Buying and renting out an apartment or house

In today’s low-interest phase (editor’s note: even at the end of 2023, after more than ten years of low interest rates), only a few forms of investment are still worthwhile. Savings accounts currently generate virtually no returns (this will still be the case at the end of 2023, with significantly higher key interest rates. Savings accounts always lag behind in terms of returns) and call money and fixed-term deposits also barely manage to compensate for inflation. The highest returns can currently only be achieved with shares and real estate.

- However, shares are too uncertain and volatile for many investors.

- Real estate, on the other hand, offers a consistently high return with a high level of protection even in times of crisis. The principle: buy a house to rent out.

Using a house as an investment generates a fairly secure and attractive return. However, there are a few things to bear in mind. The yield booster par excellence when buying a property to rent out is the so-called leverage:

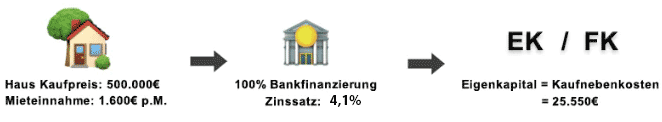

Buy a house and rent it out: How does it work? (Own illustration. As at: Nov 2023)

| Step 1 | The right house to buy and rent out is found and costs €500,000. It generates rental income of €1,600 per month. |

|---|---|

| Step 2 | The purchase price of the house – namely 500,000 euros – is financed via a bank loan. The interest rate in our fictitious example is 4.1%. |

| Step 3 | The buyer only invests a small amount of their own money: The ancillary purchase costs. These consist of land transfer tax and notary and land registry costs. The land transfer tax varies from state to state and is between 3.5-6.5%. In our example, the total ancillary purchase costs amount to 5.1%, which corresponds to 25,550 euros. |

For the property to be profitable, the expected return should be calculated realistically. How high will the rental income be? How is the basic rent per square meter calculated? The location plays a significant role here. This determines how much rent can be charged. It makes sense to take your time and compare property prices and rents in different locations.

The purchase price is also important. The ratio between the purchase price and the annual basic rent must be right and should ideally be between 20 and 25. The ancillary costs should not be forgotten, as they also play a decisive role. The calculation should definitely include notary and/or legal fees, any estate agent costs and land transfer tax.

It should also be calculated at the outset how high the expected management costs for the property will be. If the property has to be renovated first, high renovation costs may be incurred. Investors can avoid these risk factors for the building fabric by building a house and renting it out. However, building a new house is usually more expensive than buying an existing house.

Returns when renting out a house

For any type of investment, the return is the key indicator of the profitability of the investment. In the case of shares, this is easy, as apart from the difference between the selling price and the original purchase price, only the dividend needs to be taken into account. In contrast, an investment in a rented property has one major advantage: leverage.

The clever investor still takes advantage of the historically low interest rate (Note: December 2023, the key interest rate is falling again after the drastic rise in 2022-2023, further cuts in 2024 announced by the FED in mid-December 2023) to cover the purchase price with a bank loan. The low interest fees are hardly a factor these days; the rental income can then be used to repay the loan. In some cases, a certain amount of equity is required when buying a property. However, this is not always necessary. A house as an investment can also be financed without equity under certain circumstances.

The rented house generates returns through rental income

If you opt for a property as an investment, you don’t move into the property yourself: The house is financed and rented out. This has the advantage that the loan taken out for the purchase is usually covered by the rental income. Investors should ensure that the expected return is higher than the mortgage interest rate. In these cases, banks usually require little or no equity, so that even financially weaker investors can invest in real estate. Nevertheless, investors should try to at least cover the ancillary costs from their own funds. This is in line with the investment philosophy of Meine-Renditeimmobilie. The costs of buying a house basically consist of:

- Purchase price

- Notary and land registry costs

- Realtor’s commission

- Real estate transfer tax

- Additional costs

- Renovation costs, if applicable

When calculating the costs, it is important to ensure that they are the actual costs. All too often, sellers or estate agents use lower costs to make the investment appear more attractive.

Buying and renting a house without equity

It is perfectly possible to buy a house as an investment without equity. But not everyone has the opportunity to do so; there are certain requirements:

- Very good credit rating with a positive household budget

- Collateral

- A coherent concept for the house as an investment

- Experience helps

A positive financial statement is an important factor. It shows the bank that you will not get into financial difficulties even in the event of a potential rent default and that you can continue to make interest and repayment payments. This gives the bank security. Speaking of security: a house or apartment that has already been paid off (or other tangible assets such as a share portfolio) can serve as security for the bank, which significantly increases your chances.

This allows the bank to access additional funds from you in the event of tenant defaults without jeopardizing interest and repayment. A coherent concept, neatly worked out and professionally presented to your personal bank contact, helps to give your project a serious framework. This is exactly how we handle it for our customers when we process the financing on their behalf.

One advantage that we as Meine-Renditeimmobilie have over the fresh investor is our reputation with many banks and personal contacts: it is clear that our many years of cooperation have built up trust and we usually get even more complicated cases placed. If you have experience in the real estate sector – whether through private investments or professional overlaps with the financial sector – this helps to make a good impression on the bank advisor. Not a must, but of course welcome.

Building and renting out a house: Tax

Would you like to build a house and rent it out and are wondering what taxes are involved? Here is an overview:

- Land transfer tax for the plot: If you buy an undeveloped plot of land to build a house on, you will have to pay land transfer tax on the purchase price of the plot.

- Income tax: Rental income that you earn from renting out the completed house is subject to income tax.

As we are not tax advisors, this should not be seen as tax advice. Please contact your tax advisor for details.

House as an investment – what to consider

If you pay attention to a few basic factors when buying a house as an investment, you can significantly reduce your risk:

- Don’t buy too expensive: For a specific property or plot, check how expensive other properties in the area are. In addition to the usual real estate platforms, additional tools such as Geomap are helpful.

- Building land: If you buy an undeveloped plot of land, it must be designated as building land before you can build. This point is of course irrelevant if you are buying an existing house.

- Regional factors: How strong is the economy in the region, are there enough jobs in the future? How would you rate the neighborhood in which the property or house is located? Is it up-and-coming or characterized by out-migration?

- Political factors: Does the local political situation favor real estate investments? Berlin is a glaring example of a risky location in these times: the rent cap was introduced here in 2019, which is disadvantageous for landlords as the cap reduces returns. Lower rent means lower returns. However, the rent cap has been history since 2021. It remains to be seen what nationwide politics will decide regarding the rent cap.

In addition to these general criteria on the topic of “what to look out for when renting out a house”, there are property and property-specific risks that need to be considered, for example with regard to the building fabric. If you don’t want to search for yourself, we will be happy to help you find the right investment property. To do so, please contact us.