Bitcoin as a Capital Investment – Opportunities and Risks

Since its release in 2009, Bitcoin has evolved from a cryptographic experiment into one of the most discussed investment assets in the world. It combines characteristics of money, commodity, technology, and political statement. For investors, the question is no longer whether Bitcoin is relevant, but how it should be positioned within a long-term portfolio.

Why Bitcoin Fascinates Investors

Its attractiveness is fueled by several factors:

- mathematically limited supply (21 million units)

- global tradability without a central authority

- inflation hedge narrative

- extreme historical performance

Yet Bitcoin is not a simple asset. Its structure fundamentally differs from traditional asset classes — and it is precisely from this difference that both its opportunities and risks emerge.

Price Development Compared to Traditional Markets

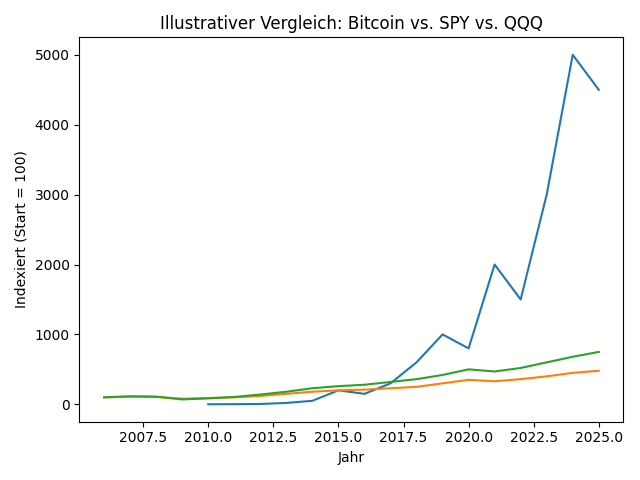

The long-term performance of Bitcoin is historically unparalleled. Even when compared with strong US equity indices such as the S&P 500 (SPY) or the Nasdaq 100 (QQQ), a completely different dynamic emerges.

| Asset | Characteristics | Volatility | Long-term Trend |

|---|---|---|---|

| Bitcoin | Decentralized digital asset | Very high | Extremely rising |

| SPY | US stock market | Medium | Steadily rising |

| QQQ | Technology sector | High | Strongly rising |

“Bitcoin is not a substitute for stocks or bonds — it is a new asset class.”

Bitcoin as an Asset Class: Properties and Special Characteristics

- Absolute scarcity through mathematical limitation

- No issuer, no debt, no cash flow

- Value arises exclusively from network effects and trust

- 24/7 global trading without interruption

In some respects Bitcoin resembles gold; in others, it is closer to a technological network like the Internet itself.

Criticism Point 1: Open Code, Multiple Versions

Bitcoin is open source. Its source code is public and continuously evolving. This means: the code is never truly “finished.”

Changes are proposed through the formal process of Bitcoin Improvement Proposals (BIPs). Any developer may submit proposals. Acceptance occurs through social consensus among developers, node operators, miners, and businesses.

No authority can force an update. Miners and nodes voluntarily decide which version to run. This results in:

- high resilience against political control

- but also coordination challenges

Hard forks such as Bitcoin Cash in 2017 demonstrate the consequences: fragmentation, market uncertainty, new coins.

Assessment: The criticism is factually correct — yet this very mechanism forms the core of decentralization.

Criticism Point 2: Arbitrary Data in the Blockchain

The Bitcoin blockchain primarily stores transactions, but technically also allows embedding arbitrary data (OP_RETURN, Ordinals).

As a result, images, texts, videos, and even potentially problematic content have already been permanently recorded.

This data is:

- public

- irreversible

- undeletable

However: owning Bitcoin does not legally imply ownership of this data. A node merely stores encrypted blocks without interpreting their content.

The concern of criminal attribution to random holders is legally unproven so far, but politically not entirely impossible.

Assessment: Technically accurate, legally still theoretical — but a genuine regulatory risk.

Criticism Point 3: Commodity or Security?

Bitcoin exhibits characteristics of:

- Commodity: limited asset, no issuer

- Security: expectation of appreciation, network effects

The SEC classifies Bitcoin as a commodity. Other cryptocurrencies were later also classified this way — a controversial development.

Bitcoin differs fundamentally: no central control, no issuance authority, no management.

Assessment: Structurally closer to a commodity than a security, but not a perfect fit.

Criticism Point 4: Regulatory Intervention

States cannot shut down Bitcoin, but they can:

- close exchanges

- block bank access

- prohibit conversion into fiat

China has done exactly this. The United States regulates heavily via ETFs and banking supervision.

Regulation therefore represents the greatest political risk for Bitcoin.

Criticism Point 5: Technical Dependencies

Bitcoin requires:

- the Internet

- DNS infrastructure

- power grids

All of these systems are subject to state control, particularly in Western countries.

Gold, by contrast, exists physically independent of infrastructure.

Assessment: Bitcoin is not a fully autonomous “commodity.”

Institutional Adoption: MSTR, BlackRock & Co.

MicroStrategy (MSTR) operates the most aggressive Bitcoin strategy in corporate history: equity, debt, and operating surplus are systematically converted into Bitcoin.

Major investors such as:

- BlackRock

- Fidelity

- ARK Invest

- Allianz (indirectly via MSTR bonds)

are now substantively engaged in Bitcoin.

“When BlackRock buys Bitcoin, it is no longer a fringe experiment.”

These capital flows are fundamentally transforming the market.

Bitcoin as an Asymmetric Bet

Bitcoin is not a safe investment — but it is one of the few assets with truly asymmetric return potential: limited downside risk, extreme upside potential.

It is suitable as a long-term allocation for investors seeking protection against systemic risk.

Yet Bitcoin remains politically, technically, and regulatorily fragile. This fragility is the price of its independence.

Bitcoin Cycles and the Role of Halvings

One of Bitcoin’s most unique features is its hard-coded issuance mechanism. Approximately every four years, the number of new bitcoins generated per block is cut in half — the so-called halving. This event abruptly reduces new supply and functions as an artificial supply shock in an otherwise free market.

Historically, each halving has been followed by pronounced multi-year bull cycles culminating in speculative excess. While these patterns do not guarantee future outcomes, they demonstrate the macroeconomic power of Bitcoin’s monetary architecture.

Unlike traditional commodities, Bitcoin’s supply remains completely inelastic. Even under explosive demand, production cannot accelerate. This mechanism amplifies cyclical movements and produces the characteristic sequence of boom, correction, and accumulation phases that have defined the market for over a decade.

“Bitcoin is the first economic asset in history whose production schedule is entirely independent of its market price.”

For long-term investors, this yields a decisive advantage: Bitcoin is immune to political supply manipulation. Its monetary growth is limited, transparent, predictable, and mathematically enforced — forming the foundation of Bitcoin’s role as a potential long-term store of value in a debt-saturated global financial system.

Buying Bitcoin: Access Channels and Market Structure

Today, Bitcoin can be acquired through various channels that differ significantly in cost, control, risk, and regulation. Three primary routes exist:

- direct purchase via crypto exchanges

- regulated financial products (ETFs, certificates, ETPs)

- indirect exposure via Bitcoin-holding companies (e.g., MicroStrategy)

The chosen access route influences not only returns, but ownership rights and risk structure.

Custody: Cold Wallets as the Gold Standard of Sovereignty

The fundamental principle of Bitcoin is: “Not your keys, not your coins.” Whoever does not control the private keys does not economically own Bitcoin.

Cold wallets — hardware devices without permanent internet connectivity — are considered the safest form of custody. Examples: Ledger, Trezor, Coldcard.

| Property | Cold Wallet | Online Wallet |

|---|---|---|

| Private key control | Fully with user | With provider |

| Hacking risk | Very low | High |

| Regulatory risk | Low | High |

| Convenience | Medium | Very high |

Critical security aspect: Cold wallets should only be purchased directly from manufacturers. Devices obtained from third parties may contain preinstalled malware that later silently extracts private keys.

The initial setup process — especially secure storage of the recovery seed phrase — is security-critical and requires discipline and documentation.

Custody via Online Providers: Convenience vs. Control

Centralized providers such as Coinbase, Binance, Kraken, or Bitpanda allow easy purchase and custody of Bitcoin via user accounts.

This solution offers high convenience but introduces systemic risks:

- counterparty risk in case of insolvency

- regulatory seizure potential

- account freezes

- no direct control over private keys

The collapses of FTX, Celsius, BlockFi, and Mt. Gox demonstrated that even large platforms can fail — with devastating consequences for investors.

“Whoever keeps Bitcoin on an exchange owns a claim — not Bitcoin.”

Substitute Products and Derivatives: Exposure Without Ownership

Many investors deliberately choose products that do not directly hold Bitcoin but track its price performance:

- spot Bitcoin ETFs

- ETNs / ETPs

- options and futures contracts

- stocks of Bitcoin-holding companies (MSTR, miners, etc.)

These instruments provide regulatory integration and tax efficiency but sacrifice Bitcoin’s core advantage: self-custody without intermediaries.

They are best suited for institutional portfolios and tactical allocations — not for systemic protection.

Hybrid Strategies: Combining Security and Liquidity

Many professional investors now pursue hybrid models:

- core holdings in personal cold storage (long-term reserve)

- smaller portion on exchanges for liquidity and trading

- additional allocation through regulated financial products

This structure combines operational flexibility with maximum sovereignty.

The larger the investment volume, the more important institutional-grade custody becomes — with multi-signature wallets, physical key separation, and legally structured inheritance planning.

Bitcoin Investment Is Also Infrastructure Management

A Bitcoin investment is not merely a purchase — it is the construction of personal financial infrastructure. The investor assumes functions traditionally performed by banks and custodians.

This responsibility is demanding — but it is precisely what distinguishes Bitcoin from all other asset classes.

Bitcoin demands competence, but rewards it with unparalleled financial sovereignty.