Asset Management GmbH and the Trade Tax (Gewerbesteuer)

An asset-managing GmbH is a special form of asset management that can be particularly useful for people with high private and capital assets. The main task of the limited company is to manage and increase the contributed assets in a tax-optimized manner.

The primary aim of the GmbH is to build up long-term assets by reinvesting tax savings, which the company receives subject to various conditions. Different tax benefits arise depending on the type of assets to be managed. There are different types of VV GmbH:

- Real estate GmbH

- Holding GmbH (for shareholdings)

- Aktien-GmbH (for private pension provision)

Is an asset-managing GmbH subject to trade tax?

This special form of GmbH is a corporation that is subject to the conditions of the German Corporation Tax Act from a tax perspective. An asset-managing GmbH is therefore generally subject to trade tax.

Does every asset-managing GmbH have to pay trade tax?

The company constitutes a business and is therefore subject to trade tax. But what is behind the myth of the asset-managing GmbH without trade tax?

When does a GmbH not pay trade tax?

There is indeed an exception. You can now breathe a sigh of relief and consider yourself lucky if you manage real estate with your asset-managing GmbH. This special form of asset-managing GmbH is exempt from trade tax.

Reduction of trade tax in the asset-managing GmbH

You have now taken the plunge and want to save on trade tax with your asset-managing GmbH. You already seem to meet the first basic requirement: Your GmbH manages real estate. In this case, you can make use of the extended property deduction.

In principle, it should be noted that this procedure makes it possible to reduce the trade tax of the asset-managing GmbH. It is a statutory regulation that provides tax relief for certain asset-managing companies by allowing the GmbH to reduce its profit in the amount of the income from the asset-managing activity when calculating trade tax. These profits are then exempt from trade tax.

If all properties are owned by a pure real estate company, all income from letting and leasing is exempt from trade tax, provided that the extended property reduction has been applied for and all requirements for the reduction are met.

To ensure this exemption, the real estate GmbH may only manage its own properties and under no circumstances may commercial real estate trading take place. The latter is defined as the acquisition and subsequent sale of at least three properties within five years. Commercial letting (hotel complexes, vacation apartments, etc.) is also prohibited. Activities such as these are a definite exclusion criterion for the reduction.

Company car in the asset-managing GmbH

Company cars are permissible and harmless for the trade tax exemption.

Trade tax reduction must be applied for

It is also important to know that the company itself must apply to the tax office for the reduction and that the following conditions must be met for it to be granted:

- Asset management character, no commercial income

- Management and use of own property

- Management and use of own capital assets

- Management of residential buildings

- Construction and sale of detached and semi-detached houses and condominiums

No rental of movable goods

You are also prohibited from renting out inventory, operating equipment or movable economic goods. But there is a solution for this too. In this case, it is advisable to take a two-pronged approach and set up another company for this purpose. This company is then there specifically for the assets of the properties to be let, without any negative impact on the trade tax exemption of your Immobilien GmbH. Furthermore, however, you can rent out your real estate to the “business asset company”, which can rent out properties with, for example, inventory as a complete package. This also results in tax advantages for your real estate company, as the rental income you receive from your other GmbH is regarded as operating expenses there. Your taxable profit is reduced.

Reduction only for indirectly used real estate

The factor that the reduction is only granted for properties that are used indirectly for the business should also not be ignored. Example: Your existing company owns an office and commercial building that is rented out to third parties. This generates high rental income that indirectly benefits your company. However, if you were to use this building yourself, it would only serve a direct purpose and the reduction would not apply. Outsourcing the property to a real estate GmbH would therefore not make sense.

No ancillary activities in the VV GmbH

With regard to ancillary activities that are not included in the areas mentioned above, you should bear in mind that any activity, no matter how small, can lead to a refusal of the extended property reduction. As a result, additional trade tax is levied, which ranges from 7% to 31.5% depending on the location; the average rate in Germany is 15%. (GewStH 2016 – II. Assessment of the trade tax (bundesfinanzministerium.de)

Exemption from trade tax when selling the existing property

Let’s assume you purchase an existing property for €200,000 and want to sell it again 5 years later for €250,000. In this case, the 50,000 euro increase in value must be taxed. In any case, corporation tax and the solidarity surcharge will apply. The investment strategy should therefore not focus on the increase in value of the properties, as the obligation to pay tax – unlike for you as a private individual – does not expire even after 10 years.

With a long-term strategy, however, it is certainly possible to mitigate or completely avoid taxation. Particularly in the case of properties with a foreseeable high increase in value, careful consideration should be given to how they are held. However, the trade tax exemption while retaining the extended property reduction is also guaranteed in this example.

Asset-managing GmbH sale of real estate trade tax

As wonderful as the above-mentioned construct may sound and, if handled correctly, it is: when selling your real estate, you must always ensure that you are not classified as trading in commercial property.

What applies to an asset-managing GmbH when selling a property with regard to trade tax?

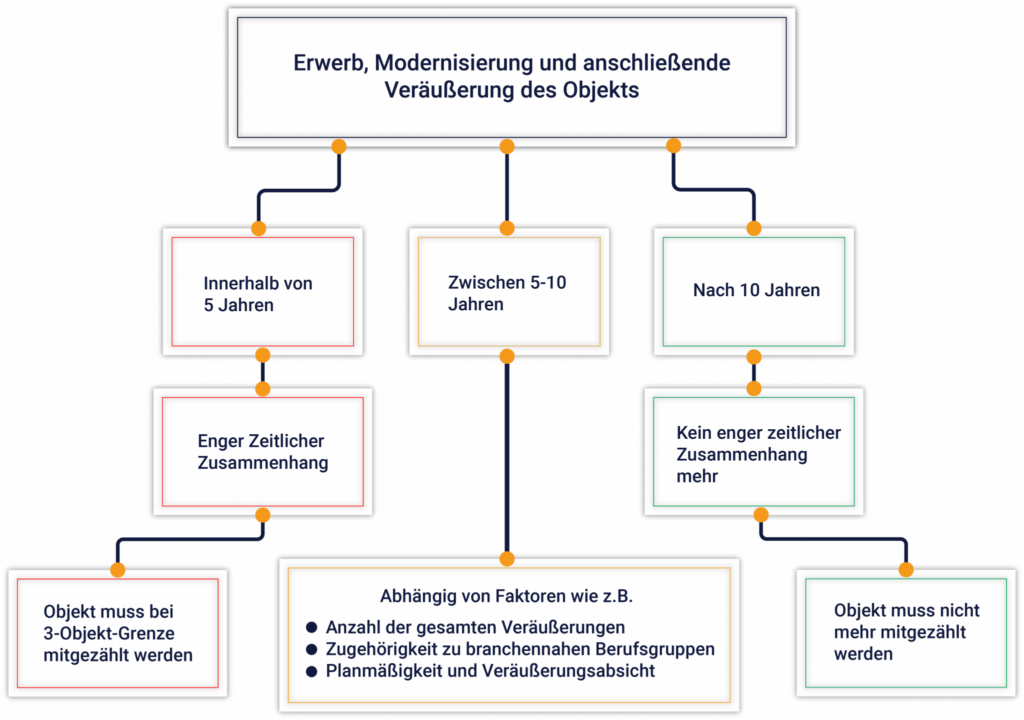

In order to escape trade tax, an extended property reduction must be agreed. One of the most important factors for this is not to be classified as commercial property trading.Generally speaking, the purchase and resale of 3 properties within 5 years is considered commercial property trading if there is a close temporal connection between the purchase of the property and the sale. Particular attention must be paid to extensive modernizations, especially in the case of existing properties. These require the property to be counted towards the 3-property limit.

A commercial enterprise is only established if the property is acquired at least conditionally with the intention of reselling it. As an indication of this, the tax authorities pay meticulous attention to the temporal connection:

Asset-managing GmbH: When is trade tax due?

Up to 5 years

If the acquisition, construction or extensive modernization and subsequent sale takes place within a period of 5 years, this indicates an intention to sell. The property must be included in the “property limit”. However, this 5-year limit is a guide, not a fixed limit. A slight overrun of 2 months, for example, does not necessarily have an adverse effect. You have the opportunity to disprove your assumed intention to sell by credibly demonstrating that you still had the serious intention of renting out, leasing or living in the property yourself in the long term at the time of purchase or at the time of completion.

Taking into account your personal circumstances and the exclusion of other factors indicating a trade, such as a high number of properties sold, short uniform sales periods or full-time work in the construction sector, it may well be possible to refute this in individual cases.

5-10 years

If we are talking about a period of 5 to 10 years, it depends above all on the other circumstances that are necessary to be classified as commercial property trading. First and foremost, this includes a high number of properties sold, as well as belonging to a professional group close to the industry, such as an architect, real estate agent or building contractor.

Upper limit 10 years

If there are at least 10 years between sale and disposal, the upper limit is reached, above which there is no longer a close temporal connection. Properties that have been rented, leased or used by you for more than 10 years do not have to be included in the 3 properties on sale.

Special case of own use

If you intend to sell your own home, this is not included in the 3 properties. It is considered a private sale transaction and, depending on the holding period, is no longer taxed privately or after 10 years. However, it is important that the property was used exclusively by you for the entire holding period or at least the last 3 years before the sale. If a property is only temporarily used privately by you, but you intended to sell it from the outset, the property must also be counted.

In this case, the situation must be considered individually and you must be able to prove that you intend to use the property yourself. If you have furnished the property individually, as an investor would be less likely to do, this indicates a serious intention, for example. The sale may also have arisen from a personal emergency situation. As you can see, many things cannot be precisely defined in general terms and are largely a matter of interpretation.

Conclusion

There is no generally valid statement or exact procedure to be on the safe side here. The decisive factors are the interplay of timing, planning and acquisition and disposal activity. It is essential for you as a shareholder of your Immobilien GmbH not to be classified as a commercial property trader under any circumstances. Otherwise, you cannot expect to be exempt from trade tax.