Stock market crash 2023 / 2024 – Outlook for share prices

Stock market crash 2024: Investors have almost become accustomed to red figures. The last low was reached in October 2023 and prices have been rising ever since. As of April 2024, there has even been a real price rally. The DAX is more than twice as high as it was at its last low in spring 2020. Sometimes share prices go up, sometimes they go down again, like on a rollercoaster. Depending on economic situations, crises, world events and other important factors, the stock market performs differently. But are we facing a DAX crash in 2024? What could lead to a stock market crash in 2024? There are several reasons for the turbulent markets:

- The war in Ukraine has been going on since February 2022. The Russian invasion is having a major impact on the entire global economy. The result: very volatile stock markets. One reason for this is the sanctions against Russia.

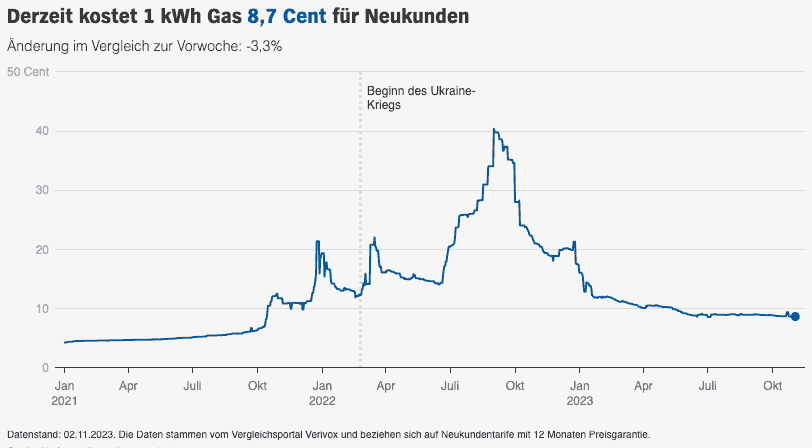

- As a result, oil and gas prices have risen sharply since 2022. The increased raw material and energy prices are still being felt by consumers in many places.

- However, gas prices have been falling again since September last year. The price of gas is currently lower than before the war in Ukraine. Scientists explain this by the mild winter months and the amount of gas saved in power plants and households.

The average gas price for new customers in Germany has been falling since September 2022 (sources: Verivox, NDR, as of 02.11.2023).

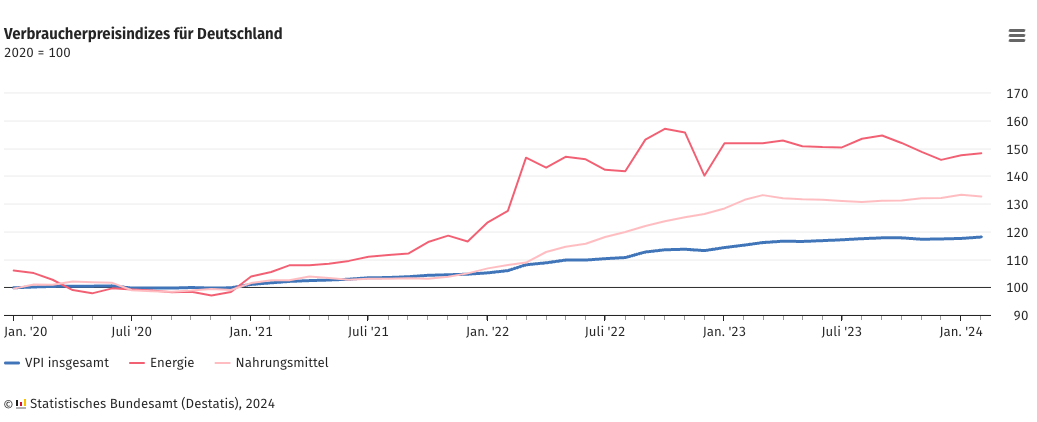

- Another consequence: Inflation rose in 2023, partly due to the war in Ukraine. In the meantime, as of April 2024, the inflation rate has calmed down somewhat, but food and energy in particular are still comparatively overpriced.

Inflation rate Germany, Federal Statistical Office March 2024

- Monetary policy is being increasingly tightened in both the USA and Europe. The US Federal Reserve recently raised key interest rates by 0.25 percentage points due to the rising inflation rate. Since the end of July 2023, this has been at its highest level in two decades at 5.50% and will be left at this high level by the Fed (as at April 2024). The European Central Bank had already raised the key interest rate several times in 2022. Further increases followed in 2023. The ECB’s key interest rate currently stands at 4.50% and was also left at this level at the last ECB meeting in March 2024. The result is additional pressure on the markets, as investors have recently felt painfully.

- Higher key interest rates generally cause financing costs to rise. This is very relevant for stock market participants because they are particularly dependent on the changing interest rate figures from the US Federal Reserve.

- The supply chains disrupted by the coronavirus pandemic are affecting many sectors of the economy.

- The current conflict between Taiwan and China is also having a huge impact on the global economy. These include, for example, supply problems for electronics and finished products.

- China’s real estate crisis is also having an impact on the German stock market. The Chinese real estate group Evergrande filed for creditor protection in the USA in August of this year due to its excessive debts of more than 300 billion euros. This news also had an impact on the DAX.

There are many possible causes for a stock market crash, and each individual crash has its own dynamics. But let’s take a step back first. Almost everyone has heard of certain stocks crashing and investors getting nervous. It happens from time to time. However, many people are not aware of when we are actually talking about a stock market crash. So in this article, we want to clarify the questions: “What is a stock market crash?”, “Are we facing a stock market crash in 2024?” and “What is the stock market forecast for 2024?”. A stock market crash is a drastic slump on the stock market. But how does it happen?

- In 2022, for example, the stock markets fell by more than 12% (source: ETF News).

- In contrast to investment properties, there are emotionally motivated sales – “just get out” is often the motto when selling spontaneously.

- External shocks are a special phenomenon, as seen with the outbreak of the coronavirus crisis at the beginning of 2020. Investors feared that the crisis would result in significant losses in value. They therefore sold large quantities of their shares in order to remain liquid. However, there were no buyers for the shares they sold. As a result, prices plummeted within a very short space of time.

- However, the bursting of a speculative bubble can also cause a bank crash in 2024. This could be triggered by various exogenous factors such as the Fed’s central bank policy, the war in Ukraine, an impending recession or the next “Black Swan” event.

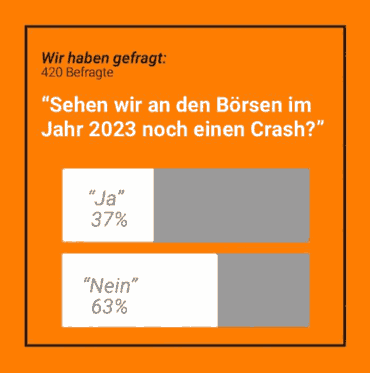

Stock market crash 2023 survey: The majority did not expect a crash

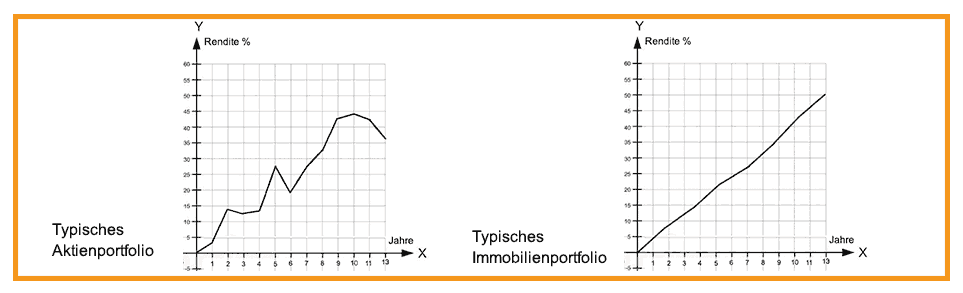

The share portfolio is more stressful for investors than a rented property with constant returns.

Although the return on the equity portfolio is positive in the long term, rented real estate is significantly less susceptible to crashes and has both a higher and more constant return* (source: own illustration).

*This is an exemplary development. In principle, of course, you can also achieve completely different returns with an equity portfolio.

How does an equity bubble develop?

A stock bubble occurs when there is great euphoria on the stock market and demand continues to grow. The rising demand also causes the share price to rise, which ultimately means that the relationship between company values and share prices is no longer balanced. The price of the share no longer corresponds to its actual value. It is overvalued. This usually only becomes apparent after a certain time lag.

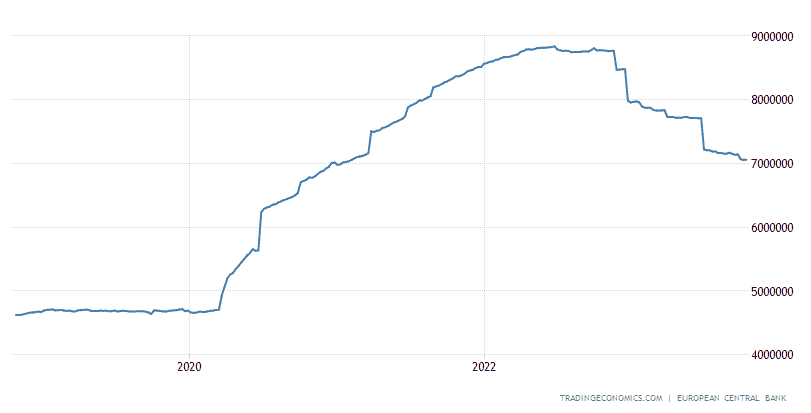

However, the speculative bubble has already formed and bursts as soon as this imbalance becomes apparent. As a result, investors want to sell their shares as quickly as possible. Speculative bubble explained simply: many investors invest in overvalued shares. But there is also another scenario: the ECB has been printing enormous amounts of money for some time (as have the other major central banks in the USA, China and Japan):

The ECB’s money supply is slowly shrinking (source).

This led to an increasing amount of money, which was now invested in shares, real estate, gold, etc. Prices rose because the increasing amount of money was distributed across the same number of shares, real estate, gold, etc. as before. Just because the prices of tangible assets are rising sharply does not automatically mean that there is a bubble. Many so-called experts ignore this.

When will the stock market bubble burst? What will cause the potential stock market crash in 2024?

The stock market is all about confidence. If a bubble forms, it therefore depends on whether investors trust that the company will still match the value of the share. If this confidence is lacking, investors are keen to sell their company shares as quickly as possible. As a result, supply is greater than demand. The natural consequence of this: The price falls. The more investors sell their shares, the further the price falls. Investors should therefore act as quickly as possible. The longer they wait, the more money they lose and the worse the consequences of a stock market crash will be for them. Unless you can sit out a stock market slump and wait until the share price recovers and rises again.

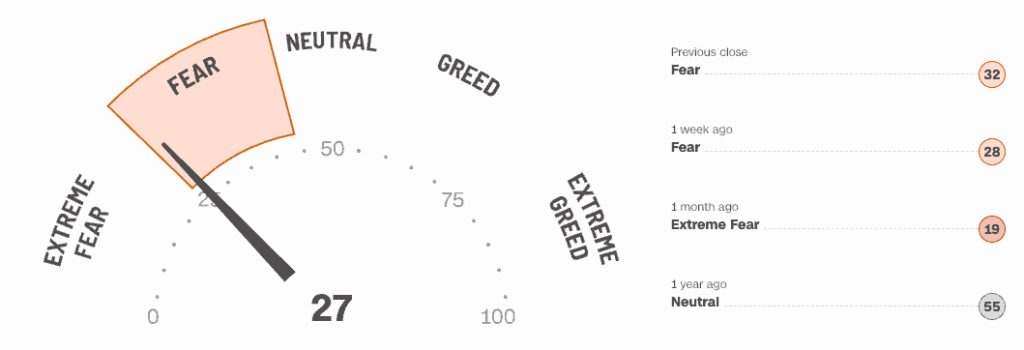

Fear and greed drive the market

Few investments are as emotionally charged as share investments. The stock market is largely driven by two emotions: fear and greed. If fear prevails, as in the scenario described above, then investors want to get rid of their shares and prices fall. If everything goes well, people become greedy and demand grows. Prices rise. This is why there is the so-called Fear & Greed Index.

This index shows which phase a market is currently in. Various factors are taken into account. Among other things, it observes how the risk behavior of investors is changing. For example, government bonds are considered a safe form of investment. If shares are found to be more popular than bonds, this is an indication that the trend is moving towards greed rather than fear.

The trading volume of share purchases and sales is also compared, as well as the trading volume of rising and falling shares. In total, this results in a value that indicates whether fear or greed is dominating the market. In the event of a stock market crash, the value is well below 50. Anyone who follows this index regularly and is aware of the causes of a stock market crash can roughly estimate when or whether a stock market crash is coming.

Fear and Greed Index (Source: CNN; as of 02.11.2023)

How to protect against a stock market crash

The bursting of a stock bubble depends on subjective factors, which in turn are determined by the behavior of individual investors. It is therefore very difficult to prevent the bubble from bursting. More and more amateurs are entering the market, which means that emotions and mass psychological phenomena are becoming increasingly important. It is true that governments and central banks have options for cushioning price collapses or regulating them before a bubble develops. However, private investors have few options to really influence or stop a stock market crash.

What can investors do specifically ?

- It is almost impossible to protect against a stock market crash. However, investors can protect themselves against the consequences of a stock market crash. Shares are always valued in terms of a company’s future earning power. If the potential sales growth is no longer in proportion to the current valuation of the share, caution is called for. In order to be able to assess the relationship between potential and current valuation, it helps to look at key figures. The following video illustrates the relationship between company valuation and sales growth:

- The negative consequences of a crash can also be minimized by investors spreading their money across several investment categories: Real estate, for example, is less speculative. An investment in asset values can be decisive here. While shares are subject to daily changes in value due to rapid buying and selling, the value of real estate remains relatively stable. This means that real estate is not affected by short-term price fluctuations and therefore offers significantly more security.

- However, if you don’t want to rely solely on real estate, you should at least partially invest in it. Risk diversification is an existential issue when investing capital. It therefore makes sense to spread your assets. An investor who loses only ten percent of his assets during a stock market crash is in a much better position than someone who has invested his entire assets in securities. Risk diversification should therefore not be underestimated. There is a very low negative correlation of -0.14% between shares and real estate. With a correlation close to 0, it can be assumed that the value of one investment (e.g. shares) will not develop in line with the value of another investment (e.g. real estate). In addition, with a volatility of less than 3 %, real estate offers a very low susceptibility to fluctuation. A risky equity transaction can therefore be wonderfully hedged.

- To avoid going down with flags flying in the event of a stock market crash, risk diversification is not the only important factor. Equity investors should also make sure that they do not invest all of their assets, but only the portion of their assets that they can do without in case of doubt. If this is not observed, in the worst case a large part of the assets can go up in smoke in the event of a stock market crash. A cash reserve provides additional protection. If the entire invested assets are actually lost, a certain “nest egg” in the safe can be of crucial importance.

Conclusion: What protects against a stock market crash?

In principle, investors should not put all their eggs in one basket. Investing in tangible assets is always advisable. Yes, shares are also a tangible asset, but the principle of risk diversification also applies here. A portfolio consisting of shares, real estate and other tangible assets offers significantly more security than a pure share portfolio.

Development of the stock market in 2024

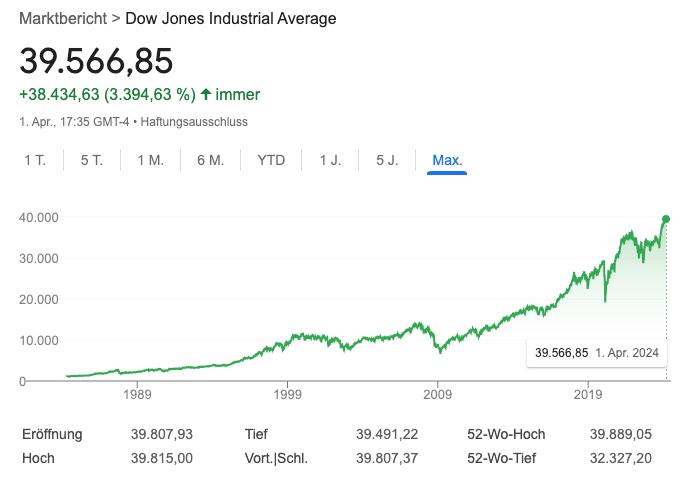

The performance of the stock market in 2024 was characterized by a race to catch up in both the USA and Germany. The Dow Jones has doubled since its low in March 2020.

Dow Jones doubles since March 2020, source Google

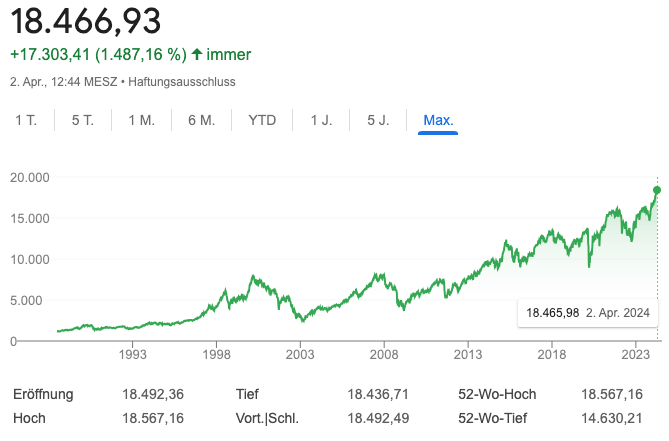

The DAX outperformed the Dow Jones and even more than doubled:

DAX more than doubled since March 2020, source Google

2023 was a year of cautious optimism on the stock market. After several months of bullishness (rise), there was another bear market (slump) in October 2023, as in the previous October, before shares resumed their bull run (rise). Although shares usually recover again and again, there is still the uncertainty of longer dry spells, which may come at the worst possible time, namely when you want or need to cash in some of your shares.

Finally, it should not be forgotten: The gap between rich and poor is widening and society is becoming more and more divided. While the middle and lower classes are getting poorer and poorer, the rich are getting richer and richer. Assuming that only a few loans are granted, it is obvious that they will be granted to people with a good credit rating. This means that the rich can benefit from leverage, while others are denied it. Wealth can thus be increased even in times of crisis.

Why the stock market might not crash after all

The high level of government and corporate debt worldwide speaks against a sustained reduction in aid from the Fed and ECB. Although central banks are temporarily reducing aid and raising interest rates, we cannot be sure whether or not we will see the historically low interest rates of the past again.

The financing of the national budget naturally plays a major role here. Highly indebted countries are very dependent on cheap money, which is controlled by central banks. Further support from new money would therefore also be more than desirable from the state’s point of view.

However, it is becoming increasingly difficult to assess the development of the market. After all, there are now more and more retail investors in addition to institutional investors. The psychology of the masses is gaining influence. This can develop for the better or for the worse. The decisive factor here is human emotion, which – as already mentioned – ranges between fear and greed. The best example of such a mass phenomenon is the rush by the WallStreetBets community to buy GameStop shares at the beginning of 2021. Millions of small investors organized themselves on internet forums to buy shares in the long-established company GameStop, which was being targeted by short sellers. As a result, the price of GameStop shares multiplied in the short term.

Investing in shares will therefore become even more complex in future. In summary, a solid analysis of share values and a broad-based investment foundation consisting of shares, real estate and other tangible assets is a good basis for financial security.