Cashflow: Den Geldfluss bei Anlageobjekten berechnen

Auch Renditeimmobilien haben einen Cashflow. Bei einem positiven Cashflow springt jeden Monat ein kleiner Gewinn raus. Ein negativer Cashflow bedeutet, dass die monatlichen Ausgaben für die Renditeimmobilie (meist: geringfügig) höher sind als die Mieteinnahmen. Ein anfänglich negativer Cashflow spricht keineswegs gegen ein Immobilieninvestment. Schließlich wird der Cashflow spätenstens dann sehr positiv, wenn das Objekt abbezahlt ist.

Definition des Cashflows bei Immobilien

Der Cashflow stellt Einnahmen und Ausgaben gegenüber, die im Zusammenhang mit einer vermieteten Immobilie anfallen. Wenn die Einnahmen die Ausgaben übersteigen, ergibt sich ein positiver Cashflow.

Sind die Ausgaben größer als die Einnahmen, ist der Cashflow negativ. Mit „Cashflow-Immobilien“ sind Renditeobjekte mit einem positiven Cashflow gemeint.

Eine gut gepflegte Immobilie ohne Wartungsstau wird früher oder später zur Gelddruckmaschine, wenn das Darlehen getilgt wurde.

Cashflow von Anlageimmobilien

Die Ausgaben werden von den Einnahmen abgezogen. Bleibt Geld übrig, ist der Cashflow positiv. Im gleichen Zug lässt sich die Immobilienrendite berechnen.

Zur Kostenseite gehören die Kreditrate sowie Kosten für Instandhaltung und Verwaltung. Bei den Verwaltungskosten kommt es darauf an, ob sich der Käufer selbst um die Verwaltung kümmern und die Verwaltungskosten dadurch senken möchte.

Den Ausgaben werden nun die Mieteinnahmen gegenübergestellt. Die Differenz stellt den monatlichen Ertrag dar. Das monatliche Ergenis ist der Cashflowist das – sofern es sich um einen Überschuss und damit um einen positiven Cashflow handelt.

Beispielrechnung für Immobilien-Cashflow

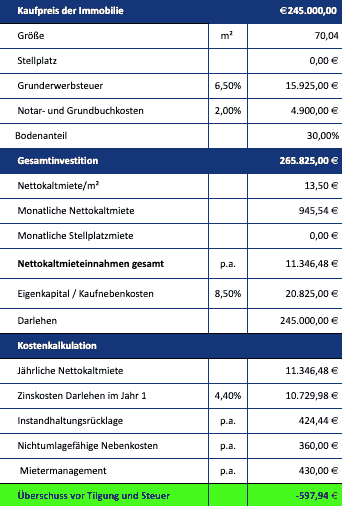

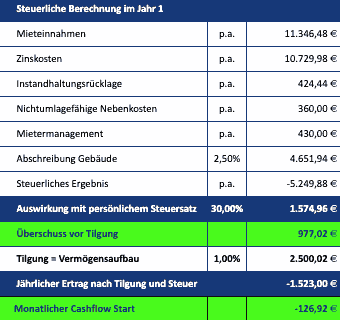

Ein Beispiel für eine Cashflow-Berechnung könnte so aussehen:

Berechnung des Cashflow einer Renditeimmobilie

Positiver Cashflow bei Immobilien

Eine Immobilie mit positivem Cashflow bringt regelmäßig Geld ein. Dies ist nicht bei jedem Immobilieninvestment gegeben, denn es gibt auch eine große Anzahl negativer Cashflow-Immobilien, für die Anleger monatlich einen meist kleinen Betrag zuschießen müssen.

Um einen positiven Cashflow zu erreichen, gibt es jedoch einige Stellschrauben, an denen Sie drehen können. So gibt es Positionen in unserer obigen Beispielberechnung, die variabel sind.

Zinssatz und Tilgung sind verhandelbar und auch bei den Verwaltungskosten lässt sich oft was machen. Auf der anderen Seite sollten die Mieteinnahmen so hoch wie möglich sein. Diese hängen von der Lage und dem Zustand der Immobilie ab.Wie wichtig ist ein positiver Cashflow?

Sie kaufen eine vermietete Wohnung unter Marktwert, weil der aktuelle Mieter ein 80-jähriger Rentner ist, der seit 20 Jahren ohne Mieterhöhung in der Wohnung lebt.

Der Cashflow ist in diesem Fall aufgrund der geringen Mieteinnahmen sicherlich deutlich negativ.

Nach zwei Jahren verstirbt Ihr Mieter mit 82 Jahren. Was aus menschlicher Sicht traurig ist, ermöglicht Ihnen als Eigentümer, die Wohnung zu marktüblichen Konditionen neu zu vermieten.

Plötzlich stehen der unveränderten Kreditrate deutlich höhere Mieteinnahmen gegenüber. Der Cashflow wandelt sich radikal und ist plötzlich deutlich positiv.

Sie sehen: Der Cashflow beschreibt lediglich die aktuellen Zahlungsströme, die mit der Anlageimmobilie zusammenhängen.

Je nach Zeithorizont des Anlegers kann ein anfänglich negativer Cashflow in manchen Fällen eine gewisse Zeit lang toleriert werden, solange sich das Investment längerfristig doch rechnet.

Manche unserer Kunden wünschen sich von Tag eins an einen positiven Cashflow. Wir können beide Wünsche realisieren, da wir Objekte selbst entwickeln und demnach individuelle Bedürfnisse unserer Kunden oberste Priorität haben.