Stocks or real estate: Which is safer, which generates more returns?

Investing money: Shares or real estate? Which is safer, shares or real estate? For which investor are shares more suitable, for which real estate? If real estate: how many assets in real estate?

- Commonalities: Asset class, time horizon, target group

- Historical returns in comparison

- Leverage effect of equities vs. real estate

- Asset inflation shares vs. real estate

- Passive income shares vs. real estate

Shares vs. real estate: similarities

In principle, shares and real estate are very different from each other, but both investments belong to the same asset class. In both cases, they are tangible assets. If you look deeper into one of the asset classes, there are different strategies:

Depending on which equities (growth stocks? value stocks?) or real estate (high leverage or high equity? Speculative areas or conservative long-term winners?), every investor will find the right “sector” for them. Depending on the approach, both equity and real estate investments can be flexibly adjusted in terms of risk.

Based on this flexibility, it can be said in principle that both equities and real estate are suitable for almost every type of investor to a certain extent. The time horizon has another thing in common. Of course, both forms of investment can also be considered speculative and short-term, but in most cases both equities and real estate investments are made for the medium to long term.

Shares and real estate are also similar in terms of the target group. After all, both investments are possible with small monthly amounts. You can set up a share savings plan from around EUR 50 per month – although the question of suitable share tips arises. In the case of real estate, the monthly outlay is slightly higher, depending on the purchase price and yield. However, a certain credit rating is a basic requirement here.

Real estate vs. shares: return

An important difference between real estate investments and equity investments lies in the form of financing:

|

Real estate investment |

Share investment |

| Financing through |

Borrowed capital |

Equity |

| Return on equity |

Low, as interest rates are currently high |

Low, as a lot of equity is used |

-

If I, as an investor, now use 10,000 euros of equity capital for an equity investment, I can expect a return of between 5 – 7% p.a. (this is the long-term average on an MSCI World ETF).

-

If I, as an investor, put 10,000 euros of equity into a real estate investment, I can buy a condominium worth around 100,000 to 120,000 euros (assuming that the ancillary purchase costs are covered by equity).

Due to the current sharp rise in interest rates, the return on equity when buying a property is currently rather low with 100% debt financing. The potential increase in value and inflation protection are not yet taken into account. The leverage effect is often referred to in the investment sector. This describes the leverage effect that is generally created by borrowing. In practice, this leverage effect is used for real estate, but only rarely for shares.

In the case of shares, leverage can be used by buying derivatives or taking out a Lombard loan. With derivatives, an investor can acquire more positions than would be possible with the equity invested. With a Lombard loan, the investor borrows against his securities account and receives funds from the bank to buy shares – at correspondingly high prices. Trading with leverage always involves the risk of a total loss and is therefore not for beginners.

Investing money in real estate – most people think that this requires a lot of their own money. But this is not the case, as it usually makes sense for the investor to cover only the ancillary purchase costs (notary and land registry costs as well as land transfer tax and, if applicable, estate agent costs) with equity. The full purchase price is financed.

The leverage effect for real estate is achieved through a standard bank loan. As shown above, debt financing currently has a rather negative effect on returns. In the case of real estate, the risk is very limited, as a high loss in value is not normally to be expected.

Asset inflation shares vs. real estate

During the coronavirus crisis at the beginning of 2020, central banks on all continents pumped billion after billion into the money supply almost in lockstep to get the global economy moving. This measure inevitably led to an increase in the money supply (“Broad Money Supply M2”). In practical terms, this means that more and more dollars, euros and remittances were distributed among a constant quantity of goods such as real estate, gold, Bitcoin and shares. Even a child can see what this must lead to – inflation and rising asset prices. The consequence of increased inflation is the loss of the purchasing power of money.

The war in Ukraine is also pushing up the inflation rate. The outbreak of war has even more economic consequences: rising interest rates and energy prices, supply bottlenecks, shortages of oil and gas.

Passive income shares vs. real estate

When it comes to generating passive income, few things are better suited than buying and renting out a property. Although it is also possible to build up passive income with shares, it is important to ensure that the shares pay dividends. But then the value of the share will not rise sharply.

Growth shares generally do not pay dividends, so investors have to decide whether they want to earn a regular income from their share transactions or speculate on an increase in value. With real estate, on the other hand, both are possible:

-

The property generates rental income, whereby this rental income can be seen as a kind of dividend – which is distributed monthly.

-

The increase in value of the property that is realized with the sale is the equivalent of the price gain on a share.

The property could therefore be described as the better share: Low equity investment due to debt leverage, monthly dividend thanks to regular rental income and participation in increases in value on the real estate market.

Historical returns asset classes

As an investor faced with the decision shares or real estate, the question arises in retrospect: what is there to say about the historical returns of these asset classes? In order to compare equities and real estate in a reasonably “fair” way, we need to keep one thing in mind: Equities are normally used by the typical private investor without borrowing. The capital available for retirement provision is invested, no loan is taken out.

Real estate as a capital investment is fundamentally different, where it makes sense to take out a construction loan. Today, the key interest rate in the eurozone is 4.50% due to high inflation. This means we have a turnaround in interest rates, which indirectly leads to higher interest rates on loans. This means that the leverage is now somewhat weaker.

Historical return MSCI World

The return generated by an investment in the MSCI World can be used as a benchmark for real estate investments. We look at the period from 1987 to today. During this period, the average annual return was 8.01%.

Historical return on real estate

For a rented property as an investment, a return on equity of 10 to 25% could be expected before the interest rate turnaround with a debt capital investment of 100%. If the investor wanted to use more equity – for example, raising 20% of the purchase price from their own funds and only financing 80% – they could expect a return on equity of 5 to 10%.

Please note: These figures do not take into account the increase in value of real estate in Germany. The percentages quoted relate to asset growth through rental income. To get a complete picture, the increase in value would have to be added, which would increase the returns even further.

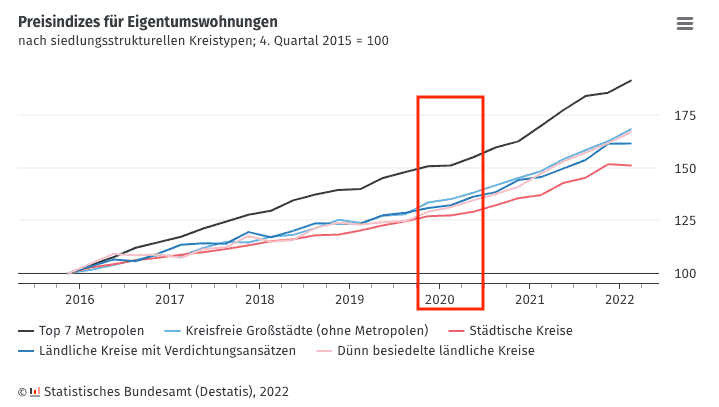

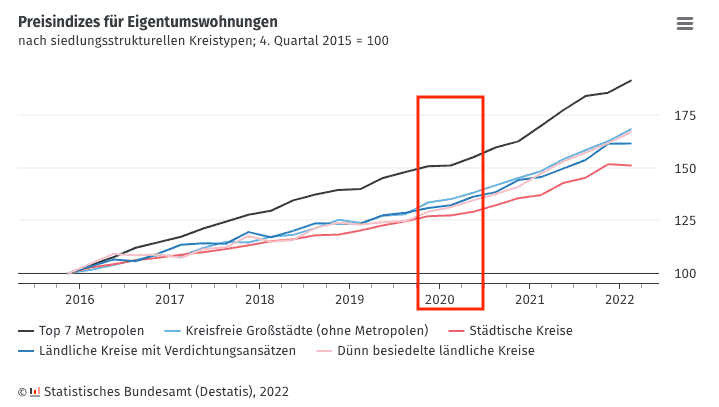

The coronavirus crisis in 2020 showed just how stable the value of real estate is in contrast to shares. Stock markets plummeted by up to 30% at their peak, while real estate, as before, was in a steady upward trend.

Condominiums lost almost no value during Corona.

Conclusion: comparison of real estate vs. shares

When comparing shares or real estate, real estate is the clear winner. This means you don’t have to choose between regular returns or increasing the value of the property. Despite a few similarities, real estate has significantly more advantages and sends the share to the boards in round two.

Incidentally, a combination of both asset classes is not mutually exclusive – quite the opposite. In principle, shares and real estate make a great tandem:

-

In times of economic downturn, when equities often perform poorly, real estate benefits from low interest rates (cheaper borrowing and increased value through the income capitalization approach).

-

In times of economic upturn, both share valuations and interest rates rise. As real estate prices rise at the same time, diversified investors benefit optimally from this asset combination of equities and real estate.

We would be happy to advise you on the optimal combination of both asset classes. With our 360° package for investment properties, we are happy to accompany you on the way to your first (or next) investment property.