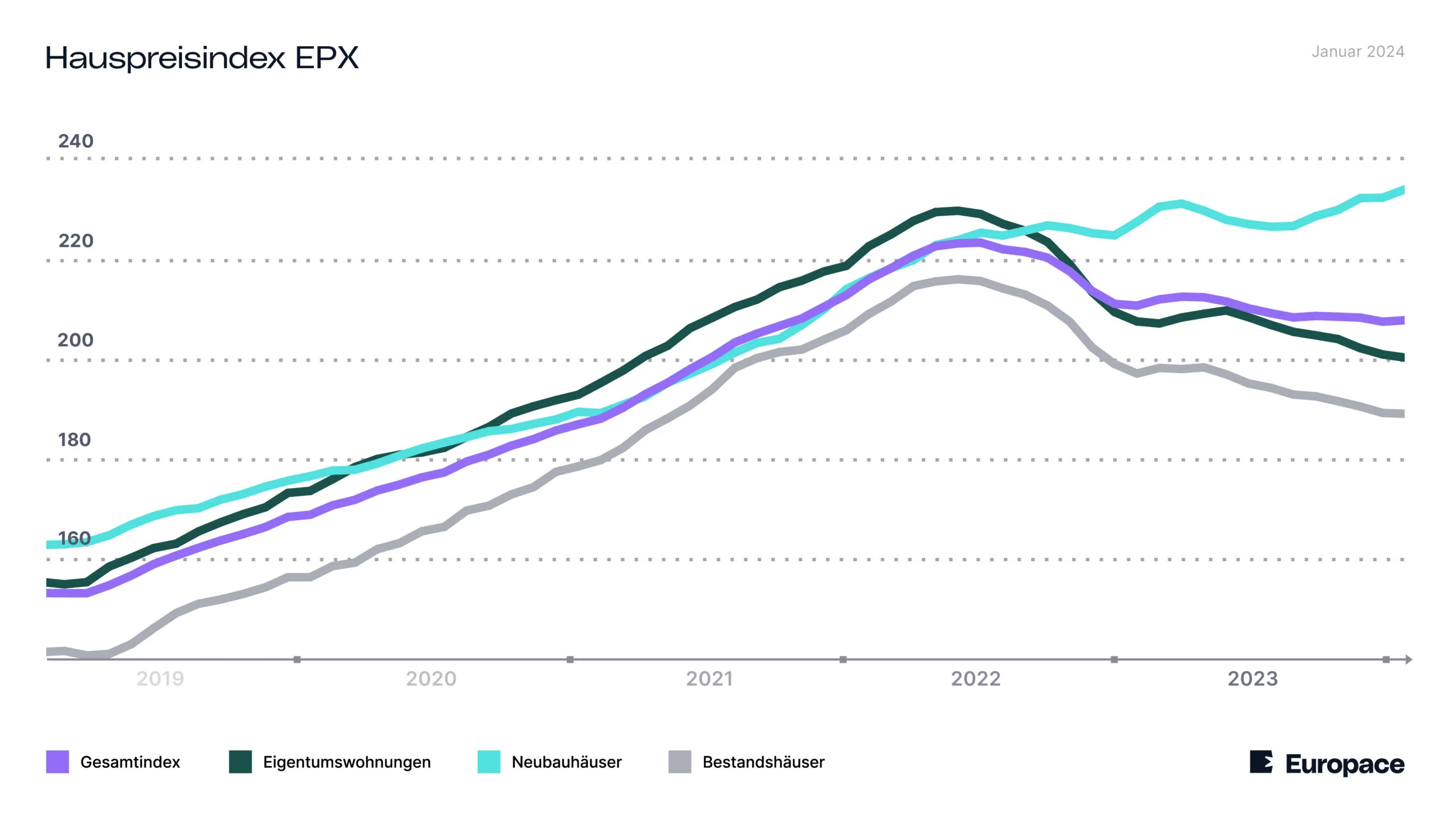

Inflation entwertet Geld, während Immobilienwerte stabil bleiben oder sogar steigen

Immobilien und andere Sachwerte wie Gold und Aktien steigen meist parallel zur Inflation im Wert. Bei Immobilien und Dividendenaktien, nicht aber bei Wachstumsaktien, steigt neben dem Immobilienwert bzw. Aktienkurs oft auch die laufende Rendite durch Anpassung der Miete und höhere Dividendenzahlungen.

Die aktuelle Inflation in Deutschland sieht wie folgt aus:

| Januar 2023 | 8,7 % |

|---|---|

| Februar 2023 | 8,7 % |

| März 2023 | 7,4 % |

| April 2023 | 7,2 % |

| Mai 2023 | 6,1 % |

| Juni 2023 | 6,4 % |

| Juli 2023 | 6,2 % |

| August 2023 | 6,1 % |

| September 2023 | 4,5 % |

| Oktober 2023 | 3,8 % |

| November 2023 | 3,2 % |

| Dezember 2023 | 3,7 % |

| Januar 2024 | 2,9 % |

| Februar 2024 | 2,5 % |

| März 2024 | 2,2 % |

| April 2024 | 2,2 % |

Quelle: Statistisches Bundesamt

Eine Inflation wirkt sich hauptsächlich auf Geldwerte aus. Doch wie sieht es mit Sachwerten aus?

Grundsätzlich bieten Aktien Schutz vor Inflation. Da der Aktienmarkt jedoch starken Schwankungen ausgesetzt ist, ist die Anlage in Wertpapiere spekulativ. Die empfehlenswerte Alternative ETF ist weniger spekulativ, aber ETF-Kurse sind immer noch volatiler die Wertentwicklung bei Immobilien.

Eine Immobilie kann eine steigende Inflationsrate durch parallel ansteigende Mieteinnahmen ausgleichen. Dividendenaktien können dies ebenfalls, indem das Unternehmen die Höhe der Dividenden anpasst. Ein kleiner Unterschied ist hier, dass Mieten monatlich, Dividenden aber fast immer jährlich ausgezahlt werden.

Langfristig gesehen erzielen Immobilieninvestoren in der Regel einen deutlichen Wertzuwachs. Knappe Güter wie Gold, Aktien und Immobilien können nicht vermehrt werden.

Eine größer werdende Menge an Geld verteilt sich auf dieselbe Menge an Gütern wie vor der Geldmengenerhöhung. Die Konsequenz: Steigende Werte von Gütern wie Immobilien und Aktien.

Ukraine-Krieg und Immobilien

Der seit Anfang 2022 andauernde Krieg in der Ukraine hatte negative wirtschaftliche Folgen in der ganzen Welt.

Die bereits durch die Pandemie verursachten Lieferengpässe haben sich verschärft. Energie wurde sehr teuer. Andere Güter, wie etwa Weizen, wurden knapp.

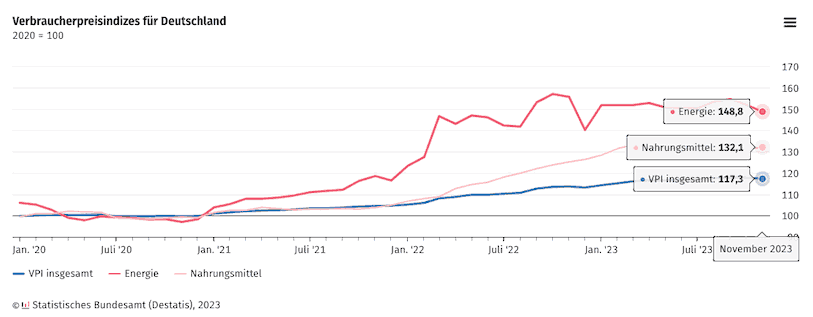

Diese hat zu einem deutlichen Preisanstieg bei Lebensmitteln geführt:

Seit 2020 stiegen Energiekosten überproportional um 48,8 % und Nahrungsmittel um 32,1 %. Die Verbraucherpreise insgesamt sind im November 2023 um 17,3 % höher als 2020.

Trotz dieser Ereignisse gibt es aber keinen Grund zur Sorge im Immobilienmarkt. Auch die nunmehr höheren Zinsen sind, historisch gesehen, immer noch moderat.

Immobilien sind für Kapitalanleger grundsätzlich auch in Krisenzeiten eine sichere Investition. Als Sachwerte bieten sie einen guten Inflationsschutz.

Immobilien – Schulden und Inflation

Schulden sind schlecht. Allerdings muss man hier zwischen guten und schlechten Schulden unterscheiden, vor allem, wenn es um Immobilien geht.

Der Erwerb einer Renditeimmobilie ergibt beispielsweise meist nur Sinn, wenn Sie den Hebeleffekt des Fremdkapitals nutzen.

In der Praxis sieht das so aus, dass Sie einen Bankkredit aufnehmen, um Ihre Immobilie zu erwerben. Die monatlichen Kreditraten zahlen letztlich nicht Sie, sondern Ihr Mieter.

Was passiert mit einem Immobilienkredit in einer Inflation? Grundsätzlich steigen während einer Inflation die Preise, was sich auch auf die Zinsen für neue Kredite auswirkt. Hohe Inflation bedeutet steigende Zinsen für neue Kredite.

Es steigen jedoch auch die Mietpreise – wenn auch zeitversetzt. In diesem Szenario würde also der Mieter die Mehrkosten des Kredites durch die erhöhte Miete abdecken.

Außerdem – und darin liegt der große Vorteil von fremdfinanzierten Immobilien während einer Inflation – können Sie den Kredit viel leichter abbezahlen, denn die Kreditsumme ändert sich nicht, während die Mieteinnahmen steigen.

Es ist jedoch wichtig zu beachten, dass die Kreditzinsen heute ebenfalls höher sind. Dennoch kann es möglich sein, den Kredit durch höhere Mieteinnahmen schneller zurückzuzahlen, beispielsweise durch Sondertilgungen.

Immobilien schützen vor Inflation

Keine andere Anlagemöglichkeit kann Sie wahrscheinlich so gut vor Inflation schützen und gleichzeitig Vermögen aufbauen wie Renditeimmobilien.

Das Bargeld im Safe verliert immer mehr an Kaufkraft. Aktienmärkte stürzen ein oder bewegen sich seitwärts. Spekulationsobjekte wie Kunst oder Autos stellen selbst ohne Inflation ein hohes Risiko dar.

Auswirkungen von Deflation auf Immobilien

Bei einer Deflation ist das Angebot größer als die Nachfrage. Eine Deflation wirkt sich auch auf Immobilien aus:

Werden viele Immobilien angeboten, aber nur wenige nachgefragt, sinken die Preise. Zudem sinkt das Preisniveau für Mieten, Gehälter und Waren.

Der aufgenommene Kredit muss allerdings zu den alten Konditionen abbezahlt werden, was für Hausbesitzer eine besondere Herausforderung darstellen kann und nicht immer möglich ist.

Somit ist Deflation kein günstiges Umfeld für Renditeimmobilien. Eine deflationäre Situation wollen Staaten und Zentralbanken aber um jeden Preis vermeiden.

Beispielhaft kann hier Japan genannt werden: Um die Deflation seit 1990 (Auslöser: Platzen der Finanzblase) zu bekämpfen, steuert die japanische Zentralbank mit massiven Gelddruckorgien gegen.

Ziel ist ein Inflationswert von 2%. Sollte eine ähnliche Krise Deutschland betreffen, sähen dann die Maßnahmen ganz ähnlich aus. Für den Inhaber einer Renditeimmobilie eine gute Ausgangsposition.

Deflation und Immobilien in Japan

Wie weit sinken die Preise bei Deflation? Diese Frage können wir am Beispiel Japans beantworten. Japan hat seit den 90er Jahren mit Deflation zu kämpfen.

Als die Finanzblase platzte, gingen die Preise in den Keller. Der japanische Aktienindex Nikkei brach ein. Die Immobilienkredite konnten nicht mehr zurückgezahlt werden. Viele Banken mussten Insolvenz anmelden.

Auch der Arbeitsmarkt war betroffen. Die Arbeitslosigkeit stieg enorm an. Die japanische Regierung hat mit der Aufnahme neuer Staatsschulden versucht, die Wirtschaft wieder anzukurbeln – allerdings ohne Erfolg. Der Aktienindex fiel von ca. 40.000 auf 16.000 Punkte.

Viele Immobilien waren plötzlich nur noch die Hälfte des ursprünglichen Kaufpreises wert. Dank der Maßnahmen der Zentralbank konnten die deflationären Tendenzen jedoch im Zaum gehalten werden.

Japanische Immobilien steigen aktuell wieder deutlich im Wert und sind nicht mehr so weit von den Werten von 1990 entfernt.

Inflationsgeld: Wenn das heutige Geld morgen nichts mehr wert ist.

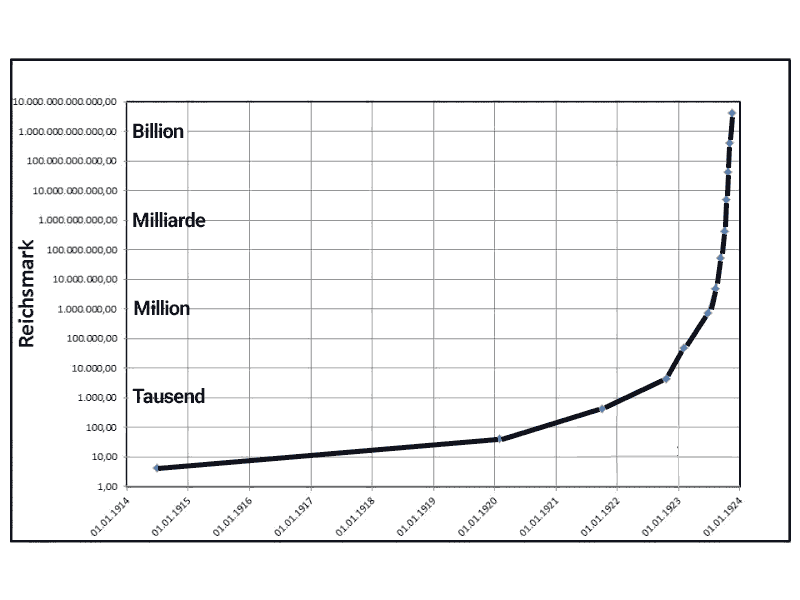

Inflation von 1923 und Immobilien

Deutschland hat im Jahre 1923 genau das Gegenteil erlebt – nämlich eine Hyperinflation. Bei einer Hyperinflation steigt das Preisniveau extrem schnell, mindestens um 50 % pro Monat (das wären ganze 13.000% pro Jahr!).

Damals haben die Menschen ihr Geld in Schubkarren oder Reisetaschen transportiert und versuchten, es so schnell wie möglich gegen Waren einzutauschen, da das Geld Tag für Tag an Wert verlor.

Der Preis für ein Hühnerei stieg von 7 Pfennig im Jahr 1912 auf 2,1 Millionen Papiermark im September 1923, 227 Millionen im Oktober und schließlich 320 Milliarden im November.

Daraufhin beschloss die Regierung noch im selben Monat eine Währungsreform, wodurch sämtliche Vermögen, aber auch Schulden, von einem Tag auf den anderen wertlos wurden.

Wer in solch einem Moment eine Anlageimmobilie besitzt, ist vollständig vor den verheerenden Wirkungen einer Hyperinflation geschützt.

Hyperinflation in Deutschland: aus Hunderten wurden Billionen.

Fazit und Ausblick

Das Spannungsfeld zwischen dem Wunsch der Wirtschaft nach maximalen Gewinnen einerseits und billigem Geld andererseits wird uns weiter an- und abschwellende Inflationsraten bescheren.

Mit Renditeimmobilien sind Investoren gut gegen den Vermögensverlust durch Inflation abgesichert.

Neben einer zu erwartenden Wertsteigerung sind vor allem künftige Mieteinnahmen inflationsgeschützt.