Investing in tangible assets: Investments you can touch

Definition: What are tangible assets?

What are tangible assets? The answer is basically quick. A tangible asset is the value of an item. The German Civil Code (BGB) further defines what a thing is:

Property within the meaning of the law is only physical objects.

A tangible asset is characterized by the fact that it is limited in its available quantity. A classic car…

- of a specific make,

- of a specific model,

- of a specific year of manufacture

often only exist a few hundred times. Tangible assets are therefore not infinitely available – and that makes them attractive.

Investing in tangible assets such as classic cars is worthwhile in these times.

So we are talking about assets that have real physical substance and a lasting material value that stands the test of time, even in times of crisis. Tangible assets such as gold probably come to mind first! However, gold only represents an extremely small proportion of all financial assets.

So, apart from gold, what else is meant by tangible assets in the financial sector? If you want to invest in tangible assets, you have a wide choice. Some examples of tangible assets are

- Investing money in real estate

- Precious metals/commodities (gold, silver…)

- Shares

- Collectibles (cars, paintings, coins…)

- Cryptocurrencies

Tangible assets are offset by monetary assets. Monetary assets include, among others:

- Savings account

- Building society savings contract

- Fixed-term deposit

- Bonds

- Futures transactions

A good way to differentiate is to consider the following: If inflation suddenly sets in, certain things such as savings accounts, fixed-term deposits etc. lose purchasing power in the short term – they retain their absolute euro value. In contrast, tangible assets increase in value during inflation – they become more expensive and increase in their absolute euro value. Investing in tangible assets is truly worth its weight in gold during periods of inflation.

A tangible asset is therefore like a plastic duck in a bathtub: if the water level rises, the duck on the surface rises with it.

Which tangible assets to invest in? To answer this question, let’s first get an overview of examples of tangible assets.

Property as a tangible asset

Real estate as a tangible asset requires a little differentiation. If you buy a property for your own use, it is not an investment but a cost. However, if you rent out your property, you are using it as a capital investment that finances itself through the monthly rental income. How does the principle work?

- Buy a property and only pay the ancillary costs from your own funds (usually 5-10% of the purchase price)

- Rent out an apartment

- Use rent to pay interest and repayments to the bank month by month This allows you to build up assets from day 1, as your tenant is effectively helping you to pay off the property.

Many factors have to be right for this investment to really pay off. For example, the location, the ratio between rent and purchase price and the need for renovation play a major role in achieving an attractive return.

You can also use our property calculator to determine the potential return on your property. Our customers usually use the 360° service with property selection, advice, financing and management. This way, real estate investment is free of hassle and worry, even after the purchase.

Wine as a tangible asset

Of course, not just any bottle of wine will do. When we talk about a tangible asset investment, we are referring in particular to wine, whisky or champagne. If we are talking about a tangible asset investment, then only high-quality red wines that can be expected to increase in value over time come into question.

Both the work and the maturing process are special and complex, and there are often only a few examples of a batch of wine left. It is precisely this rarity that makes investing in one of these wines so attractive. As with all forms of investment, it is important to familiarize yourself with the subject matter or turn to trustworthy experts so as not to buy a pig in a poke.

Once you have acquired a promising wine, the most important thing is to store it correctly, as it must be able to age. Only then can you achieve a pleasing return in the future. The composition of the wine changes over time: tannins, residual sugar, acidity and alcohol content are the key components.

Their change defines the taste of the wine in the future and also its value. Basically, it can be said that the right development can only be achieved under optimal storage conditions. The wine must be stored in a cool, dark and humid place at around 10-12 degrees. A professional wine refrigerator is also ideal for this.

Gold as a tangible asset

Investing in gold is probably the first thing that comes to mind for most people when it comes to investing in tangible assets. Like other precious metals, gold is a finite commodity, which is precisely what makes it so sought-after and leads to a further increase in value. In the minds of many, gold is a symbol of security and enduring value that can survive even crises and has done so in the past. It is therefore not surprising that there is an increased demand for gold, especially when inflation is rising.

Gold as a tangible asset

You can buy physical gold either from a bank, a precious metal dealer or online. In all these cases, you should always carry out a thorough price comparison of the providers and ensure that they are reputable and reliable. You can store the gold you buy either in your own safe or in a safe deposit box. (We would not recommend hiding it under your pillow).

It is also possible to invest in gold-related securities, which you can do conveniently via your securities account. However, you should not forget that gold as a tangible asset is subject to the behavior of speculators and therefore possible fluctuations in value.

Which tangible assets in the event of inflation

The biggest or most serious difference between tangible and monetary assets lies in their behavior during inflation. During inflation, your cash loses purchasing power and therefore significantly in value:

Imagine that inflation sets in and the inflation rate is 100% from one day to the next. Although €1,000 under your pillow will still be worth €1,000 a day later, you will only be able to buy half as much with that €1,000. For example, if a loaf of bread costs €10 the next day instead of €5.

Investing in real assets gives you more security. Tangible assets can protect against currency crises or national bankruptcies. Of course, there are also differences between real assets that you should be aware of.

Safe tangible assets

Not all tangible assets are safe. A clear distinction must be made here between speculative and safe tangible assets. Speculative tangible assets include shares, commodities and collectibles. These investments are sometimes subject to very strong price fluctuations and therefore represent a high risk for investors.

Safe tangible assets, on the other hand, include real estate, as it normally increases in value and does not fall. In addition, demand for residential real estate is not expected to fall, as everyone needs a place to live. If you choose your location wisely, you have a very good chance of successfully putting your own retirement provision on a secure footing.

Green tangible assets

The philosopher Heraclitus said: “Nothing is as constant as change.” And so change is also evident within our society. More and more people want to live more consciously and sustainably. This trend is also having an impact on financial products. In recent years, many investors have already focused on renewable energies in the form of wind or solar power systems.

This area of investment can certainly bring advantages for investors. Renewable energies are a very fast-growing market. Both supply and demand are increasing rapidly. For a more sustainable future, many countries around the world have committed to supporting and promoting the expansion of alternative energy supply options. This also has an impact on the stability of this investment area.

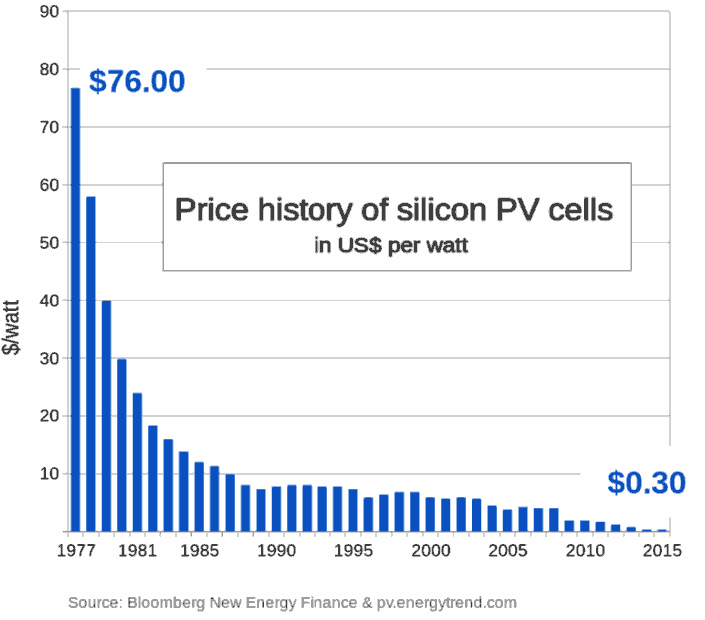

The cost per watt of solar systems has fallen rapidly over the last 50 years.

Unfortunately, however, many of them have also discovered that these green investments also entail a certain degree of risk and are therefore not safe. However, environmental awareness and security are not mutually exclusive if you combine your interests wisely.

Anyone who buys a property for rental purposes and designs it to be energy-efficient can not only combine security with sustainability, but also have the prospect of various funding opportunities.

What are good tangible assets

Especially in challenging times, the urgent question arises as to how and what is the best way to invest. Of course, this is an individual question, but in retrospect, safe tangible assets such as real estate have almost always proven themselves as investments.

Good tangible assets are those that combine security with promising factors such as an attractive return. Even in times of crisis. Do you have any questions or would you like to find out more about how your portfolio could soon be enriched by a property? We will be happy to support you by phone, email or in person at our office in Munich or Stuttgart.