Immobilienrendite berechnen: Was ist eine gute Mietrendite?

Eine Immobilie kann eine lukrative Kapitalanlage sein. Für eine erste Einschätzung sollte die mögliche Immobilienrendite berechnet werden. Das funktioniert entweder händisch oder mit einem Renditerechner für Immobilien.

Die Immobilienrendite zu berechnen, ist kein Hexenwerk. Entweder händisch oder mit einem Renditerechner für Immobilien

Kalkulation: Immobilie als Kapitalanlage

Um den Cashflow einer Immobilie zu errechnen, werden lediglich die Ausgaben von den Einnahmen abgezogen. Zu den Ausgaben gehören vor allem die Finanzierungskosten, also Zinsen und Tilgung. Hierbei ist interessant, wie sich Ihre monatlichen Zahlungen an die Bank zusammensetzen. Die Rate ist jeden Monat gleich, doch zu Beginn besteht sie hauptsächlich aus Zinszahlungen, während sehr wenig des Darlehens getilgt wird. Jahr für Jahr verringern sich jedoch die Zinszahlungen, da der Zinssatz immer nur auf den Restdarlehensbetrag anfällt. Und so dienen Ihre Raten mit der Zeit immer mehr der Tilgung und weniger den Zinszahlungen.

Mietrendite berechnen

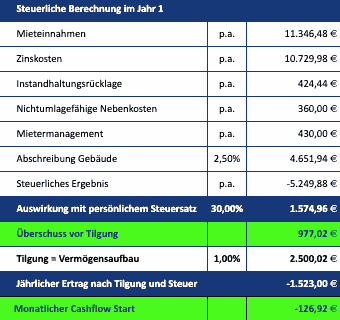

Von den Einnahmen sind neben Zins und Tilgung die nicht umlagefähigen Nebenkosten in Form von Instandhaltungsrücklagen und Verwaltungskosten abzuziehen. Die Einnahmen, die den oben genannten Ausgaben entgegenstehen, sind Ihre Mieteinnahmen. Diese decken den Großteil der Kosten ab. Die Differenz können Sie steuerlich geltend machen. Nach der Steuererstattung ergibt sich somit der reale Cashflow Ihrer Immobilie.

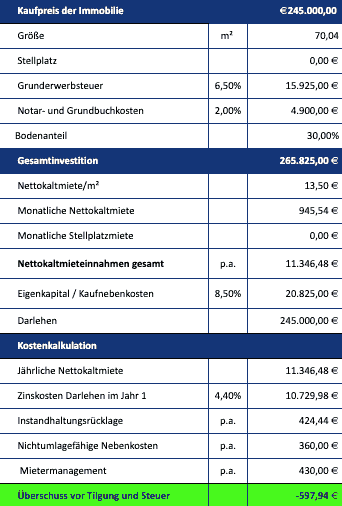

Gehen wir davon aus, dass Sie eine in Kiel gelegene Wohnung zu einem Kaufpreis von 245.000 Euro erwerben möchten. Die Wohnung hat 70 qm. Die Kaufnebenkosten betragen 20.825 Euro, bestehend aus 6,5 % Grunderwerbsteuer (Schleswig-Holstein) und 2,00 % Notar- und Grundbuchkosten. Die Grunderwerbsteuer variiert von Bundesland zu Bundesland; der Durchschnitt liegt bei 5 %. Es handelt sich also um eine Gesamtinvestition in Höhe von 265.825 Euro, von der Sie 20.825 Euro als Eigenkapital stellen und 245.000 Euro über eine Bank finanzieren. Die Mieteinnahmen betragen jährlich 11.346,48 Euro (Netto-Jahreskaltmiete).

| Mieteinnahmen | € 11.346,48 |

|---|---|

| abzgl. Darlehenszinsen (bei einem Zinssatz von 4,5 %) | € 10.729,98 |

| abzgl. Instandhaltungsrücklagen | € 424,44 |

| abzgl. Verwaltungskosten | € 430,00 |

| Überschuss vor Tilgung und Steuern | € -597,94 |

| abzgl. Tilgung (2 %) | € 2.500,02 |

| Ertrag nach Tilgung (pro Jahr) | € -1.523,00 |

| Monatlicher Aufwand nach Steuern ca. | € -126,92 |

Dies ist eine Beispielkalkulation. Der Zinssatz hängt von der Bonität ab und davon, wieviel Eigenkapital vorhanden ist. Auch die Verwaltungskosten können sich anders darstellen. In obigem Zahlenbeispiel wurde der 360-Grad-Service von Meine-Renditeimmobilie angesetzt, da es sowohl die WEG-Verwaltung als auch die Sondereigentumsverwaltung inkl. Mietermanagement umfasst. Wir kalkulieren grundsätzlich immer konservativ; dafür haben wir vier verschiedene Betrachtungsweisen.

- Verliert die Immobilie an Wert?

- Bleibt der Wert konstant?

- Was wäre eine durchschnittliche Wertentwicklung?

- Wann wäre die Wertentwicklung sehr gut?

Wann lohnt sich eine Anlageimmobilie?

Eine Anlageimmobilie lohnt sich, wenn die Mietrendite stimmt. Wie sich diese zusammensetzt, erkennt man anhand folgender Beispielrechnung:

Berechnung der Bruttomietrendite

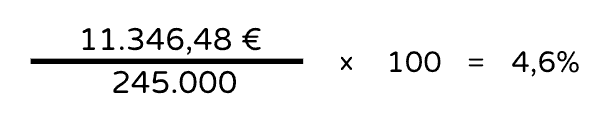

Im obigen Beispiel ergibt sich eine Bruttomietrendite von 4,6%:

Beispielrechnung Bruttomietrendite

Um eine solche Mietrendite zu erreichen, müssen aber bestimmte Bedingungen erfüllt sein:

- Die Immobilienlage-Bewertung

- Miete auf aktuellen Marktniveau

- Guter Kaufpreis

- Passende Kreditkonditionen

Gesamtheitliche Berechnung eines Investments in Immobilien

Eine gesamtheitliche Betrachtung beinhaltet auch die Nebenkosten, die bei der Vermietung anfallen, die Kaufnebenkosten und die Finanzierungskosten in Form von Tilgung und Zinssatz. Eine solche Berechnung sieht so aus:

Gerne erstellen wir kostenlos eine Immobilienkalkulation mit Excel für Ihre Immobilie oder ein Renditeobjekt, das Sie in Erwägung ziehen. Nehmen Sie einfach Kontakt zu uns auf.

Wertsteigerung einer Immobilie berechnen

Mit unserem Investitionsrechner können Sie sehen, wie sich der Wert von Immobilien im Laufe der Zeit durchschnittlich verändert, je nachdem, ob es sich um ein kleines, ein mittleres oder ein großes Immobilieninvestment handelt. Die Kalkulation zeigt Ihnen, wie sich die Mieten und die Immobilienpreise in den letzten Jahren in Deutschland entwickelt haben. Selbst herausfordernde Zeiten haben gezeigt: Immobilien haben sich auf lange Sicht fast immer bewährt, auch in Bezug auf die Wertstabilität beziehungsweise Wertsteigerung und erleiden wenn nur eine temporäre Wertminderung. Gewohnt und gemietet werden muss immer.

Wertberechnung von Immobilien: Methoden

Es gibt verschiedene Methoden, um den Wert einer Immobilie zu ermitteln:

Ertragswert

Hierbei werden lediglich die Mieteinnahmen berücksichtigt. Eine schlichte Wohnung, die hohe Mieteinnahmen erzielt, hat einen höheren Ertragswert als eine gehobene Immobilie, die aufgrund einer unattraktiven Lage günstig vermietet werden muss.

Einheitswert

Diese Berechnungsmethode wird hauptsächlich für die Ermittlung der Grundsteuer benötigt. Der Einheitswert kann zwar ebenfalls nach dem Ertragswertverfahren berechnet werden, allerdings werden hier andere Zahlen zugrunde gelegt. Ausschlaggebend sind die Werteverhältnisse der Jahre 1964 für Immobilien in Westdeutschland und 1935 für Ostdeutschland. Weitere Faktoren sind die Lage der Immobilie sowie Ausstattung und Bauweise.

Verkehrswert

Beim Immobilienkauf zählt der Verkehrswert. Die Berechnung des Verkehrswertes einer Immobilie erfolgt in der Regel durch einen Gutachter und spiegelt die aktuellen Marktverhältnisse wider.

Kredit berechnen für Immobilie

Üblicherweise wird der Großteil des Kaufpreises mit Hilfe eines Kredites finanziert. Das macht vor allem Sinn, um den Fremdkapitalhebel zu nutzen. So können Investoren mit niedrigem Eigenkapitaleinsatz hohe Einnahmen erzielen. Aus diesem Grund ist die Eigenkapitalrendite bei finanzierten Immobilien deutlich höher als bei anderen Anlageformen. Eine Faustregel lautet, dass der Kreditrahmen das 150fache des Haushaltsnettoeinkommens betragen sollte. Mit unserem Finanzierungsrechner können Sie die Kreditkonditionen ganz einfach kalkulieren. Neben den Finanzierungskosten können Sie außerdem die Erbschaftssteuer und die Schenkungssteuer über Immobilien berechnen lassen.

Abschreibungen Immobilien

Bei der Abschreibung handelt es sich um ein Steuerkonstrukt, das dem Vermieter einer Immobilie gewisse steuerliche Erleichterungen bietet. (Hinweis: Bei selbstgenutztem Wohneigentum gilt diese Regelung nicht.) Vermieter können ihre Kosten über eine festgelegte Nutzungsdauer von 50 Jahren linear abschreiben. Zu den absetzbaren Kosten gehören die Anschaffungs-, die Herstellungs- sowie die anschaffungsnahen Herstellungskosten.

Anschaffungskosten

Wenn Sie eine Immobilie erwerben, fallen zunächst Anschaffungskosten an. Dazu gehört der Kaufpreis, aber auch die Grunderwerbsteuer sowie Notar- und Maklergebühren fallen in diese Kategorie.

Herstellungskosten

Nun könnte es sein, dass Sie sich dazu entscheiden, den Keller auszubauen oder neue Fenster/Türen einzubauen. Die Kosten hierfür gehören zu den Herstellungskosten und sind ebenfalls steuerlich absetzbar – über 50 Jahre.

Anschaffungsnahe Herstellungskosten

Dies sind die Kosten für Instandhaltungsmaßnahmen oder Renovierungen. Hierbei gibt es eine Besonderheit. Liegen die anschaffungsnahen Herstellungskosten innerhalb der ersten drei Jahre nach dem Immobilienerwerb unter 15 % des Gebäudewertes, so können diese direkt von den Mieteinnahmen abgezogen und sofort steuerlich abgesetzt werden. Wird dieser Wert überschritten, so sind diese Kosten auch über 50 Jahre abzuschreiben.

Abschreibungen bei Denkmalgeschützten Immobilien

Wird die denkmalgeschützte Immobilie vermietet, können die Modernisierungs- bzw. Sanierungskosten über acht Jahre zu 9 % und weitere vier Jahre zu 7 % abgesetzt werden. Nutzt der Eigentümer die Denkmalimmobilie selbst, können die Modernisierungskosten über zehn Jahre zu 9 % steuerlich geltend gemacht werden.

Was ist eine gute Rendite bei Immobilien?

Immer wieder wird mit guten Renditen zwischen 5- 6 % geworben. Diese Rendite ist in der Tat sehr attraktiv, aber in vielen Fällen werden hierfür keine realistischen Zahlen zugrunde gelegt. Daher stellt sich die Frage: Wie hoch ist bei Immobilien die durchschnittliche Rendite?

In den letzten Jahren hat sich in Deutschland herauskristallisiert: Eine gute und realistische Rendite liegt bei 3-4 % (Anm.d.Red.: Zum Jahreswechsel 2023/2024 sind 4,8% drin). Dies unter Berücksichtigung sämtlicher Kosten. Wer von Anfang an die wichtigen Kennzahlen im Kopf hat und seine Kaufentscheidung wohlüberlegt und mit Hilfe von Profis in Angriff nimmt, kann eine solche Rendite erreichen. Wir sind sehr stolz darauf, dass die von uns begleiteten Immobilienprojekte im Schnitt eine Bruttomietrendite von ca. 4,8% erzielen und teilweise sogar Wohnungen mit über 5% Mietrendite anbieten können.

Checkliste für eine Immobilie mit guter Mietrendite

Was ist also wichtig, wenn Sie den ersten Schritt machen möchten, um ein erfolgreicher Immobilieninvestor zu werden und Ihr Vermögen aufzubauen?

- Informieren Sie sich über die Möglichkeiten: In einem unverbindlichen Erstgespräch analysieren wir gemeinsam Ihre individuelle Situation und arbeiten Ihren persönlichen Mehrwert durch ein Immobilieninvestment heraus.

- Immobiliensuche: Wir helfen Ihnen, die richtigen Entscheidungen zu treffen und machen es uns zur Aufgabe, die passenden Immobilien für Sie zu finden.

- Rendite der Wohnung berechnen: Das Ergebnis der Immobiliensuche ist das Finden der „perfekten“ Renditeimmobilie. Dabei muss natürlich in erster Linie die Rendite stimmen.

- Finanzierung: In Zusammenarbeit mit mehr als 450 Banken bekommen Sie von uns das optimale Finanzierungskonzept für Ihre individuelle Situation und Ihre Bedürfnisse.

- Umsetzung: Wir lassen Sie nicht allein. Wir begleiten Sie zu Ihren Besichtigungs- und Notarterminen, bis alles offiziell abgeschlossen ist.

- Übergeben Sie uns die Verwaltung: Mit tropfenden Wasserhähnen oder dem Aufsetzen von neuen Mietverträgen müssen Sie sich nicht herumschlagen. Wir kümmern uns, wenn gewünscht, um Renovierungsarbeiten, Mietermanagement, uvm.

- Passives Einkommen generieren: Die ersten Mieteinnahmen landen auf Ihrem Konto und Sie erkennen, wie angenehm es ist, mit Ihrer Immobilie passiv Ihr Vermögen zu mehren. Machen Sie weiter so und planen Sie das nächste Projekt, das Ihnen weitere Gewinne einbringt.

Das Team von Meine-Renditeimmobilie beantwortet all Ihre Fragen und steht Ihnen bis zum erfolgreichen Geschäftsabschluss zur Seite. Auch wenn Sie Fragen zum Thema „Immobilienrendite berechnen“ haben, helfen wir Ihnen gerne weiter. Schließlich haben wir in den letzten sechs Jahren bereits den einen oder anderen Immobilieninvestor auf dieser Reise begleitet und unterstützt. Fordern auch Sie jetzt Ihre kostenlose Erstberatung an und zählen Sie sich selbst bald zum stolzen Immobilienbesitzer!

Häufig gestellte Fragen zur Immobilienrendite-Berechnung

Wie berechne ich die Immobilienrendite?

Brutto Mietrendite: Jährliche Nettokaltmiete / (Kaufpreis + Nebenkosten)

Netto Mietrendite: (Nettokaltmiete – Verwaltungskosten p.a. – Instandhaltungskosten p.a.) / (Kaufpreis + Nebenkosten)

Wie viele Prozente Rendite sollte eine Immobilie mindestens einbringen?

Je nach Standort empfehlen wir unseren Kunden eine Mietrendite zwischen 3,7 Prozent an guten Standorten, die sicher sind und wo die Vermietbarkeit dauerhaft gewährleistet ist, und mehr als 5 Prozent an schwächeren Standorten mit größeren Risikofaktoren.

Was bedeuten 5 Prozent Rendite?

5 Prozent Rendite bedeuten bei einer vermieteten Immobilie, dass die Jahreskaltmiete 5 Prozent des Kaufpreises einschließlich Kaufnebenkosten beträgt. Je höher die Rendite, desto besser ist das Verhältnis von Mieteinnahmen zu Kaufpreis.