Best ways to invest between 5000 and one million Euro

What is the best way to invest €1 million? If you are in the fortunate position of asking yourself this question, you should know that there are various investment strategies. All circumstances and conditions really need to be taken into account for this amount. Anyone who currently wants to invest 5,000, 10,000, 20,000, 50,000, 100,000 or 1 million euros should inform themselves well. There are numerous ways to make clever use of this situation to achieve your savings goals.

§ Legal notice: This article is for information purposes only and merely represents our assessment of the various investment options. Our explanations are expressly not investment recommendations.

Investing 1 million euros

What options are there for investing €1 million? Given the persistently high inflation, investors should focus on tangible assets.

| Shares investment EUR 1 million | Real estate investment without debt capital | Real estate investment with outside capital EUR 1 million | Savings account EUR 1 million | Daily money * | |

| Return on the invested capital | – +10% p.a. | Ca. 4-5.5% p.a. (depending on location) | approx. 6-15% p.a. (depending on the amount of external capital and location) | approx. 1.50% p.a. | Ca. 3.0 – 3.2% p.a. |

| Security | For long investment horizon: Relatively safe | Relatively safe | Relatively safe | Up to €100,000 per bank deposit guaranteed | Up to €100,000 per bank deposit guaranteed |

| Variability susceptibility | High (e.g. corona shock => -30%) | Low | Greater | None | None |

| Liquidity | Relatively high | Medium to long term investment horizon required | Medium to long term investment horizon necessary | Relatively high | High |

We have not considered fixed-term deposit offers in the style of “6 months, only for new customers …” or offers from small banks that are practically unknown in Germany.

➡️ As you can see: The savings book is ahead in all evaluation categories – except for returns. And this is of course the decisive criterion for many people.

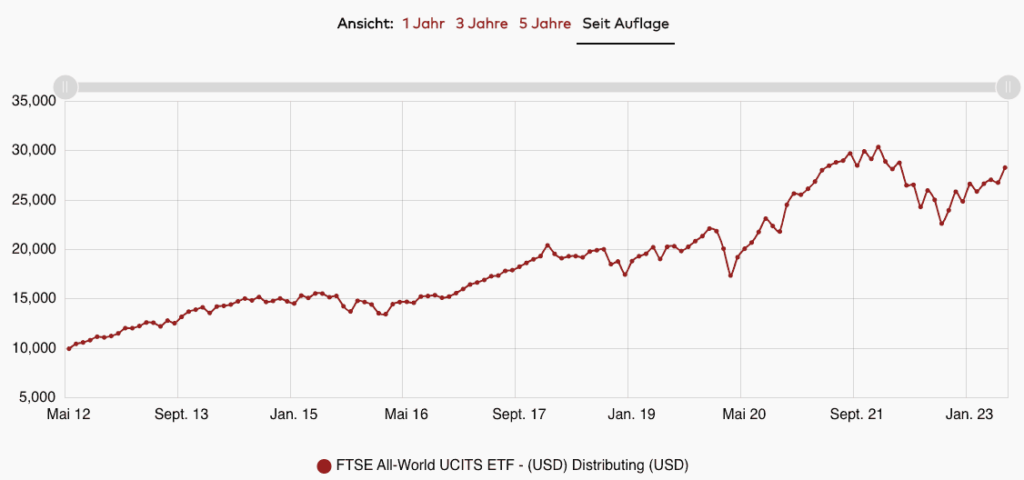

➡️ Continue with equity investments, possibly also broadly diversified in the form of one or more ETFs. It should be noted that the volatility of equity investments is quite high. In some market phases, investors have to wait a long time before the potential turbo of the stock markets (re)ignites. If a million euros is invested in equities and the market declines, the capital is initially tied up (unless the investor wants to sell at a loss).

If you look at the performance of the MSCI World between 2014 and 2016, for example, the performance after two years of holding was 0%:

When investing in equities, investors always need to have the stomach to ride out flat or negative market phases (source: Vanguard)

➡️ A rented condominium (investment property) purchased with €1 million in equity normally generates a return of between 4 and 5.5%, depending on the location and rental income. That is between €40,000 and €55,000 per year before costs and taxes. Thanks to the relatively high level of security and low susceptibility to fluctuation, an investor who invests €1 million in this way can count on this cash flow with relative certainty.

➡️ The most sensible way to invest in a property is to use borrowed capital. This means that an investor can not only invest 1 million euros in real estate, but – for example, with 50% borrowed capital – acquire a real estate volume of 2 million euros. On the cost side, interest costs and the repayment of the loan are added to the remaining expenses. With one or more properties worth 2 million euros, the rental income is correspondingly much higher, in our example between 80,000 and 110,000 euros. Service charges, interest and repayments are deducted from this. What remains is an amount that allows the owner to enjoy a number of amenities.

Let’s take a brief look at the current situation. Rising interest rates and high inflation are causing your assets to steadily decrease. This massively thwarts the savings goals of investors, and you ask yourself: what to invest in?

But let’s look to the future with a positive outlook, because – as always – it depends on how you deal with the circumstances. Hoarding your money under your pillow or leaving it in the bank is not the answer. Especially in these times, you should never leave your money lying around.

Investment options overview

If you are wondering how and where you can currently invest your money correctly, you should keep an eye on certain criteria. In our current assessment, we look at the following criteria:

- Yield

- Security

- Flexibility

- Complexity

- Future opportunities

- Green conscience

- Suitable phase of life

- Saving taxes

The return is the income that you achieve with your investment. The return is closely linked to the criterion of security. If you choose a safe investment, the return is usually limited. If you want to achieve the highest possible return, you should not place too much emphasis on security. A high return is usually also associated with a high risk.

As far as flexibility is concerned, we are referring to the availability of your assets. What does that mean? Well, you can sell a share in a matter of seconds, but not in all market situations. If you invest your assets in fixed-term deposits, they are not available for a certain period of time. This means that when considering how to invest your money, you should be clear about whether or not you want to access the money in the foreseeable future.

Complexity should also always be taken into account, as not every type of investment is suitable for beginners. If you have no previous experience with financial investments, you should avoid overly complex financial products or at least take a step-by-step approach or seek advice.

The magic triangle of investment is a good way to assess returns, flexibility and security. We also look at the future prospects of the individual forms of investment. Which investment is likely to continue to yield a profit in the future?

A green conscience has increasingly been added to the list of requirements for a suitable investment, especially in recent years. People are living more consciously and sustainably and also expect these qualities from their financial products. Which investment option is right for you also depends heavily on your current phase of life.

Are you a student? Do you have children? Are you married? What stage of life are you currently in? And how long would you like to invest your money for? If you still have your life ahead of you, for example, it makes sense to think long-term and invest smaller amounts each month.

The last criterion we look at is the tax aspect of an investment. Where are there options to save taxes (for example with real estate)? In our assessment, we focus on the most common forms of investment: Call money/fixed-term deposits, government bonds, shares/funds/ETFs, gold and real estate.

Depending on the amount of capital available, different types of investment or portfolio mixes can be considered. Below we show you which options are available to you for which amount.

Investing 5,000 euros

What should I invest in if I want to invest EUR 5,000?

Real estate:

Surprising for many people: with 5,000 euros, it is possible to invest in a property as a capital investment. The idea is to buy an apartment in a location that ensures good rentability and cover the purchase price with a bank loan. The 5,000 euros are used for ancillary purchase costs. The bank loan is paid back bit by bit with the monthly rental income and the interest is largely serviced.

However, a small monthly investment is usually necessary. Later, when the loan is paid off, an attractive monthly cash flow is generated in the amount of the rental income – of course, the costs still have to be deducted from this. Undoubtedly one of the best investments at the moment if you have 5,000 euros of equity available. The risk (“concrete gold”) and equity investment (use of borrowed capital) are low.

Rating: ⭐⭐⭐⭐ (4/5)

Government bonds:

Government bonds are now offering somewhat more attractive interest rates again. In addition, you would have a “safe” position in your portfolio, as government bonds are also referred to as a “risk-free interest rate”. However, the example of the debt ceiling in America shows that this interest rate is not really risk-free at all.

The limit was exceeded once again in the first half of 2023, whereupon a new compromise had to be found to prevent a national bankruptcy. It was agreed that the debt ceiling could be suspended until 2025, provided that government spending was reduced over the same period. There was a similar situation in 2021.

Rating: ⭐⭐ (2/5)

Shares/funds/ETFs:

Shares, funds and ETFs can be suitable forms of investment. However, it may make more sense to set up a savings plan rather than make a one-off investment. This way, you can avoid buying at an expensive entry point. It may be possible to purchase a property in combination with a share or ETF savings plan.

Rating: ⭐⭐⭐⭐ (4/5)

Gold:

In principle, gold is very suitable as part of a portfolio.

Rating: ⭐⭐⭐⭐ (3/5)

Daily money/fixed-term deposits:

An investment in call money or fixed-term deposits can currently be worthwhile, as interest rates have risen again somewhat. However, they are still rather low. The call money account also scores points when it comes to flexibility, as your money is available daily. You may also be able to terminate your fixed-term deposit account before the end of the term and have the money paid out. However, this procedure is associated with high costs and loss of interest.

Rating: ⭐⭐⭐⭐ (3/5)

Invest 10,000 euros

What are the options for investing €10,000?

Real estate:

A real estate investment is all the more worthwhile if it is made with this investment amount. With this amount, there are already more properties available for purchase. With €10,000 of available capital, real estate is therefore an important part of the answer to the question: what to invest in?

Rating: ⭐⭐⭐⭐⭐ (5/5)

Government bonds:

With 10,000 euros, government bonds are a possible addition to the investment. We are also currently experiencing the interest rate hike, which is leading to rising yields on government bonds.

Rating: ⭐⭐ (2/5)

Shares/funds/ETFs:

Investing part of your portfolio in shares or funds can make sense – depending on your own investment strategy and horizon.

Rating: ⭐⭐⭐⭐ (3/5)

Gold:

It is also advisable to combine gold with another investment in this asset class.

Rating: ⭐⭐⭐⭐(3/5)

Daily money/fixed-term deposits:

Both investments are known for the security of the money. Up to 100,000 euros per bank can be secured by the state. The other advantage may lie in the high degree of flexibility, although this can result in additional costs for fixed-term deposits.

Rating: ⭐⭐⭐⭐ (3/5)

Invest 20,000 euros

Investing €20,000 – what to invest in?

Real estate:

EUR 20,000 can be a perfect budget for making a sustainable real estate investment in one or more properties. Just as with a capital of 10,000 euros, the equity of 20,000 euros should be used for incidental purchase costs. The difference is that you may be able to purchase several properties or an apartment in an A-location.

The purchase price is again financed via a bank and your tenants repay the loan for you. It is important to take out a favorable loan. It is advisable to carry out a financing comparison here. This type of investment can form a major part of your retirement provision.

Rating: ⭐⭐⭐⭐⭐ (5/5)

Government bonds:

With an investment amount of 20,000 euros, government bonds are generally regarded as a certain safety anchor.

Rating: ⭐⭐ (2/5)

Shares/funds/ETFs:

In this case, asset allocation is worthwhile for passive private investors. This involves a diversified portfolio that is well suited to long-term investment horizons.

Rating: ⭐⭐ (2/5)

Gold:

In principle, adding gold to an investment portfolio with 20,000 euros can be a sensible move.

Rating: ⭐⭐⭐⭐(3/5)

Daily money/fixed-term deposits:

In this asset class, your money may not grow as you would like it to. But you can access your money flexibly. You can use both types of investment as a financial reserve. At least two to three net salaries should be in your account. Both call money and fixed-term deposits offer rather low interest rates. There are therefore much better alternatives for investing your money in a yield-oriented way.

Rating: ⭐⭐⭐⭐ (3/5)

Invest 30,000 euros

How do you invest 30,000 euros?

Real estate:

With 30,000 euros, you can initially proceed in the same way as with 20,000 euros. This means buying one or more properties financed through a bank.

Rating: ⭐⭐⭐⭐⭐ (5/5)

Government bonds:

Anyone looking for a safe haven in this asset class (30,000 euros) can find it in government bonds.

Rating: ⭐⭐ (2/5)

Shares/funds/ETFs:

Shares can make sense. However, investors must be very willing to take risks. It may be a good idea to combine an investment in shares with the purchase of a property. In this way, the property offers security and the investor can invest part of their money in shares at a high risk. If, on the other hand, you don’t want to take any risk, you are more likely to combine your real estate investment with government bonds or gold.

Rating: ⭐⭐ (2/5)

Gold:

Gold is well suited as a small part of the investment. You can invest the rest of your assets in real estate.

Rating: ⭐⭐⭐⭐ (3/5)

Daily money/fixed-term deposits:

Although you have low interest rates on call money or fixed-term deposits, your money is available to you flexibly.

Rating: ⭐⭐⭐⭐ (3/5)

Invest 50,000 euros

How can 50,000 euros be invested profitably?

Real estate:

With EUR 50,000, an investor can build up a real estate-focused portfolio that can be supplemented with additional building blocks. For example, you can invest 2/3 of the assets in real estate. The procedure is the same as for the EUR 30,000 described above. The other third can be sensibly divided between the other investment strategies.

Rating: ⭐⭐⭐⭐⭐ (5/5)

Government bonds:

Government bonds are a conceivable alternative to gold for integration into a mixed portfolio.

Rating: ⭐⭐ (2/5)

Shares/funds/ETFs:

This may be a good addition to the portfolio of an investor with a medium to high risk profile.

Rating: ⭐⭐⭐⭐ (3/5)

Gold:

Like government bonds, gold is also a safe component of a mixed portfolio.

Rating: ⭐⭐⭐⭐ (3/5)

Daily money/fixed-term deposits:

As an investor, you receive low interest rates with this form of investment, but your money is safely invested in your account.

Rating: ⭐⭐⭐⭐ (3/5)

Invest 100,000 euros

With 100,000 euros, you can create a diversified portfolio with a focus on real estate.

Real estate:

With EUR 100,000, it is possible to acquire several properties as an investment. These properties form the basis of a diversified portfolio that is either heavily hedged with gold and/or government bonds or contains a risk-oriented component in the form of shares and ETFs.

Rating: ⭐⭐⭐⭐⭐ (5/5)

Government bonds:

As mentioned above, government bonds can serve as a hedge for the portfolio.

Rating: ⭐⭐⭐⭐ (3/5)

Shares/funds/ETFs:

For risk-averse investors, filling the portfolio with equities is probably not a sensible option. With a medium risk profile, an admixture of equities or ETFs can be smart if the real estate portfolio is also hedged with gold and/or bonds.

Rating: ⭐⭐⭐⭐ (3/5)

Gold:

Gold can be a good alternative to government bonds to hedge your portfolio. Gold also offers a high degree of security, but the return is limited. Its independence from crises makes gold an attractive safe anchor for difficult times. If gold is bought, then at best not as a certificate or similar, but as “real” gold in the form of coins or bars. These have a real value in the event of a crisis and can be used as an object of exchange.

Rating: ⭐⭐⭐⭐ (3/5)

Daily money/fixed-term deposits:

Your investment is safe in this asset class. If you want to withdraw a small part of your investment very flexibly, an overnight money account may be an option.

Rating: ⭐⭐⭐⭐ (3/5)

Invest 200,000 euros

What options are there for investing EUR 200,000? For an equity investment of EUR 200,000, an investment portfolio with a strong focus on real estate, but which integrates safe components such as government bonds/corporate bonds and/or gold, is a good option. So specifically: what should you invest in with 200,000 euros of capital?

Real estate:

A large part of the portfolio can be based on rented properties. This means building up passive income. Up to ten properties can be purchased in this asset class, as the equity investment is between €8,000 and €12,000, depending on the location and size of the property, and is therefore relatively low.

To avoid cluster risk, you can use the concept of the virtual apartment building. This concept works as follows: Various apartments are purchased throughout Germany, which are managed centrally and cheaply. This concept works like an investment in an apartment building with several apartments. Investors also benefit from the advantage of diversification, as the properties are located in different locations.

If, contrary to expectations, a location should experience weak economic development, the overall real estate portfolio is very well protected thanks to the diversification. The main advantage over acquiring a conventional multi-apartment building is that the individual apartments are located in different German locations.

You can also achieve tax savings with real estate, which can be very significant on such a scale and therefore offer a further advantage over other types of investment. In combination with tax-saving concepts such as an asset-managing GmbH, real estate can be the key to financial independence.

Rating: ⭐⭐⭐⭐⭐ (5/5)

Government bonds:

Government bonds can also serve as a hedging portfolio component in this asset class.

Rating: ⭐⭐⭐⭐ (3/5)

Shares/funds/ETFs:

Of course, part of the assets can also be invested in shares or ETFs. However, there is no leverage in this context, as is the case with real estate, for example. This means that only the equity invested works for the investor, which leads to a reduction in the return – with a relatively high risk.

Rating: ⭐⭐⭐⭐ (3/5)

Gold:

A gold investment can be used here to hedge the portfolio.

Rating: ⭐⭐⭐⭐ (3/5)

Daily money/fixed-term deposits:

This asset class gives you as an investor a good opportunity to keep your money safe and access it flexibly. However, the returns here are rather low.

Rating: ⭐⭐⭐⭐ (3/5)

Invest 500,000 euros

You have 500,000 euros – but what to invest in? In principle, a real estate-weighted, diversified portfolio with applied tax-saving effects is the obvious choice.

Real estate:

It can be a major challenge for investors to build up a real estate portfolio over a period of several months or years that is diversified and does not represent a cluster risk.

For this reason, we have developed the concept of the so-called virtual apartment building. This concept combines the advantages of many small investments in individual apartments in different locations and the advantages of a central investment in a larger property with many apartments in one location.

In a large property, condominium and tenant management is centralized. However, there is a cluster risk in such a case, as all the apartments are in one location. With the help of the virtual apartment building, an investor can benefit from several top regions throughout Germany and at the same time have access to central management.

Compared to an investment in shares or ETFs, investors can also take advantage of tax benefits. On the one hand, it is possible to sell the property tax-free after ten years. On the other hand, a listed property can bring tax advantages, as large amounts of renovation costs can be deducted from tax.

Rating: ⭐⭐⭐⭐⭐ (5/5)

Government bonds:

Investors who do not want to take a large risk can include government bonds as a safe component in their portfolio. This component can either be supplemented or replaced by gold.

Rating: ⭐⭐⭐⭐ (3/5)

Shares/funds/ETFs:

Like real estate, shares are tangible assets. This form of investment also offers you a high-yield investment.

Rating: ⭐⭐⭐⭐ (3/5)

Gold:

Both gold and government bonds serve to hedge the portfolio. Both forms of investment can be used as safe components, but can also be combined with each other.

Rating: ⭐⭐⭐⭐ (3/5)

Daily money/fixed-term deposits:

As mentioned above, this asset class offers flexibility and security. In addition, both types of investment offer an opportunity for liquid reserves – for example, two to three net monthly salaries can be left here.

Rating: ⭐⭐⭐⭐ (3/5)

Conclusion and outlook

How can you invest money properly? That depends largely on three conditions:

- The amount of capital available,

- the investor’s need for security and

- the liquidity requirements of the investment .

A property as a capital investment represents a sustainable investment with strong returns from as little as €5,000 – but in some cases only from €10,000. If a significantly higher amount of equity is available, hedging the portfolio with bonds or gold plays a major role.

Whether additional diversification through equities or ETFs is appropriate always depends on the investor’s personal risk profile. In principle, however, it has become clear in recent decades that real estate can prove to be the better alternative due to the possible leverage and the not inconsiderable tax savings.

In summary, it can be said that in 2023 there are still a number of investment strategies for investing your savings profitably and with acceptable risk.