Wohnung oder Haus kaufen und vermieten

2024, nach dem Ende einer mehr als zehnjährigen Niedrigzinsphase, haben Festgeld, Tagesgeld und Sparkonten wieder etwas an Fahrt aufgenommen und bieten Zinssätze von etwas mehr als 3 Prozent. Damit liegen diese Anlageformen aber, wie gehabt, wieder allenfalls knapp über dem Niveau der Inflationsrate.

Daher eignen sich diese sicheren, einfachen Anlagemöglichkeiten nur dazu, Geld vor dem Wertverlust durch Inflation zu schützen. Positive Realzinsen hingegen, also das, was nach Abzug des inflationsbedingten Wertverlusts übrigbleibt, erzielen Sie mit Aktien und Immobilien.

- Aktien sind eine, im Vergleich zum Direktinvestment in Immobilien, niederschwellige Anlageform: Aktien können unkompliziert und mit wenig Geld gekauft werden. Jedoch sind Aktien schwankungsanfällig und weniger sicher als Wohnimmobilien in geeigneten Lagen Deutschlands.

- Immobilien als Kapitalanlage bieten eine durch Mieteinnahmen konstant hohe Rendite mit einer hohen Absicherung auch in Krisenzeiten. Das Prinzip: Ein Haus oder eine Wohnung kaufen, herrichten und vermieten.

Der Rendite-Booster beim Kauf eines Renditeobjekts ist der Fremdkapitalhebel:

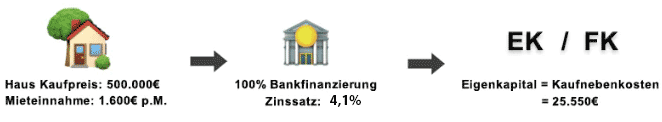

Wohnimmobilie kaufen und vermieten: Wie funktioniert das? (Eigene Darstellung. Stand: Nov 2023)

| Schritt 1 | Das passende Objekt ist gefunden. Es kostet 500.000 EUR und erwirtschaftet 1.600 EUR monatliche Mieteinnahmen. |

|---|---|

| Schritt 2 | Die 500.000 Euro werden über einen Bankkredit zu einem Zinssatz von 4,1% finanziert. |

| Schritt 3 |

Der Käufer setzt nur einen geringen Anteil an eigenem Geld ein und verwendet diesen für die Kaufnebenkosten. Diese bestehen aus Grunderwerbsteuer und Notar- und Grundbuchkosten.

Die Grunderwerbssteuer variiert von Bundesland zu Bundesland und liegt zwischen 3,5-6,5 %. In unserem Beispiel betragen die gesamten Kaufnebenkosten 5,1%, das entspricht 25.550 Euro. Die Kaufnebenkosten können bei Beteiligung eines Maklers und je nach Bundesland bis zu 12 Prozent des Kaufpreises betragen. |

Wie hoch werden die Mieteinnahmen sein? Vor allem die Makrolage und die Mikrolage des Objekts beeinflussen die mögliche Miethöhe.

Das Verhältnis zwischen Kaufpreis und Jahreskaltmiete sollte zwischen 20 und 25 liegen. In die Kalkulation gehören auch Notarkosten, Grunderwerbsteuer und gegebenenfalls die Maklerkosten.

Ebenfalls sollten die voraussichtlichen Verwaltungskosten berechnet werden, falls die Verwaltung an eine Hausverwaltung übertragen werden soll.

Bei einem Altbau stehen möglicherweise hohe Renovierungskosten an. Dieses Risiko können Anleger vermeiden, indem sie ein Haus bauen und vermieten. Doch der Neubau eines Hauses ist meist teurer, als ein bestehendes Haus zu kaufen.

Rendite bei der Vermietung von Haus oder Wohnung

Die Rendite ist bei jeder Art von Investment die entscheidende Kennziffer. Bei Aktien ist dies, neben der Differenz zwischen Verkaufspreis und ursprünglichem Kaufpreis, die Dividende.

Demgegenüber hat das Investment in ein vermietetes Haus vor allem einen großen Vorteil: Den Fremdkapitalhebel.

Der Immobilieninvestor erwirbt die Immobilie weitgehend mit Fremdkapital, also einer Finanzierung durch ein Immobiliendarlehen, und zahlt den Kredit mit Mieteinnahmen zurück.

In einigen Fällen wird beim Immobilienkauf ein gewisser Anteil an Eigenkapital vorausgesetzt. Dies ist allerdings nicht immer erforderlich. Ein Haus als Kapitalanlage kann unter Umständen auch ohne Eigenkapital finanziert werden.

Vermietete Häuser und Wohnungen generieren Rendite durch Mieteinnahmen

Wer sich für eine Immobilie als Kapitalanlage entscheidet, zieht nicht selbst in die Immobilie ein: Das Haus wird finanziert und vermietet. Das hat den Vorteil, dass der für den Erwerb aufgenommene Kredit in der Regel von den Mieteinnahmen getragen wird.

Anleger sollten darauf achten, dass die zu erwartende Rendite über dem Hypothekenzins liegt. Üblicherweise wird von den Banken in diesen Fällen kein bis wenig Eigenkapital verlangt, sodass auch weniger gut situierte Anleger in Immobilien investieren können.

Dennoch sollten Anleger versuchen, zumindest die Kaufnebenkosten aus eigenen Mitteln aufzubringen. Die Kaufnebenkosten betragen circa 5 bis 9 Prozent. Ist ein Immobilienmakler beteiligt, können die Kaufnebenkosten bis zu 12 Prozent des Kaufpreises betragen.

Die Kosten bei einem Hauskauf bestehen grundsätzlich aus:

- Kaufpreis

- Notar- und Grundbuchkosten

- Maklerprovision

- Grunderwerbsteuer

- Nebenkosten

- ggf. Renovierungskosten

Bei den Kalkulationen muss mit realistischen Zahlen gerechnet werden. Allzu oft setzen Verkäufer oder Makler niedrigere Kosten an, um das Investment attraktiver erscheinen zu lassen.

Immobilie kaufen und vermieten ohne Eigenkapital

Ein Renditeobjekt kann unter gewissen Voraussetzungen auch ohne Eigenkapital gekauft werden:

- Sehr gute Bonität mit positiver Haushaltsrechnung

- Vermögenswerte, die als Sicherheit dienen können

- Ein schlüssiges Konzept für das Haus als Kapitalanlage

- Erfahrung hilft

Anhand einer positiven Haushaltsrechnung erkennt die Bank, dass die Kreditraten auch bei einem potenziellen Mietausfall weiter bedient werden können.

Als zusätzliche Sicherheit können der Bank eine abbezahlte Immobilie oder andere Sachanlagen wie etwa Aktien angeboten werden, um die Chance einer Kreditzusage zu erhöhen.

Ein schlüssiges Konzept hilft dabei, Ihrem Vorhaben einen seriösen Rahmen zu geben. Genau so handhaben wir es auch für unsere Kunden, wenn wir die Finanzierung in deren Auftrag bearbeiten.

Meine-Renditeimmobilie hat durch langjährige Zusammenarbeit Vertrauen bei Banken aufgebaut. Daher bekommen wir oft auch kompliziertere Fälle platziert.

Wenn Sie im Immobilienbereich über Erfahrung verfügen – egal ob durch private Investments oder berufliche Überschneidungen mit der Finanzbranche – hilft das dabei, beim Bankberater einen guten Eindruck zu hinterlassen.

Haus bauen und vermieten: Steuer

Sie möchten ein Haus bauen und vermieten und fragen sich, welche Steuern im Zuge dessen anfallen? Eine Übersicht:

- Grunderwerbssteuer fürs Grundstück: Wenn Sie ein unbebautes Grundstück kaufen, um darauf ein Haus zu erbauen, so müssen Sie dafür die Grunderwerbssteuer auf den Kaufpreis des Grundstücks zahlen.

- Einkommenssteuer: Mieteinnahmen, die Sie aus der Vermietung des fertiggestellten Hauses erzielen, unterliegen der Einkommenssteuer.

Da wir keine Steuerberater sind, ist dies auch nicht als steuerliche Beratung zu sehen. Bitte wenden Sie sich für Detailfragen an Ihren Steuerberater.

Haus und Wohnung als Kapitalanlage – was beachten?

Wer einige grundlegende Faktoren beim Immobilienkauf zur Kapitalanlage beachtet, verringert sein Risiko erheblich:

- Nicht zu teuer kaufen: Prüfen Sie für ein konkretes Objekt oder Grundstück, wie teuer andere Immobilien in der Gegend sind. Hilfreich sind neben den gängigen Immobilienplattformen zusätzliche Tools wie beispielsweise Geomap.

- Bauland: Kaufen Sie ein noch unbebautes Grundstück, so muss das Grundstück als Bauland ausgewiesen sein, damit Sie bauen dürfen. Der Punkt ist natürlich irrelevant, wenn Sie ein bestehendes Haus kaufen.

- Regionale Faktoren: Wie stark ist die Wirtschaft in der Region, gibt es auch perspektivisch genügend Arbeitsplätze? Wie ist das Viertel einzuschätzen, in dem das Grundstück oder Haus liegt? Ist es eher aufstrebend oder geprägt durch Wegzug?

- Politische Faktoren: Ist die politische Lage vor Ort Immobilieninvestments gewogen? In Berlin wurde 2019 der Mietendeckel beschlossen, was für Vermieter nachteilig ist. Seit 2021 ist der Mietendeckel allerdings Geschichte.

Neben diesen allgemeinen Kriterien zum Thema „Immobilie vermieten – was beachten“ gibt es objekt- und grundstückspezifische Risiken, die es zu beachten gilt, etwa hinsichtlich der Bausubstanz.

Wer sich nicht selbst auf die Suche machen möchte, dem helfen wir gerne bei der Suche des passenden Anlageobjekts. Nehmen Sie hierfür Kontakt zu uns auf.