In Sachwerte investieren: Geldanlagen zum Anfassen

Definition: Was sind Sachwerte?

Was sind Sachwerte? Im Grunde ist das schnell beantwortet. Ein Sachwert ist der Wert einer Sache. Das Bürgerliche Gesetzbuch (BGB) legt weiter fest, was eine Sache ist:

Sachen im Sinne des Gesetzes sind nur körperliche Gegenstände.

Ein Sachwert zeichnet sich dadurch aus, dass er in seiner verfügbaren Menge begrenzt ist. Ein Oldtimer…

- einer bestimmten Marke,

- eines bestimmten Models,

- eines bestimmten Baujahres

gibt es oftmals nur wenige hundert Male. Sachwerte sind also nicht unendlich verfügbar – und das macht Sie attraktiv.

In Sachwerte wie Oldtimer zu investieren, lohnt sich in diesen Zeiten.

Die Rede ist also von Vermögenswerten, die eine wahre physische Substanz haben und einen beständigen materiellen Wert aufweisen, der sich auch in Krisenzeiten bewährt. Zuerst kommen einem vermutlich Sachwerte wie beispielsweise Gold in den Sinn! Gold repräsentiert jedoch nur einen äußerst geringen Anteil an allen finanziellen Vermögenswerten.

Was versteht man nun also, abgesehen von Gold, noch unter Sachwerten im Bereich des Finanzwesens? Wer in Sachwerte investieren möchte, hat eine große Auswahl. Einige Beispiele für Sachwerte sind:

- Geld in Immobilien anlegen

- Edelmetalle/Rohstoffe (Gold, Silber…)

- Aktien

- Sammlerstücke (Autos, Gemälde, Münzen…)

- Kryptowährungen

Den Sachwerten stehen die Geldwerte gegenüber. Zu den Geldwerten zählen unter anderem:

- Sparkonto

- Bausparvertrag

- Festgeld

- Anleihen

- Termingeschäfte

Eine gute Möglichkeit der Unterscheidung ist folgende Überlegung: Wenn plötzlich eine Inflation einsetzt, verlieren gewisse Dinge wie Sparkonten, Festgeld etc. kurzfristig an Kaufkraft – sie behalten ihren absoluten Euro Wert. Demgegenüber steigen Sachwerte in der Bewertung während einer Inflation – sie werden teurer und steigen in ihrem absoluten Euro-Wert. In Sachwerte investieren ist in inflationsgeplagten Perioden wahrlich goldwert.

Ein Sachwert ist also wie eine Plastikente in der Badewanne: Steigt der Wasserspiegel, steigt die Ente an der Oberfläche mit nach oben.

In welche Sachwerte investieren? Um diese Frage beantworten zu können, verschaffen wir uns zuerst einen Überblick über Sachwert-Beispiele.

Immobilie als Sachwert

Bei der Immobilie als Sachwert muss ein bisschen differenziert werden. Wenn Sie eine Immobilie zum Eigennutz erwerben, handelt es sich nicht um eine Investition, sondern um einen Kostenapparat. Wenn Sie Ihre Immobilie allerdings vermieten, nutzen Sie sie als Kapitalanlage, die sich durch die monatlichen Mieteinnahmen selbst finanziert. Wie funktioniert das Prinzip?

- Immobilie kaufen und nur die Nebenkosten aus Eigenkapitalmitteln tragen (in der Regel 5-10% vom Kaufpreis)

- Wohnung vermieten

- Miete nutzen, um Zins und Tilgung bei der Bank Monat für Monat zu begleichen. Sie betreiben damit ab Tag 1 Vermögensaufbau, denn ihr Mieter hilft Ihnen quasi dabei, die Immobilie abzubezahlen.

Damit sich dieses Investment wirklich lohnt, müssen viele Faktoren stimmen. So bestimmen unter anderem der Standort, das Verhältnis zwischen Miete und Kaufpreis sowie die Notwendigkeit einer Renovierung eine große Rolle, um eine attraktive Rendite zu erzielen.

Unsere Kunden nutzen meistens den 360°-Service mit Immobilienauswahl, Beratung, Finanzierung und Verwaltung. So ist das Immobilieninvestment frei von Aufwand und Sorgen, auch nach dem Kauf.

Wein als Sachwert

Hierbei kommt natürlich nicht jede x-beliebige Flasche Wein in Frage. Sprechen wir von einem Sachwert Investment, dann ist im Besonderen die Rede von Wein, Whisky oder Champagner. Sprechen wir von einem Sachwertinvestment, dann kommen ausschließlich hochqualitative Rotweine infrage, bei denen im Laufe der Zeit mit Wertsteigerung zu rechnen ist.

Hierbei ist sowohl der Arbeits- als auch der Reifeprozess besonders und aufwändig sowie oftmals gibt es nur noch wenige Exemplare einer Weincharge. Genau diese Rarität macht das Investment in einen dieser Weine so attraktiv. Wichtig ist es, wie bei allen Investmentformen, sich gut mit der Materie vertraut zu machen oder sich an vertrauensvolle Fachleute zu wenden, um nicht die Katze im Sack zu kaufen.

Haben Sie erstmal einen vielversprechenden Tropfen erworben, ist nun die richtige Lagerung das A und O, denn der Wein muss altern können. Nur dann kann man in Zukunft auch eine erfreuliche Rendite erzielen. Die Zusammensetzung des Weines verändert sich nämlich im Laufe der Zeit: Tannine, Restzucker, Säure und Alkoholgehalt sind die ausschlaggebenden Bestandteile.

Ihre Veränderung definiert den Geschmack des Weines in Zukunft und auch seinen Wert. Grundsätzlich lässt sich sagen, dass die passende Entwicklung nur unter optimalen Lagerungsbedingungen erzielt werden kann. Hierbei gilt, dass der Wein kühl, dunkel und feucht bei ca. 10-12 Grad gelagert werden muss. Dafür bietet sich auch ein professioneller Weinkühlschrank an.

Aktien und ETFs als Sachwerte

Auch Aktien sind Sachwerte, da Sie Ihr Vermögen in ein reales Unternehmen stecken und damit Anteile an diesem Unternehmen erwerben. Doch sind ETFs Sachwerte? Bei einem ETF können Sie ein entsprechendes Portfolio auswählen, das sich auf Immobilien, Aktien, Rohstoffe, etc. erstreckt. Von daher stellen auch ETFs Sachwerte dar, die einen bestimmten Index abbilden, wie beispielsweise den DAX oder den S&P 500.

Gold als Sachwert

In Gold investieren kommt wohl den meisten Menschen als Erstes in den Sinn, wenn es darum geht, eine Kapitalanlage in Sachwerte vorzunehmen. Wie andere Edelmetalle handelt es sich bei Gold um einen begrenzten Rohstoff und genau das macht ihn so gefragt und führt zur weiteren Wertsteigerung. In den Köpfen vieler ist Gold ein Symbol für Sicherheit und andauerndem Wert, der selbst Krisen überdauern kann und in der Vergangenheit konnte. Es ist also nicht verwunderlich, dass gerade bei steigender Inflation eine erhöhte Anfrage nach Gold zu verzeichnen ist.

Gold als Sachwert

Physisches Gold können Sie entweder bei einer Bank, bei einem Edelmetall-Händler oder im Internet erwerben. In all diesen Fällen sollten Sie unbedingt einen gründlichen Preisvergleich der Anbieter durchführen und auf Seriosität und Verlässlichkeit achten. Das erworbene Gold können Sie entweder in Ihrem eigenen Tresor oder einem Bankschließfach lagern. (Das Versteck unter dem Kopfkissen würden wir Ihnen nicht empfehlen.)

Auch das Investment in goldbezogene Wertpapiere ist möglich, welches Sie bequem über Ihr Wertpapierdepot tätigen können. Allerdings dürfen Sie nicht vergessen, dass der Sachwert Gold dem Verhalten von Spekulanten und somit möglichen Wertschwankungen unterliegt.

Welche Sachwerte bei Inflation?

Der größte beziehungsweise folgenschwerste Unterschied zwischen Sach- und Geldwerten liegt im Verhalten während einer Inflation. Bei einer Inflation verliert Ihr Bargeld an Kaufkraft und damit deutlich an Wert:

Stellen Sie sich vor, dass sich eine Inflation einstellt, bei der die Teuerungsrate von heute auf morgen bei 100% liegt. 1.000€ unter Ihrem Kopfkissen sind zwar auch einen Tag später noch 1.000€ wert – jedoch können Sie sich von den 1.000€ nur noch halb so viel kaufen. Zum Beispiel wenn ein Brot statt 5€ am nächsten Tag 10€ kostet.

Wer in Sachwerte Geld anlegt, hat hier mehr Sicherheit. Sachwerte können gegebenenfalls vor Währungskrisen oder Staatsbankrotten schützen. Natürlich gibt es aber auch unter den Sachwerten Unterschiede, die Sie kennen sollten.

Sichere Sachwerte

Nicht alle Sachwerte sind sicher. So muss hier deutlich zwischen spekulativen und sicheren Sachwerten unterschieden werden. Zu den spekulativen Sachwerten gehören unter anderem Aktien, Rohstoffe und Sammlerstücke. Diese Investments unterliegen teilweise sehr starken Preisschwankungen und stellen somit ein hohes Risiko für Anleger dar.

Zu den sicheren Sachwerten zählen hingegen Immobilien, da sie im Normalfall im Wert steigen und nicht sinken. Zudem ist nicht zu erwarten, dass die Nachfrage nach Wohnimmobilien zurückgehen wird, da schließlich jeder einen Wohnsitz benötigt. Wer den Standort klug wählt, der hat sehr gute Chancen, die eigene Altersvorsorge erfolgreich in sichere Bahnen zu lenken.

Grüne Sachwerte

Der Philosoph Heraklit sagte bereits: „Nichts ist so beständig wie der Wandel.“ Und so ist auch innerhalb unserer Gesellschaft ein Wandel erkennbar. Immer mehr Menschen möchten bewusster und nachhaltiger leben. Dieser Trend wirkt sich auch auf die Finanzprodukte aus. Bereits in den letzten Jahren setzten viele Anleger auf erneuerbare Energien in Form von Wind- oder Solaranlagen.

Für Investoren kann dieser Investmentbereich durchaus Vorteile mit sich bringen. Bei erneuerbaren Energien handelt es sich um einen sehr schnell wachsenden Markt. Sowohl Angebot als auch Nachfrage steigen rasant. Für eine nachhaltigere Zukunft haben sich viele Staaten weltweit dazu verpflichtet, den Ausbau alternativer Energieversorgungsmöglichkeiten zu unterstützen und voranzutreiben. Dies wirkt sich folglich auch auf die Stabilität dieses Investmentbereiches aus.

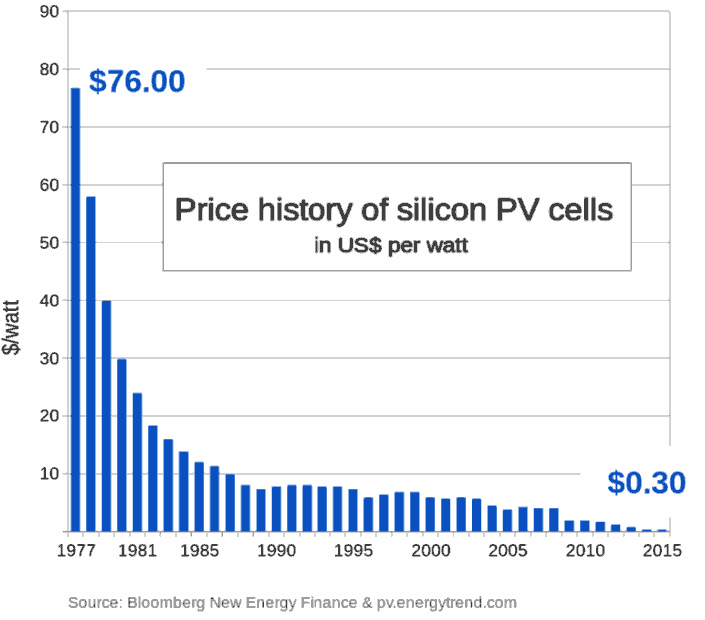

Die Kosten pro Watt bei Solaranlagen sind in den letzten 50 Jahren rapide gesunken.

Leider mussten aber viele von ihnen auch feststellen, dass auch diese grünen Investments ein gewisses Risiko mit sich bringen und daher nicht sicher sind. Dabei schließen sich Umweltbewusstsein und Sicherheit nicht aus, wenn man seine Interessen klug kombiniert.

Wer eine Immobilie zu Vermietungszwecken erwirbt und diese energieeffizient gestaltet, kann nicht nur Sicherheit mit Nachhaltigkeit verbinden, sondern hat auch noch Aussicht auf verschiedene Fördermöglichkeiten.

Was sind gute Sachwerte?

Gerade in herausfordernden Zeiten stellt sich die dringende Frage, wie und worin man am besten investieren soll. Selbstverständlich handelt es sich hierbei um eine individuelle Frage, jedoch haben sich sichere Sachwerte, wie Immobilien als Kapitalanlagen rückblickend, nahezu immer bewährt.

Gute Sachwerte sind diejenigen, die Sicherheit und vielversprechende Faktoren wie eine attraktive Rendite miteinander vereinbaren. Und das auch in Krisenzeiten. Sie haben Fragen oder möchten mehr erfahren, wie auch Ihr Portfolio bald um eine Immobilie reicher wird? Wir unterstützen Sie gerne telefonisch, per Mail oder persönlich in unserem Büro in München oder Stuttgart.