Founding a Real Estate GmbH: Pros and cons

Do you already have a diversified portfolio of worthwhile properties, are you in the process of building one up or are you about to make your first purchase and are wisely planning how to proceed? In any of these cases, setting up a real estate company can be an interesting option.

What is the best way to hold and manage my properties?

A limited liability company is formed specifically for real estate. This is a special form of asset-managing company with limited liability. You can find out more about this topic in the article on asset-managing GmbHs. The main aim of a real estate GmbH is usually to keep the tax burden as low as possible and to reinvest the resulting tax savings wisely and sensibly. It is particularly important to think about the taxation of rental income in the case of high-income properties.

What is an asset-managing real estate GmbH allowed to do?

A real estate GmbH may only manage and use real estate assets. In addition, it is legally permitted to manage its own capital assets (e.g. shares), manage residential buildings and build and sell houses or condominiums.

Commercial trading is defined as the purchase and resale of three or more properties within five years. It should also be noted:

- No co-letting of inventory, operating equipment or movable economic goods such as kitchens

- No commercial activities of any kind within the GmbH (neither commercial property trading nor commercial letting such as hotel complexes, vacation apartments, etc.)

Tax advantages of the real estate GmbH

What options are there for saving taxes with a real estate GmbH? What tricks are there to reduce the tax burden on rental income?

1. extended property reduction

In principle, a GmbH is subject to trade tax, even if it manages assets. In the case of a real estate GmbH, however, there is an exception: the extended property deduction. When calculating trade tax, the real estate GmbH may reduce its profit by the amount of income from the asset management activity. Strictly speaking, this means the profits from letting real estate. If certain conditions are met, the real estate company is completely exempt from trade tax.

| Taxation of income from letting & leasing | Taxation of capital gains | |

|---|---|---|

| Immobilien-GmbH | Exempt from trade tax | Fully taxable |

| Privately held property | Taxation in accordance with the Income Tax Act | Complete tax exemption after 10 years |

It is also important to know that the company itself must apply to the tax office for the reduction and the following conditions must be met for approval:

- Asset management character, no commercial income

- Management and use of own property

- Management and use of own capital assets

- Management of residential buildings

- Construction and sale of detached and semi-detached houses and condominiums

The Immobilien-GmbH exclusively manages rental income and may not be commercially active under any circumstances in order to avoid being classified as a commercial enterprise. This also happens, among other things, if the real estate GmbH engages in activities such as

- Renovations

- Construction work

- Repairs

This regulation offers a wonderful opportunity to optimize profits, especially for high-yield properties. However, with the advantage of ongoing low taxation, you also accept the disadvantage that increases in the value of the property are subject to tax when sold by the asset-managing GmbH. For anyone who has acquired a property below its value, it may make more economic sense to manage the property privately rather than through a GmbH.

This also depends heavily on the intended holding period. A distinction is made between a period of up to 10 years and 10 years or more. If the aim is to hold the property for a long time and only sell it at a later date, it may also make more sense to keep the property in private ownership, weighing up the profit from the sale on the one hand and the profit from letting on the other. In this way, the tax-free sale after 10 years can be used and, in contrast to the sale by a GmbH, no losses have to be accepted with regard to the taxation of capital gains.

| Sale as a private individual | Sale through Immo-GmbH | |

|---|---|---|

| Holding period < 10 J | Private tax rate | Ltd tax rate |

| Holding period > 10 J | tax-free | Tax rate GmbH |

But now let’s think one step further. Let’s assume the property has been owned for at least 10 years and is also in good condition. Why not sell the property tax-free to your own real estate company? This way, you can take advantage of the tax-free sale and the property can then generate rental income as the property of the real estate company.

2. 6b reserve

Unfortunately, the real estate limited liability company loses the opportunity to sell the property tax-free after 10 years. However, there is an alternative. The 6b reserve, also known as the “hidden reserve”. The following conditions must be met in order to sell the property tax-free in accordance with Section 6b EStG:

- The property sold must have been part of the company’s fixed assets for 6 years

- The new property must be purchased within 4 years and become part of the fixed assets again

According to § R 6.6. para.1 EStR, the taxation of hidden reserves can be avoided if these are tied up in a reserve and deducted from the acquisition costs of the replacement asset at a later date when the replacement asset is purchased.

- For existing properties: within 4 years

- For new construction of a building: Within 6 years

This procedure can also be helpful with regard to private assets. If the “no purchase/sale of more than three properties in five years” limit has been exceeded or if there is an intention to do so, the 6b reserve can help to avoid being classified as commercial property trading. The 6b reserve makes it possible to reduce the taxable profit and thus save taxes. This represents a further significant structural and tax advantage for the real estate management company.

Reserves are a type of appropriation of profits; in this sense, unlike provisions, they are equity. In general, reserves are created through taxed profit. However, tax law allows tax-free reserves to be created in certain cases. Strictly speaking, this is referred to as tax deferral until hidden reserves can no longer be converted into a tax-free reserve. Particularly in the area of real estate investment, the tax deferral in the case of the 6b reserve can have an almost unlimited term and is therefore equivalent to a direct tax saving.

The proceeds can therefore be used in full to finance new investments. Liquidity remains stable and considerable capital benefits can be generated through smart investment decisions. Reinvestment of reserves is permitted in the form of investments:

- In land, provided the profit was generated from land

- In buildings, insofar as the profit arose from land, buildings or shares in corporations (without partial income method)

- In shares in corporations, insofar as the profit arose from buildings or shares in a corporation (by natural persons or partnerships)

Assumption: You bought a property for €100,000 in January 2008 as managing director of a limited liability company. The depreciation runs until the sale (we assume for depreciation purposes that the purchase price = building value). In January 2015, the property is sold for €200,000 due to a good performance.

The real estate company would like to reinvest the profit, but no suitable property has yet been found. For this reason, a reserve in the amount of the hidden reserve (€200,000 – €100,000 + €14,000 depreciation) is formed for the time being and released in 2019 in order to acquire a new property (purchase price €200,000). The reserve reduces the purchase price and therefore also the depreciation.

| With 6b reserve disposal in 2015 | Without 6b reserve | |

|---|---|---|

| €90,000 | Residual carrying amount | €90,000 |

| €200,000 | Sale price | €200,000 |

| €110,000 | Hidden reserve | €110,000 |

| €110,000 | Reserve | 0 € |

| 0 € | Profit | €110,000 |

| 0 € | Tax (approx. 15%) | €16,500 |

| Reserve phase until 2019 | ||

| €16,500 | Investment amount | 0 € |

| 4 years | Investment period | 4 years |

| 5.00% | Assumed interest rate | 5.00% |

| approx. 3,500 € | Yield | 0 € |

| New acquisition: | ||

| €200,000 | Acquisition costs | €200,000 |

| €110,000 | Reserve | 0 € |

| €90,000 | Book value | €200,000 |

| €1,800 | AfA 2% | €4,000 |

| €270 | Tax savings | €600 |

The creation of reserves results in a tax saving of €16,500. In the meantime, a profitable investment in shares, for example, can generate a further €3,500. The lower tax write-off due to depreciation is significantly lower in proportion.

Taxes in the asset-managing real estate GmbH

Within an asset-managing GmbH, the total tax rate is made up of corporation tax (15%) + solidarity surcharge on the amount of corporation tax (5.5%) + trade tax (15%). In the special form described above, there is no trade tax thanks to the use of the “extended property reduction”.

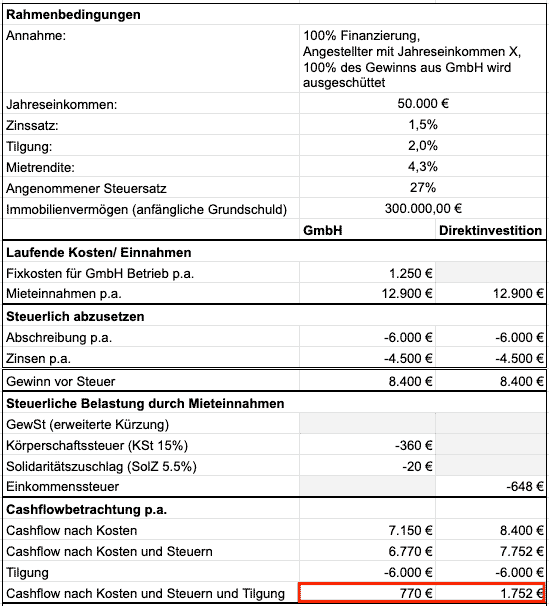

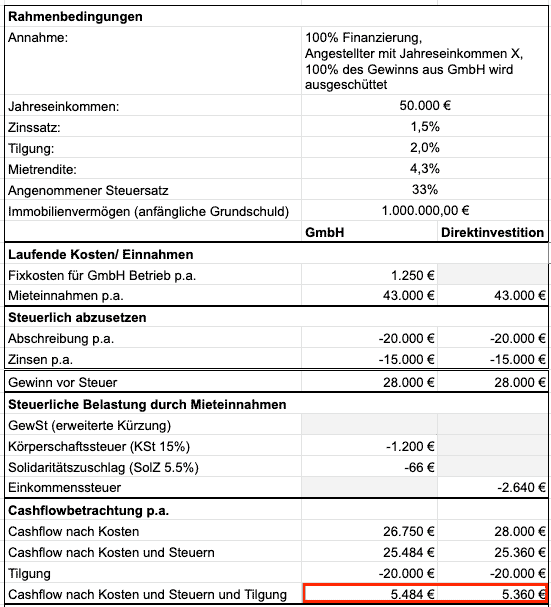

The following example calculation provides practical evidence of the tax advantage of an asset-managing real estate company described in theory. This compares the cases of direct investment (private property purchase) and purchase with an asset-managing real estate company.

Case 1 shows the example of an investor with taxable income of EUR 50,000 and a tax rate of 27%. A property is purchased for 300,000 euros. As the red-framed comparison shows, the investment within a GmbH is not worthwhile. It makes more sense to hold the property privately.

Asset-managing GmbH 300,000 euros in real estate assets are not enough

The real estate GmbH becomes attractive in case 2: The investor earns EUR 50,000, has real estate assets of EUR 1 million and a tax rate of 33%. The “break-even” point here is around EUR 1 million in real estate assets:

Asset-managing GmbH worthwhile from 1,000,000 euros in real estate assets

The more real estate assets there are, the higher the notional tax rate on private assets and the greater the advantage of a real estate GmbH.

Conclusion on the real estate GmbH

If you want to create long-term reserves by selling real estate in order to reinvest and further increase your assets, the consistently low tax rate of a real estate company is suitable for you. If you are prepared to meet the above requirements, you can effectively reduce the tax rate on rental income to around 16%. Apart from the possibility of avoiding trade tax, managing real estate in a limited company set up specifically for this purpose has other advantages, such as the 6b reserve.

Setting up a real estate GmbH is a worthwhile consideration, especially if you have high rental income from several properties. Roughly speaking, a real estate GmbH is worthwhile if you have a long investment horizon, little trading and real estate assets of more than €1 million. In addition, the constant accumulation of additional assets is essential to ensure the profitability of a real estate GmbH. A detailed consultation and analysis of the individual situation with your trusted tax advisor is mandatory.