Is there a real estate bubble in Germany and when will it burst?

In this article, we shed light on the topic of the 2024 real estate bubble: What is the 2024 real estate price forecast for Germany? What indications are there that a real estate bubble is still in the making? And what happens when the real estate bubble bursts? Will property prices fall? Can we expect a real estate crash in 2024? There is a saying in the financial markets:

“History doesn’t repeat itself, but it rhymes.”

This wisdom applies not only to the stock market, but also to the price development of real estate. The exact repetition of a past bubble is unrealistic. We are unlikely to see a second 2008/2009 on the markets. In general, however, as soon as price valuations rise explosively within a very short period of time, caution is often replaced by euphoria – which can encourage the real estate bubble to burst.

Real estate bubble in Germany: Realistic or not?

The first major speculative bubble occurred in the Netherlands in the 1630s, when the so-called tulip mania came to a spectacular end. At that time, the trade in tulips had developed into an incredible business. The prices for tulip bulbs rose to absurd heights, although they were happily paid. The traders even hoped that prices would continue to rise so that they could make even greater profits.

In some cases, all savings were spent on buying the then new and rare plant and later selling it at a high profit. In 1637, an auction was finally held in an inn in Haarlem. And what happened? Nobody wanted to buy any more. Prices collapsed and many speculators lost their savings. At least that’s how the story is told. Nowadays, many believe that much of this story belongs in the realm of legend.

Nevertheless, this story vividly describes how a bubble forms. Demand for a certain product becomes high and prices rise. Everyone wants to profit from it and at some point people realize that the price of the product is far above its actual value, so no one wants to buy it anymore. Demand falls, prices plummet and the bubble has burst. Now many are talking about a real estate bubble coming in Germany.

Real estate bubble in Germany in 2024?

Record low interest rates prevailed in Germany thanks to the low prime rate. As the key interest rate indirectly influences the conditions for building loans and property price trends are in turn heavily dependent on interest rate conditions, among other things, prices for residential property as an investment have risen steadily in recent years.

However, we are currently observing a completely different situation on the real estate market. Property prices are falling and interest rates have risen rapidly since the start of 2022. As a result, fewer and fewer people are able to buy a property. The suspicion of a bubble is therefore very real. Last year, the real estate bubble 2023 was already under discussion.

Real estate bubble in Germany: only a regional danger.

However, the real estate bubble can only be said to have burst when property prices explode so dramatically that they become decoupled from their real value. The pace also plays a major role here. If purchase prices rise much faster than rental prices, for example, this could be an indication of a real estate bubble.

Many people think of Munich first and foremost. Is there a real estate bubble in Munich? Most experts say: No. Because in Munich, investors pay a high price, but in return they get a bright economic and demographic outlook. And these are important criteria for the good rentability of an investment property.

According to the latest “Living in Germany 2023” study by the Sparda banks, the district of Munich is at the top of the regional ranking for regional attractiveness. Basically, it can be said that the abstract risk of a bubble exists in almost all major German cities in A-locations. Prices here have risen very quickly in recent years.

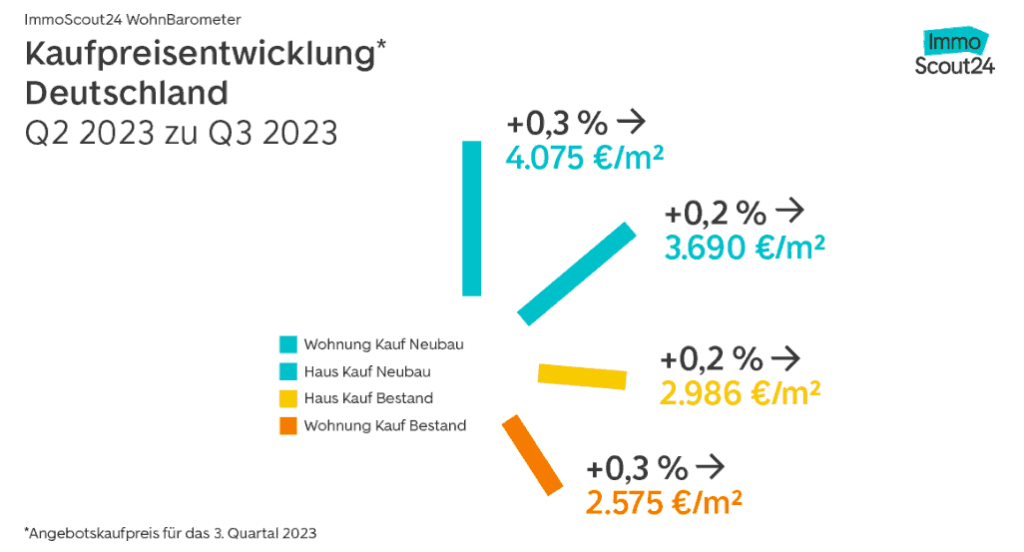

However, we have already observed a decline in real estate prices across Germany since mid-2022. The situation on the real estate market is currently looking somewhat better. According to a study by ImmoScout24, a slight price increase in residential real estate in Germany can be observed in the third quarter.

Increase in asking purchase prices across Germany in the third quarter by 0.2 and 0.3 percent. Source: ImmoScout24. As of October 2023.

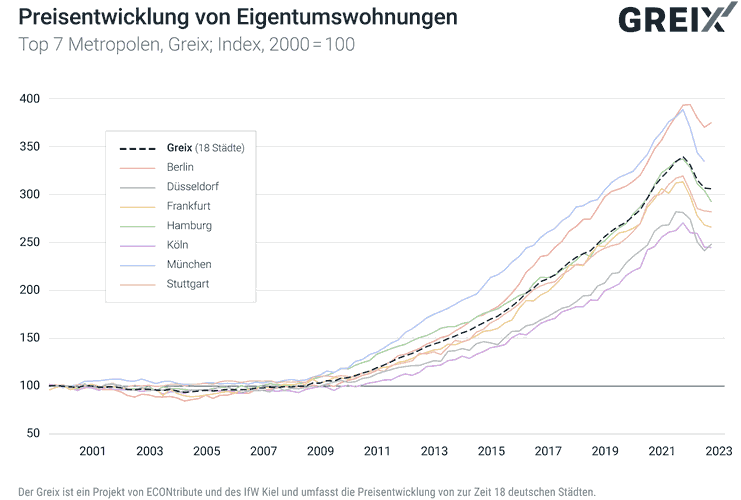

Property prices are slowly stabilizing, as can be seen in the following chart using the example of condominiums in the top 7 metropolitan areas:

Source: IfW Kiel, as of 03.08.2023

Prices have also fallen in smaller cities or towns, but not to the same extent. Looking at the German real estate market as a whole, there are no signs of a real estate bubble in 2024, even if prices in some A-locations are still above average.

In summary, a general statement on the subject of a real estate bubble in Germany is nonsensical and misleading. Yes, there are regional areas with highly inflated real estate markets, but there are many more regions with attractive potential and undervaluation. So anyone who is put off by a “real estate bubble bursting” is missing out on interesting yield opportunities.

Indicators for the emergence of a real estate bubble

Wouldn’t it be great to be ahead of other investors by being able to spot a real estate bubble in its nascent stage and act accordingly? Fortunately, there are various indicators that can be observed as early warning signals:

Construction activity

If the construction industry were to flourish and at some point account for a high proportion of the overall economic power in Germany, we would be dealing with a possible indication of exaggerations on the real estate market. A lot of activity in the area of new construction can be observed when new construction becomes a real alternative to existing properties from a price perspective, which would have previously increased in price accordingly.

New construction in Germany has currently slowed down significantly since the coronavirus era due to increased material and energy costs, inflation, higher interest rates and supply chain problems. In some cases, new construction projects have even come to a complete standstill, if you think of Vonovia’s construction freeze, for example. After all, this is the largest residential construction group in Germany.

Private debt

The formation of a price bubble on the real estate market is usually accompanied by a sharp increase in private debt when private individuals take out multiple real estate loans. In principle, the relevant indicators therefore point to a non-overheated real estate market and therefore no real estate bubble. New construction activity and private debt will need to be monitored in future in order to identify possible price exaggerations in advance.

Does Germany face a real estate bubble in the future?

I’m sure many people are asking themselves the following questions: What’s next? Why isn’t the real estate bubble bursting? Will real estate prices fall? What is the real estate price forecast for 2024? Will there be a real estate crash in 2024? Experts currently assume that real estate prices in Germany will continue to fall. Furthermore, we do not expect interest rates to fall in the short term, as the overall economic situation will not change overnight due to high inflation, among other things.

Inflation affects salaries as well as rents and purchase prices for residential property. As mentioned above, few properties are currently being built, which is putting additional pressure on the rental market. Due to these facts, rental prices are expected to rise in 2024. There should not be a real estate crash, but a price correction is possible or has already occurred.

Effects of the Ukraine war on the real estate market

The outbreak of war in Ukraine in February 2022 has shaken the entire world. This crisis has not only had serious humanitarian consequences, but also global economic ones. Energy prices have risen, inflation and interest rates have also increased. More and more refugees are arriving from Ukraine, demand for real estate is growing and there are supply bottlenecks. Due to the shortage of Russian goods such as oil and gas – but also of Ukrainian wheat – food is becoming more expensive.

But what about real estate as an investment in times of war? Although interest rates for real estate loans have risen dramatically recently, we are still in a period of low interest rates – historically speaking. Investors can profit well from residential real estate, as these tangible assets offer security of value and good protection against inflation even in times of crisis. Real estate therefore remains a safe form of investment in the long term.

Example: China real estate bubble

In China, we have seen very clearly in recent years what happens in a real estate bubble. The Chinese real estate market was booming and people were buying more and more – in a sense, the motto was “Buy at any price!”. The motto should rather have been: “When will the real estate bubble burst?” Because it was always foreseeable. However, the Chinese buyers did not plan to rent out these properties.

They were speculating that prices would continue to rise and that they would be able to sell their properties at a high profit in the future in order to extract a high real estate yield. Tenants would – in their opinion – have reduced the value of the property and so there were a lot of vacancies. In China, the real estate bubble has produced one thing above all: ghost towns. Many properties were built and bought, but no one ever moved into them. This led to the China real estate crash.

The Chinese real estate bubble as a warning example

The real estate market is the most attractive form of capital investment in China. Shares are rather unpopular with the population due to the high risk, and bonds are also not very popular as the returns are often lower. As a result, 70% of Chinese private assets are invested in the real estate sector.

Meanwhile, the government’s problem was record-breaking national debt and underperforming economic growth. To stimulate the economy, the state decided to promote housing construction. This would create new jobs, generate an oversupply of real estate and thus lower property prices.

This should then encourage investors to invest in shares in private companies rather than in real estate. As a result of these measures, many property owners are now having to accept significant losses in value. The extent to which the coronavirus has exacerbated the situation will become clear in the coming years. In Germany, such an intervention in the free market is unthinkable. Accordingly, the risks of such a price collapse on the real estate market are very unlikely.

Risks of real estate investment

The question arises as to when and whether a real estate bubble will occur in Germany in 2024. What impact will the coronavirus and energy crisis have? How can you minimize the risks in the current crisis period? In the long term, the risks will minimize themselves. Every downturn is followed by an upturn. All you need is a little more patience.

However, if you want to be proactive in times of crisis, there are a few points you should bear in mind. After all, real estate as an investment also harbors a few risks that are easy to avoid. The location plays a major role. It can be decisive for your economic success as a real estate investor. If you are not familiar with the real estate market, please do not do anything on your own. Especially at the present time, it is important to get good advice to avoid making the wrong decisions. A good real estate guide is worth its weight in gold here.

In times of crisis, it is logical that properties in unattractive locations are the first to become vacant. Investors who commit to a very good location from the outset have a low risk of suffering from vacancies, even in crisis situations. To further minimize the risk of a real estate bubble, we recommend a diversification strategy.

Don’t put all your eggs in one basket. If you invest in both real estate and equities and possibly bonds, you are not dependent on a single form of investment and can offset any losses. You can also benefit greatly from diversification by acquiring properties in different locations. Ultimately, a diversified investment portfolio, choosing a good location and buying at a good price are essential for building wealth in the long term and having a solid financial foundation even in turbulent times.