6% |

| May 2023 | +6,3% |

| June 2023 | +6,8% |

| July 2023 | +6,5% |

| August 2023 | +6,4% |

| September 2023 | +4,3% |

| October 2023 | +3,0% |

| November 2023 | +2,3% |

| December 2023 | +3,8% |

| January 2024 | +3,1% |

| February 2024 | +2,7% |

| March 2024 | +2,3% |

This speaks for inflation in 2024

Inflation occurs when the total money supply increases while it is spread over a constant quantity of goods. Individual goods therefore become more expensive and this is referred to as inflation. Unfortunately, the connection is not quite that simple – otherwise we would already have the answer!

As shown above, it is not enough to simply increase the money supply. Another prerequisite for rising inflation is the increasing velocity of money in circulation.

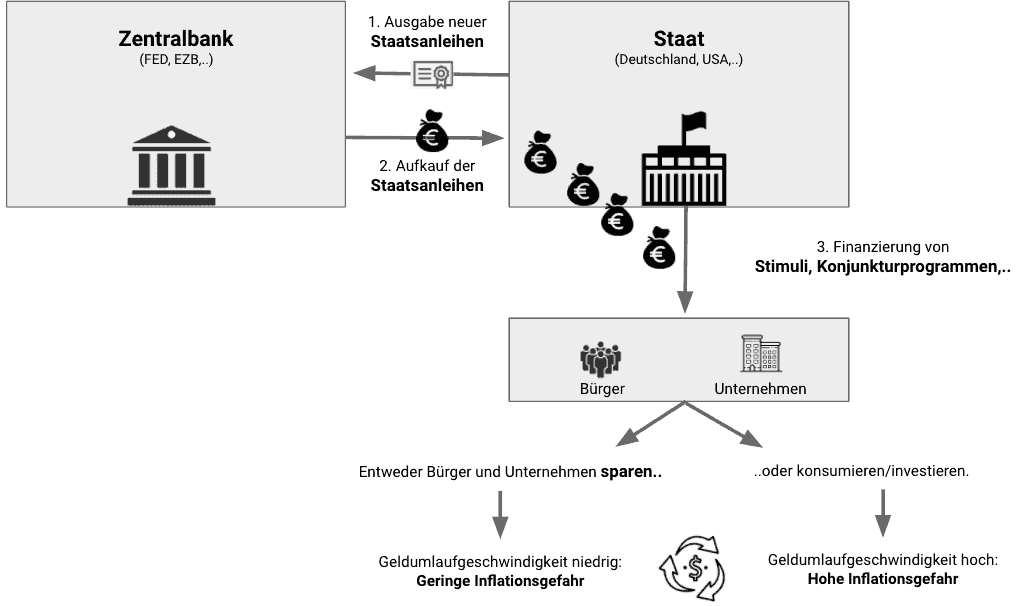

The velocity of money in circulation determines, among other things, the rate of inflation (source: own illustration).

The velocity of circulation defines the speed at which money changes hands in an economy (for example, when goods are purchased). When money is printed, it ends up in the wallets of citizens and companies (for example via stimuli paid by governments and aid for ailing companies). However, if it is not spent there, the velocity of circulation is low – in this case, the probability of inflation is low.

Causes of inflation in 2023 are that the money saved by companies and private households will come into circulation as the lockdowns are over and the vaccines are widely distributed. As a result, we may see a surge in the price of goods: Inflation is occurring. The reason for this is, among other things, increased demand with too little supply.

Another aspect responsible for inflation in 2023 is the war in Ukraine, which has shaken the whole world. As a result, there are high energy and food costs as well as supply bottlenecks.

A third trend that plays into the hands of inflation is the deglobalization caused by coronavirus. In the phenomenon of deglobalization, value-adding activities (e.g. production) are increasingly located in the home country because supply chains are interrupted. As the costs of producing goods, for example, are higher in developed countries such as the USA or Germany (higher wage levels, etc.), this has an impact on the selling price of goods. This leads to price increases and thus: Inflation.

And finally, there is a fourth factor that speaks in favor of higher inflation in 2023. It concerns the general debt situation of European countries. Germany’s debt amounts to around 65% of its economic output, while other countries are in a much worse position (France 109%, Italy 140%, Greece 160%).

These debts have to be serviced and therefore incur financing costs. Paying off the mountain of debt is a huge challenge and can actually only be achieved in two ways:

-

Option 1

Increasing government revenue, for example by raising taxes, but this is politically unpopular.

-

Possibility 2

Use the emerging inflation strategically so that debts are no longer worth as much in the future and can be paid off more easily when inflation picks up and government revenues increase due to higher tax receipts.

This speaks against hyperinflation in 2024

In addition to combating unemployment, the mandate of every central bank includes guaranteeing price stability. Central banks have various tools at their disposal to keep inflation in check or to fuel it.

Considering the goal of price stability, it is the task of the central bank to ensure that inflation does not rise above a certain level. This is usually around 1.5-2.5% per year. If inflation rises above four or five percent, this has a wide range of negative effects on the financial system, the economic system and therefore ultimately also indirectly on society. In order to maintain social peace, a central bank will therefore generally use tools to keep emerging inflation in check.

Another aspect that speaks against hyperinflation is the influence of the deflationary effect of our increasingly digitalized world. One example: whereas in the past many of the functions of a modern smartphone (calculator, sending messages, making calls, taking pictures, mobile working, etc.) had to be provided by separate products such as a calculator, a camera, a computer/laptop, etc., all these functions are already integrated into a modern smartphone. The bottom line is that the consumer has to spend much less money to get the same number of functions.

This is just one example of the ongoing technological development in many areas, which has a deflationary effect. Ultimately, there is a decoupling between capital and productivity, so that digital products such as an app, for example, have to be programmed at great expense at the beginning, but can then be downloaded millions of times without incurring additional production costs. This is a deflationary driver that will accelerate in the coming years and should not be underestimated. However, it should be noted that these developments will probably only be reflected in the inflation rate in a few years’ time, as the influence of technology on inflation is currently still limited.

Conclusion: Inflation in 2024

Due to the greatly increased amount of money that has been (and is being) pumped into the financial and economic system, as well as the supply chain problems caused by the coronavirus pandemic and the war in Ukraine, a high inflation rate is expected to continue in 2023.

Combating inflation is one of the most important economic and social goals in 2023. On the one hand, inflation will not fall overnight if the European Central Bank (ECB) continues to raise key interest rates, as this always takes some time. On the other hand, the problem of supply bottlenecks and the challenge of high energy costs – which have a significant influence on current price increases – will continue to exist as a result of the increase in interest rates.

What does inflation mean for investments

If the general price level (inflation) rises, this has a profound impact on various financial investments. The level of inflation is one of the most important criteria for the success or failure of a financial investment. It is important to remain flexible when it comes to inflation and to constantly adapt to changes in inflation rates so that your own investment – ideally with inflation protection – is a success. Below we outline the options for reacting to inflation.

Which investment is good for inflation?

How can you counteract inflation? With medium to high inflation, tangible assets have major advantages over monetary assets. As a reminder: tangible assets are all capital goods that are limited in quantity. And the value per capital good therefore generally develops in line with inflation as the money supply increases. Tangible assets therefore protect against inflation and are not devalued by inflation. If a tangible asset also actively generates a return, such as rental income from real estate as a capital investment, the investor benefits twice over.

Tangible assets such as real estate as a capital investment, gold or shares can protect against inflation (source: own illustration).

Other tangible assets, such as gold, simply put, increase in value so that the tangible asset is not devalued by flaring inflation. In addition to real estate, the class of tangible assets also includes shares, gold and exotic investments such as cryptocurrencies, vintage cars, wines and works of art.

Which investment is bad with inflation?

Investments that pay a fixed rate of interest and are tied for a certain period of time (for example government bonds, corporate bonds with a fixed term and cash – depending on their respective interest rate, of course) are particularly bad when it comes to inflation.

As the amount of money in the system increases and goods become more expensive, cash is devalued to the extent that you can buy fewer goods for the same amount of money. In addition to the types of investment already mentioned, cash values also include overnight money, fixed-term deposits, savings accounts, etc.

Inflation-proof investments

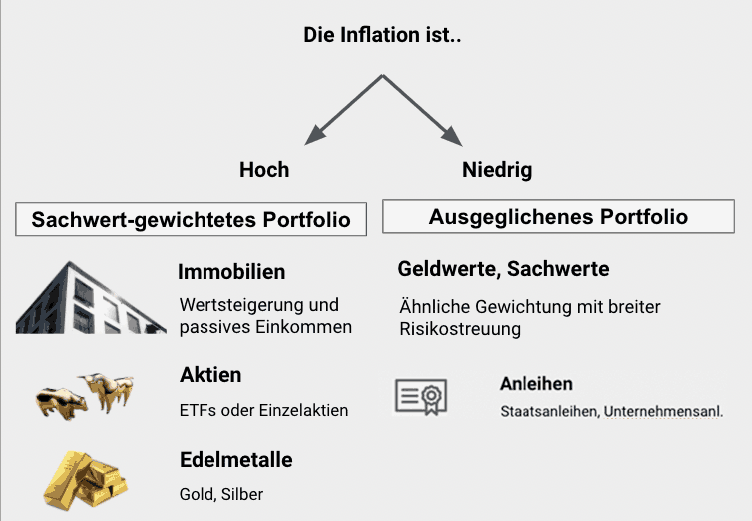

What is the best investment at the moment that works well even with inflation? In our opinion, the conclusion of the above argument boils down to a broadly diversified portfolio with an overweighting of real assets.

In the event of inflation, a stable portfolio should have an overweighting of real assets, e.g. real estate as an investment (source: own illustration).

A property as an investment is a relatively safe haven and one of the smartest investment decisions in the medium to long term. However, other tangible assets also belong in a broad-based portfolio (e.g. shares, gold, possibly also Bitcoin, although this depends very much on the investor).

In addition to the proportion of real assets in the portfolio, it could also make sense to hold short-term government and/or corporate bonds in the portfolio in order to limit the volatility of the portfolio. We would be happy to explain to you in a non-binding information meeting how a property as a capital investment protects against inflation and how a “normal” investor can implement an investment in a property as a capital investment.