Real estate appreciation: Development of real estate prices

The essentials in brief: Residential real estate prices in Germany fell by an average of -7.1% in the 4th quarter of 2023 compared to the 4th quarter of 2022. According to the Federal Statistical Office, this was the fifth consecutive quarter in which prices fell compared to the same quarter of the previous year. However, historical price data shows ongoing increases in housing prices.

Is there still an increase in the value of real estate today? For years, we have been reading and hearing about a real estate bubble and that it will soon burst. The coronavirus caused additional uncertainty. Many people held on to their money, but at the same time wondered how they could avoid the dangers of inflation and thus currency devaluation. Not so easy when common forms of investment such as savings accounts hardly pay any interest.

Real estate value development: positive for more than 10 years

Real estate as a capital investment was the saving straw for many investors – after all, concrete gold is a safe investment, according to the credo. To give you as an investor a feel for the price trends on the real estate market in recent years and to shed light on future potential, we have summarized everything you need to know about property appreciation in this article. We answer the question of whether – and if so, where – there are still opportunities for value appreciation and what you should look out for now as an investor in real estate.

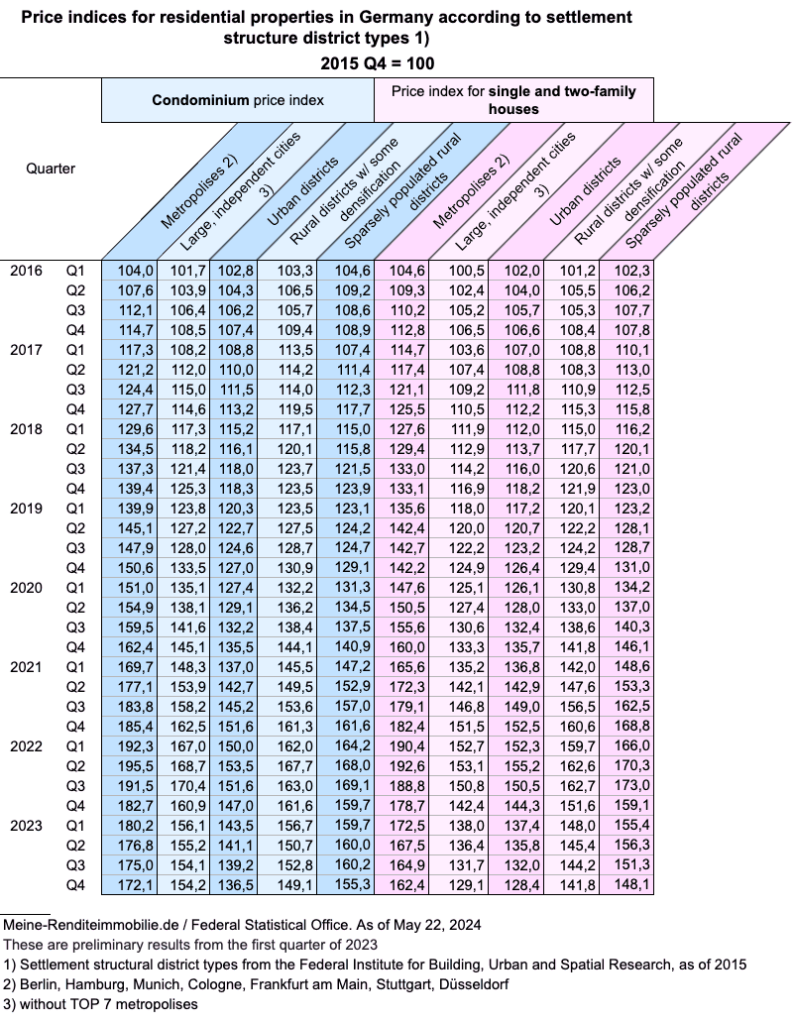

Residential property price indices from 2015-2023

Statistics looking further back than 2015 can be found below. Below is a list of property prices from 2015 to 2023, sorted by settlement size and property type (apartment/house).

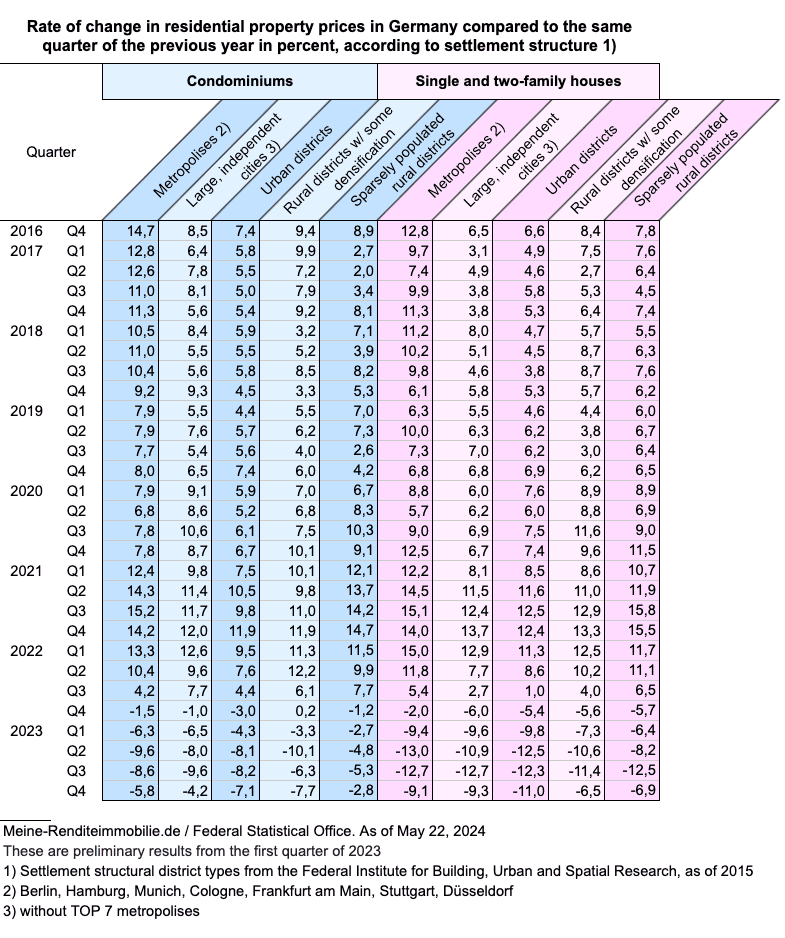

Rate of change in residential property prices in percent from 2015-2023

Percentage price increase for residential properties from 2015 to 2023, sorted by settlement size and property type (apartment or house).

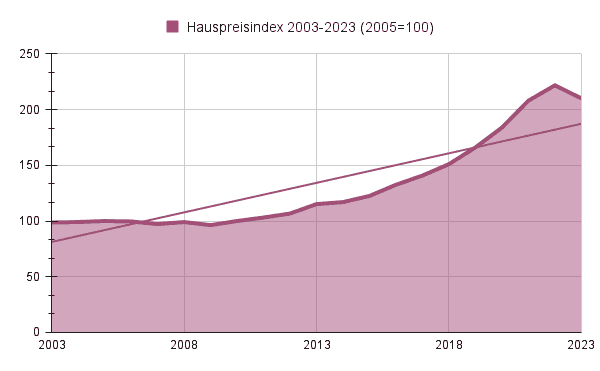

Real estate appreciation over the last 20 years

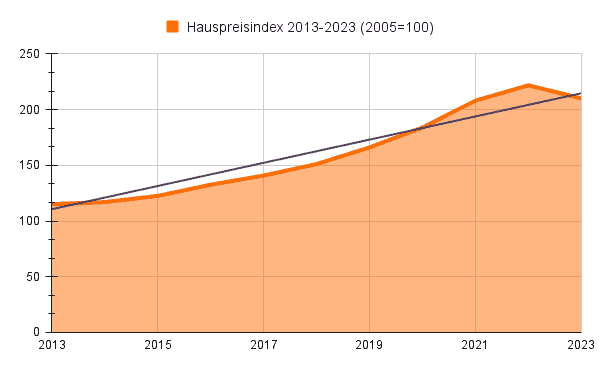

To get a first impression of the increase in the value of real estate, let’s take a look at the following statistics from the last 20 years:

Real estate appreciation – table (Source: Europace, own calculations and own presentation)

At first glance, it is immediately apparent that the value of real estate was relatively stable between 2003 and 2010 and that there was no increase in the value of real estate until around the end of 2009. The value of real estate even fell slightly at first and then stagnated. The values above should be considered independently of whether it is intended as an investment or a home.

The house price index is shown with a value of 100 for 2005 and 2010. If the pink line is below 100, the value of real estate at the time under consideration was lower than at the reference date of 2005. This applies to the years 2006-2009. If the pink line is above 100, the value of real estate was higher.

The constant line shows the trend in the period under consideration between 2003 and 2023. From 2010, when the ECB pumped massive amounts of money into the markets in response to the 2008/2009 financial crisis, the house price index gained momentum, and did so massively, at least until around mid-2022. The main message of the charts: The increased demand for real estate has accordingly ensured higher prices.

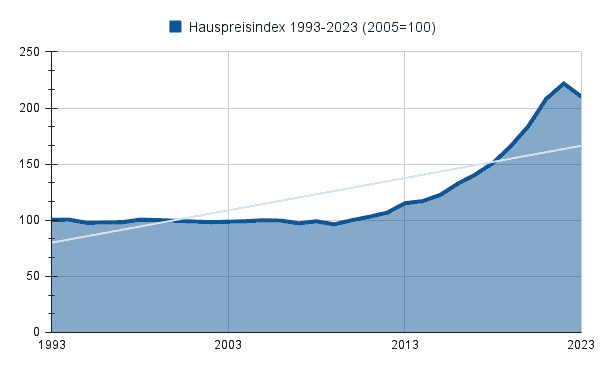

Real estate value appreciation in the last 30 years

Let’s extend the period under consideration to 30 years. How has the value of real estate increased over the last 30 years?

Real estate appreciation over the last 30 years (Source: Europace, own calculations and own presentation)

Again, the reference value is 100 in 2005. What does the graph say? The curve was relatively flat between 1993 and 2005. Little increase in the value of real estate was observed during this period. However, this is not negative news if you consider how real estate works as a capital investment.

The biggest advantage is that a rented apartment costs the owner very little in monthly maintenance. This is because the tenant takes over the majority of the costs for the owner – who also builds up assets, as the loan becomes smaller and smaller through the monthly repayments.

The owner is therefore not dependent on the increase in value per se, but can regard it as a “nice” side effect. If prices remain stable, they benefit from the repayment every month, even without an increase in value. From 2010 onwards, as described above, real estate prices will gain considerable momentum. This speculative gain is of course good news for owners. Low interest rates and the ECB’s loose monetary policy led to a sharp rise in property prices.

Real estate appreciation in the last 10 years

Let’s focus on the period that is most relevant for us in 2023: Real estate value appreciation over the last 10 years:

Real estate value appreciation over the last 10 years (Source: Europace, own calculations and own presentation)

The black trend line clearly shows how strongly real estate prices have risen over the last 10 years. Many investors are therefore unsettled and fear future negative performance. But is this fear well-founded? To answer this question, we need to take a look at the reasons for the high increase in property values over the last 10 years:

- Crisis mode of the ECB: First the financial crisis in 2008/2009, then coronavirus in 2020 and now rising inflation. These events forced the ECB and central banks around the world to stimulate the economy, save (private) livelihoods and support state budgets as well as stabilize monetary policy. For years, the central bank has purchased bonds totaling more than five trillion euros, forcing interest rates down. This has enabled countries to afford even more debt. But now that is a thing of the past.

- Low interest rates: If you look at the development of interest rates over the last 100 years, they have fallen constantly. Decade after decade, interest rates have fallen. Even though a turnaround in interest rates has now taken place, the key interest rate is still “only” 4.50%. The end of the loose monetary policy has therefore already gained momentum.

- Immigration: In the last 10 years, many people have migrated to Germany, both war refugees and economic migrants.

Are the aforementioned trends over and is a negative performance therefore to be expected? In part, yes, because the ECB has already raised key interest rates several times since 2022 after many years of zero interest rate policy. The ECB Council is still prepared to do everything possible to ensure that the inflation rate reaches its target value of two percent again in the medium term.

As soon as construction interest rates rise, demand for real estate slowly declines because it is more difficult for people to finance property. As a result, we are currently seeing a fall in property prices in Germany. Despite all the events, it can be said that real estate has proven to be a proven capital investment even in times of crisis. Because even despite a temporary decline, real estate prices will in all likelihood develop positively in the long term.

Finally, immigration: rising temperatures and sea levels will probably make some regions of the world uninhabitable or simply no longer productive enough in the future. We should prepare ourselves for further immigration, which could further boost demand for housing in safe Germany. Real estate is and will remain a promising investment.

Real estate appreciation: table

The increase in the value of real estate over the last 10, 20 and 30 years is very interesting. Munich is one of the most extreme examples of real estate appreciation in Germany. The following table of property value appreciation shows how property prices in Munich, Bavaria and Germany have developed since 2017.

Property price development: 30 sqm apartments

We evaluated more than 100,000 property prices for the table. Let’s start with the increase in value of apartments with 30 sqm:

| Year | Munich 30 sqm | Bavaria 30sqm | Germany 20sqm |

|---|---|---|---|

| 2017 | €6,630 | €4,204 | €2,859 |

| 2018 | €7,345 | €4,878 | €3,333 |

| 2019 | €8,032 | €5,221 | €3,720 |

| 2020 | €8,749 | €5,811 | €4,137 |

| 2021 | €9,761 | €6,882 | €4,820 |

| 2022 | €9,930 | €6,817 | €4,709 |

Development of property prices: 60 sqm apartments

Similar increases in value can be observed for apartments with a size of 60 sqm:

| Year | Munich 60sqm | Bavaria 60sqm | Germany 60sqm |

|---|---|---|---|

| 2017 | €6,643 | 3,671 € | €2,463 |

| 2018 | €7,090 | €3,966 | €2,692 |

| 2019 | €7,571 | €4,294 | €2,953 |

| 2020 | €8,191 | €4,868 | €3,347 |

| 2021 | €8,973 | €5,451 | €3,718 |

| 2022 | €9,282 | €5,625 | €3,796 |

Development of real estate prices: 100 sqm apartments

Apartments with a size of 100 square meters have developed as follows since 2017:

| Year | Munich 100sqm | Bavaria 100sqm | Germany 100sqm |

|---|---|---|---|

| 2017 | €7,079 | €4,073 | €2,954 |

| 2018 | €7,769 | €4,356 | €3,173 |

| 2019 | €8,153 | €4,673 | €3,454 |

| 2020 | €8,578 | €5,042 | €3,746 |

| 2021 | €9,299 | €5,551 | €4,143 |

| 2022 | €9,759 | €5,711 | €4,075 |

This is definitely an extraordinary development. The increase in property values in Munich certainly cannot be extrapolated to the next 10 years. However, although prices have risen quite sharply in recent years and we can observe a decline today, there is still potential for investors to invest in real estate in Munich.

Now more than ever, anyone thinking about buying a property as an investment needs to choose cities that have very good development potential. Of course, no one can predict exactly which cities will develop and how. But there are various key figures and information that can help in the selection process. It is therefore perfectly possible to minimize risks and focus on regions and locations that meet all the requirements for future value appreciation.

Conversely, nobody wants to invest in a location where prices will stagnate or fall over the next few years. However, it is not possible to predict this aspect precisely, as strong locations could also be affected.

Calculating property value appreciation

Do you already own a property and are thinking about selling it? Or would you like to know the sales value of your property out of curiosity? Of course it is possible to calculate the increase in property value. However, the exact determination of a possible sales price depends on many different factors.

The location is a decisive factor, as the example of Munich shows. If the property is located in the countryside or in an area where demand for housing is not particularly high, this has an impact on the increase in value and therefore the sales price. In addition, the condition, year of construction, living space and plot area and other factors play a role in determining an exact market price. Due to this high level of complexity, a surveyor is usually commissioned. This expert takes all important factors into account and determines a current market value.

One way to get a first impression is to use our property valuation service. After entering some data about the property, you will receive an estimate of the value. Find out more in a personal consultation with us.

How can I increase the value of a property?

Passive form of real estate value enhancement

Even BEFORE the purchase, influence can be exerted on a future increase in value. To do this, the development of the infrastructure in the surrounding area should be considered: Is a shopping center to be built nearby? Are schools or kindergartens being built? Is a company planning to erect office buildings?

Is there to be a direct connection to the highway? Is a subway station being built? If you plan for the long term, you can expect a major increase in value in the future.

Active form of value appreciation

The value of an existing property can be actively increased. The aim is to upgrade the property. For example, through the so-called fix & flip. A property in need of renovation is purchased, renovated to a high standard and later resold at a higher price. A few examples of renovations that can increase the value:

- Furnishings that create added value (high-quality fitted kitchen and attractive bathroom)

- High-quality floors

- Well-insulated windows

- Energy-efficient heating system

It is always important that the furnishings are of a high quality and look good, but are not too expensive to buy. A real wood parquet floor does not always make sense from an investor’s point of view, as it is extremely expensive to purchase and install. Vinyl flooring looks extremely good, but is comparatively cheaper.

Property value appreciation renovation Fix&Flip

Converting a larger apartment into two smaller ones can also increase the value. For example, the average price per square meter in Munich for a 30 m² apartment is currently €8,676 and €7,659 for a 60 m² apartment. If converted into two apartments, this would mean an increase in value per square meter of 3.6%.

What happens in the event of an increase in value

As long as you are not planning to sell the apartment, nothing happens at first. If you sell before the statutory period of ten years, you will be liable for tax on the gain. If you sell after this period, the profit is completely tax-free. This is a major advantage of real estate in contrast to other forms of investment such as shares.

Tax is also payable if the property is bequeathed to you. In this case, it is worth considering a gift during your lifetime. The increase in value also plays a role in the event of a divorce. This results in an equalization of gains. The increase in value of the property since the beginning of the marriage is divided equally. Of course, only if there is no prenuptial agreement or other agreement.

Real estate bubble 2023

After the sharp price rises of recent years, many people wondered whether the exaggerations on the real estate market could lead to the bursting of a real estate bubble in 2023. In fact, property prices fell by 7.1% in the last quarter of 2023 compared to the previous year. We cannot yet speak of a bubble bursting on this scale, even if the price decline is comparatively significant. In well-chosen locations in Germany, prices are not expected to collapse now or in the future. As a leading industrial nation, Germany has too much substance for that.

When a certain type of investment rises too sharply in value, it is referred to as a bubble. Perhaps you have heard of tulip mania? This is now known as the first ever investment bubble. At the end of this bubble (in 1637), tulip bulbs were sold for the equivalent of 87,000 euros today. That’s an incredible sum for one flower.

Property appreciation calculation

Real estate prices have already stagnated or even fallen slightly – but a bubble in the classic sense is unlikely to burst, as demand for tangible assets is still high due to inflation. In addition, significantly less new construction is currently taking place in Germany, which in turn is helping to strengthen existing properties. However, it will be more important than ever to examine properties carefully in order to minimize potential risks.

People are therefore looking for investment opportunities – whether they are on a small budget or a wealthy investor wondering: what is the best way to invest a million euros? Sensible investments should protect the money and, in the best case, increase in value. This can also be clearly seen in the sharp rise on the stock markets. People are emptying their overnight and fixed-term deposit accounts and looking for the few available investment opportunities to achieve a return. Real estate is a relatively safe option.

We do not believe that there will be a real estate bubble in 2024 or that it will burst. There has already been a downward correction. On the one hand, property prices may continue to stagnate or even fall slightly. On the other hand, rents will also rise due to inflation and the current lower number of new construction projects.

Our company pays particular attention to ensuring that our customers receive a good selection of properties in suitable locations at the best possible conditions. We also attach great importance to sustainability in terms of price and economic development. To this end, we have state-of-the-art tools at our disposal for selecting investment properties.

How does the value of a property increase?

There are many reasons for the rise in property prices. Interest rates, demographic trends, the relationship between supply and demand, etc.

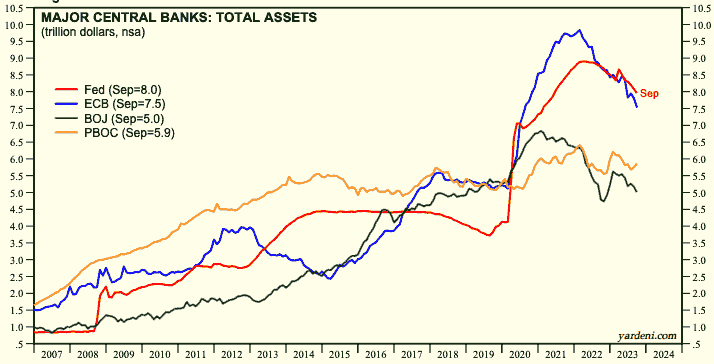

What is particularly striking, however, is the correlation between the inflating central banks around the world and international real estate prices. Let’s take a look at the balance sheets of the major central banks. These have literally exploded since the 2008 financial crisis. But here, too, there has been a change of course since last year, as can be seen from the following chart.

Since 2008, the balance sheets of the major central banks have continued to rise (values in trillions of USD, source: Haver Analytics)

This is done primarily through bond purchases such as government bonds, corporate bonds, mortgage-backed securities, etc. Since the start of these purchase programs, which represent nothing more than indirect support for the economy by distributing euros, yen and dollars to institutions and companies, real estate prices have developed almost in lockstep with the central bank balance sheets shown above.

How will real estate prices continue to develop and what will the increase in real estate values look like in 2024? Central banks are caught in a dilemma: On the one hand, they have to be careful to keep burgeoning inflation in check. This has led to a rise in key interest rates and thus to a significant turnaround in interest rates. On the other hand, the economy is now so dependent on the central banks’ money drip that “cutting off” the aid will lead to an immediate economic slowdown and consequently a recession.

Despite higher interest rates, it is currently a good time to get in, as properties are being bought more cheaply today than they were a year ago – so there is also direct potential for value appreciation. However, the various factors are often difficult for newcomers to assess. We are happy to assist you in your selection with our many years of expertise.