Recession in Germany: Significance for citizens and the economy

If we look at world events, especially in retrospect, they were crazy. To a certain extent, it still does. Starting with the coronavirus pandemic, the excessive rise in energy costs, high inflation and the war in Ukraine. But is it time to take a deep breath or should we remain cautious with regard to the economic situation in Germany? Have we made it out of the cold water and escaped the economic crisis in 2023 or are we not yet completely out of the woods? Let’s start on a positive note: there are indicators that give hope for improvement.

But what exactly is a recession, how does it affect gross domestic product and what does a recession mean for citizens? What are the effects of a recession? And what consequences does a recession have for real estate in particular? In the course of our article, we would like to shed some light on these issues and answer any other questions that may arise.

Recession definition

What is a recession? A recession is one of the four phases that the economic cycle can go through. The phase is characterized by an economic development with a negative growth rate and a significant overall economic slowdown. In common parlance, recession is often used as a synonym for economic decline, downturn or economic crisis.

Recession and the economy: Opinions differ as to exactly when a recession occurs. The most important macroeconomic factor – to assess the overall economic situation of a country, i.e. its business cycle – is the gross domestic product (GDP).

Officially, we speak of a recession when the gross domestic product of a country stops increasing or even decreases in two consecutive quarters compared to the previous quarters. The opposite of a recession is the expansionary phase or economic upswing. By and large, a recession is only one phase of the overall economic cycle. We will take a closer look at the exact classification below.

Classification in the economic cycle. How serious is a recession?

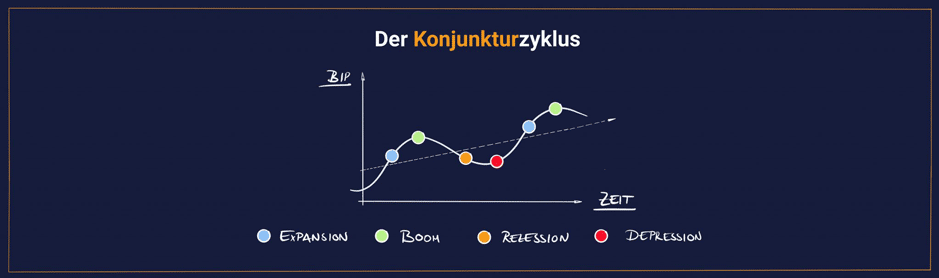

What phases does an economic cycle go through?

Four phases of the economic cycle

The four phases that occur in waves:

- Expansion = upswing

- Boom = economic boom

- Recession = downturn

- Depression = low phase

Short-term economic fluctuations are generally part of a healthy economic cycle, as are all four of the naturally occurring phases mentioned above.

A recession is therefore also part of a natural cycle and cannot be avoided per se. Although even a short phase of recession can have far-reaching effects, a recession only becomes really threatening as soon as it lasts for a longer period of time and leads to a depression.

Typical characteristics and key factors that can indicate a recession

If you are now trying to find out whether the economy is currently in a recession, you can look at the occurrence of typical characteristics which, especially in combination, can indicate that a recession is imminent.

- Stagnating or falling gross domestic product (compared to the previous quarters)

- Change in the interest rate structure for US bonds

- Continuing and sharply rising inflation

- Diminishing or absent willingness to invest

- Decline in purchasing power and demand

- Falling retail and wholesale sales

- Overfilled warehouses

- Cessation of production

- Increased reduction in overtime and rising short-time working

- Layoffs and rising unemployment

- Pessimistic economic forecasts

- Dropping share and stock market prices

Reasons for a recession

There are numerous factors that influence the overall global and economic situation and its development. Consequently, there are also various approaches and theories that attempt to explain the emergence of a recession. However, it is not possible to generalize the reasons that lead to a recession. Some of the theories are defined below:

-

Overproduction and overinvestment

One cause can be exuberant optimism on the part of companies during economically strong phases such as the economic boom. Excessive investment can lead to excess production capacity. This forces companies to reduce these capacities again due to a lack of demand.

-

Lack of financial resources

The opposite scenario can also lead to a recession. If companies lack sufficient financial resources, they cannot invest. As a result, economic growth also suffers.

-

Structural change in key industrial sectors

One significant cause that can trigger a recession is structural change in particularly important industries. If a major sector of the economy collapses, there is a risk that the entire economy will be thrown off balance. The more profound the changes are, the more massively companies are affected and suffer major damage as a result. The path to recession is often pre-programmed and difficult or impossible to avert.

Are we facing a recession?

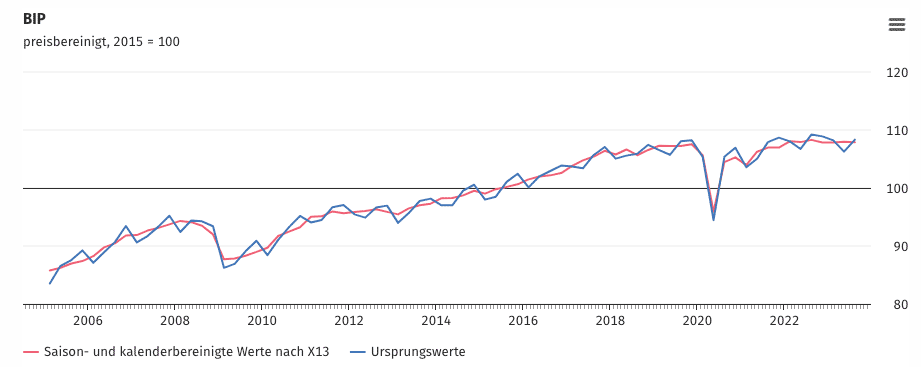

Towards the end of 2022 in particular, the question of whether there would be a recession in the following year was omnipresent. For good reason, and it remains topical. Let us now take a look at a decisive assessment factor: gross domestic product. According to initial estimates, a slight increase was expected at the beginning of this year. Hopes were high, but the disappointment following the recent publication of the adjusted figures was all the greater.

According to a press release from the Federal Statistical Office on 25.05.2023, gross domestic product fell by 0.3% in the first quarter of 2023 compared to the fourth quarter of 2022. In the second quarter of 2023, economic output stagnated compared to the first quarter of this year. Germany was therefore in a technical recession. This occurs when gross domestic product falls or stagnates for two consecutive quarters. In the third quarter of this year, GDP fell by 0.1%.

Source: Federal Statistical Office

Another key factor considered when assessing recession risk is the development of the yield curve for US bonds with a maturity of 2-10 years. Within one year of an inverted yield curve, the probability of a recession is 67% and within two years thereafter it is already 95%. It reversed for the first time in the US at the end of March 2022. Even back then, there was therefore a lot to suggest that there would be a global recession. The yield on US bonds has still not really recovered, although there has been a slight increase.

But what about changes in key industrial sectors? In mid-2022, the alarm bells were ringing about the development of oil and gas prices. Nobody forgets that so quickly, but the winter is over and despite the worst fears, the dreaded gas shortage fortunately did not materialize, thanks to the mild winter.

However, according to the Federal Statistical Office (as at October 9, 2023), production in the manufacturing sector fell by 0.2% overall in August this year compared to the previous month. In addition, various developments can be observed in the manufacturing sector during this period. For example, declines can be seen in the following economic sectors: Construction production, energy production and production of consumer goods. In contrast, industrial production, the automotive industry and the production of capital goods and intermediate goods developed positively.

Fortunately, the unemployment and redundancy rates were also comparatively low. Nevertheless, many people are still struggling with the consequences of this. The latest figures from September 2023 show a 0.1 percentage point drop in unemployment compared to the previous month (source: Federal Employment Agency). Russia’s war against Ukraine is also still present and a difficult factor to assess for the global economic situation.

The connection between the recession and the war cannot be dismissed out of hand. On the contrary: according to the Federal Ministry for Economic Affairs and Climate Protection, the war continues to pose substantial threats to the German economy. At the end of last year, supply chains were disrupted, trading partners were unable to deliver and bottlenecks resulted. However, there is good news at this point: According to the ifo Institute, the supply bottleneck situation has eased noticeably. Bottlenecks are easing in various sectors, which in turn is having a positive effect on the economy.

Uncertainty remains as to how the situation will develop and whether it will worsen further. These are all factors that will undoubtedly play into the hands of another recession. If we compare the current recession with those that have taken place in the past, we can assume that we are better prepared. The economy is better able to cope with and react to the consequences thanks to the banks’ deposit protection systems and automatic stabilizers. Another ray of hope is the historically low unemployment rate. However, only time will tell exactly how the situation will develop.

Recession and inflation – how are they connected

Inflation is one of the most important indicators of a looming recession. When inflation rises, the value of money falls. This leads to a loss of purchasing power and a reduced willingness to consume, as people are anxious to keep their money together in order to be able to cover their living expenses even if costs rise.

In addition to rising production costs and supply bottlenecks, companies are naturally feeling the effects of consumers’ unwillingness to invest. The production capacity of industries continues to decline. This leads to redundancies and increased unemployment. The cycle starts all over again. So does inflation necessarily mean the onset of a recession?

It is important to take a close look at the development and progression of inflation: Is it a case of extreme and, above all, persistent inflation that can no longer be contained despite countermeasures – such as interest rate hikes? Such a progression of inflation strongly indicates a recessionary development. Inflation explodes before a recession and falls again during the recession or even moves towards deflation.

Measures such as raising interest rates are intended to have a balancing effect on supply and demand and thus bring them back into line. However, due to external factors such as the Russia-Ukraine war, central banks have also found themselves in a somewhat powerless situation: inflation is difficult to contain or even stop permanently through interest rate policy. Nevertheless, inflation fell to 3.8% in October.

However, it should not be forgotten that the resulting decisions also have serious consequences. Growth and the further development of the economy are being massively slowed down. The result of this could have been the start of a recession. And these consequences, such as the ongoing loss of purchasing power, are still looming.

The fact is, a recession can hit us at almost any time and unexpectedly. Although the ifo Institute publishes an economic forecast four times a year, we lack the ability to foresee all eventualities and counteract them in advance.

Effects and consequences of a recession

As you can see, the topic of “recession” is extremely complex and involves numerous correlations and correlating influencing factors. What specific effects and consequences does a recession have on the economy and consumers? What on the state? What exactly happens during a recession?

What are the consequences of a recession for citizens, companies and the state?

It is striking that both citizens and companies are becoming increasingly frugal in their budgeting. The concern about future developments is written all over most people’s faces! As already mentioned in the “Recession and inflation” section, a vicious circle is beginning.

Let’s look at the corporate side: Costs have to be cut back throughout the company. Almost all areas of the company suffer as a result. Sometimes even filing for insolvency is unavoidable. If redundancies and job cuts can be averted, new hires will certainly be avoided. Innovations and new projects are put on the back burner to save costs for the time being.

The consumer side is also suffering. People have less or too little money at their disposal and are struggling to pay off loans and mortgages – apart from the cost of living. Rising unemployment and less liquidity are causing consumers to lose purchasing power. This has an impact on demand. A vicious circle – because companies are also suffering from a lack of income. Short-time working and further redundancies are the result.

Small businesses and the self-employed are particularly affected by the impact of the recession, as they often have less protection than civil servants and employees. It is now up to the government and central banks to decide how much consumers and tradespeople suffer from the recession or receive support.

What are possible measures against a recession?

The state must set priorities with regard to its tasks – this may also lead to further government debt. But what course is being pursued and what are the current economic policy measures? Economic policy measures are an important part of getting the economy moving again. Let’s look at specific examples of countermeasures that can counteract a recession:

- Relief packages for households (energy prices)

- Short-time working

- expansive fiscal policy instruments, such as employment programs or tax cuts

- Protective shield for severely affected companies

The aim is to influence the overall economic situation. The consequences of a recession, such as economic fluctuations, are to be offset and the aim is to be able to achieve stable economic growth again. Of course, the state can only have a balancing effect and compensate for the lack of economic power within the scope of its possibilities. The state is therefore aiming to overcome the recessionary phase as quickly as possible.

How to structure your investments during a recession

In principle, the far-sighted investor tends to diversify. Of course, the weighting of risk can shift. The decisive factor here is which economic phase we are in at the time. In concrete terms, this means that in economically challenging times, you should be prepared to ride the economic wave and rethink the originally planned allocation or distribution of investments.

Those who have focused on investing their money for the long term will have fewer worries in this regard. A certain buffer for times of crisis has already been built into the investment strategy in advance. Otherwise, it is now up to you to seize the opportunity and adapt your investment strategy for the future. Last but not least, this is where real estate investment comes into focus, which can be a key aspect of rebalancing.

However, it is less advisable to panic sell. How does rebalancing work in practice? You can sell asset classes with too high a weighting and replace them with others.

Recession and equities: what happens to equities in a recession

Stock markets usually suffer during a recession. Such an economic downturn has a negative impact on the economy as a whole as well as on company valuations and consequently on share prices. In general, it can be said that shares lose value during a recession. This can be attributed to the poorer market environment. What do listed companies do in this situation? They cut their costs, make processes more efficient and downgrade their profit forecasts.

Ultimately, the aim is to increase profitability and thus compensate for a slump in sales. In some cases, companies are even forced to sell off certain parts that are not part of their core business, reduce dividend payments or even abolish them completely. In the past, important and influential industries and companies have already been supported by government rescue funds.

However, investors often still decide to take their money out of the stock market completely. “Safe” investments that retain their value, such as gold or real estate, are favored.

Which shares are recommended in a recession? For investors hit by the crisis, it is very important to minimize the risk of a loss in value. In a recession, it is therefore advisable to focus on long-term and stock market-oriented investments, such as ETFs. ETFs track the performance of certain indices. These are available, among other things, as a savings plan in which you invest automatically at a set interval.

This has the following advantage: if the stock market price is currently falling or has already reached its lowest point, ETF shares can be purchased particularly cheaply. This anti-cyclical investing in particular is a key component of rebalancing and an opportunity to take advantage of the current market situation. Benefit from high selling prices or low purchase prices!

Another way to invest in shares during recessionary times is to buy defensive shares. These usually remain stable even during downturns. Examples include consumer staples, healthcare and utilities stocks. These are areas that are in demand at all times.

Have you ever asked yourself the following questions? What are the best and safest stocks to hold during a recession? Should I sell my shares during a recession? Many shareholders tend to panic sell in times of crisis. This is usually not the best choice. The rapid increase in sales further accelerates the devaluation. After all, the stock market is regulated solely by supply and demand.

If your own financial circumstances allow, it may be advisable to sit out a downturn phase during the economic cycle. However, the risk associated with the respective shares must of course be weighed up so that money can be reallocated accordingly if the worst comes to the worst. Keyword “rebalancing” and the creation of additional collateral.

Are there possibly even shares that rise in a recession? And which shares should you buy then? With the exception of a few areas, such as shares in the defense industry (due to the war in Ukraine), it is probably less likely that shares will increase in value during a recession in the short term. Although just a few months ago we were able to observe a completely different situation. From September 2022 to July 2023, share prices moved in a positive direction. Among other things, the DAX reached a new high in summer 2023. However, prices have been falling again since August 2023.

However, the above-mentioned panic on the market can be an opportunity to capitalize on the recession in the long term. Many shares fall below their book value and shareholders can buy them for less than the share’s book value. However, the condition for a gain in value in the future is to survive the downturn. It is advisable to focus on companies with optimistic and visionary ideas.

As soon as the economy starts to pick up again, these will be the pioneers on the market. Progressive companies often invest more in marketing or new product launches despite economically challenging circumstances. The company is keen to gain new market share and customers. Only those who do not have to fight for sheer survival can strive for this.

Real estate and recession: consequences for the real estate market

What impact is the recession having on real estate? What happens to real estate prices during a recession? Does it make sense to buy real estate during a recession? Of course, a recession also has consequences for real estate. The real estate market itself remains relatively stable during a recession – even if prices may fall slightly. In a downturn, there may also be an increase in sales, as not all owners are able to service their loans. A tempting opportunity for investors to buy more cheaply.

With the necessary foresight, it should of course also be clear to almost everyone what will happen as soon as the market recovers and interest rates fall again. In all likelihood, prices will rise again. The recession usually affects supply and demand in the real estate sector. Demand in particular is much more affected during the downturn. In contrast, the supply of real estate remains available. Because people always have to live and rent!

As mentioned above, a recession can lead to price reductions in the real estate market. We have been seeing this trend since mid-2022. In principle, however, it can be said that the fall in property prices during a recession is potentially only a temporary fluctuation in the market.

Real estate prices can fall in the short term during a recession. However, real estate generally recovers very quickly.

Is it advisable to buy property during a recession? At the end of the day, it is certainly a highly individual decision as to what is best to invest in during economically challenging times such as a recession. Nevertheless, one should not lose sight of the opportunities that arise. Let’s turn our attention to the inflationary situation for a moment. By taking out a loan for a real estate investment, you can even benefit from inflation.

Let’s look at what exactly is meant. The ratio of rental income to debt changes due to the prevailing inflation: rents are increased and at the same time the debt taken out loses value. Higher rental income meets reduced debt in real terms. In most cases, the loan taken out is already partially repaid through rental income. A temporary reduction in value can therefore be easily absorbed when viewed as a whole.

It is not without reason that there is talk of concrete gold. Real estate is considered a tangible asset (still the component of the economy that recovers fastest when the recession weakens). That’s why NOW is exactly the right time to buy a property as an investment at much lower prices than a year ago! Not only will you benefit from the increase in property value, but also from the crisis-proof investment that protects against inflation!

Recession opportunities – take advantage of the current market situation!

A recession offers both opportunities and risks

Like a medal, a recession also has two sides. They are not both exclusively negative. In the boom phase, the entire economy tends to exaggerate. On both a small and large scale. In a recession, on the other hand, it becomes humble and sensible again. It could even be seen as a cleansing process: Existing business models are put to the test, superfluous structures are scrutinized. Non-viable companies disappear from the scene and make way for something new and innovative.

It is therefore also a time of reinvention and further development. Creativity is in demand and new and forward-looking values can develop that pay off in order to remain competitive. Major companies such as IBM, Uber and Airbnb have already emerged in past times of crisis. In the long term, such a market shakeout has a positive effect on overall economic growth. An economically challenging time like now can also be a wake-up call for each and every one of us to awaken all the potential that lies dormant within us and to recognize and take advantage of the opportunities that present themselves.