Einfach erklärt mit Beispielen: Magisches Dreieck der Geldanlage

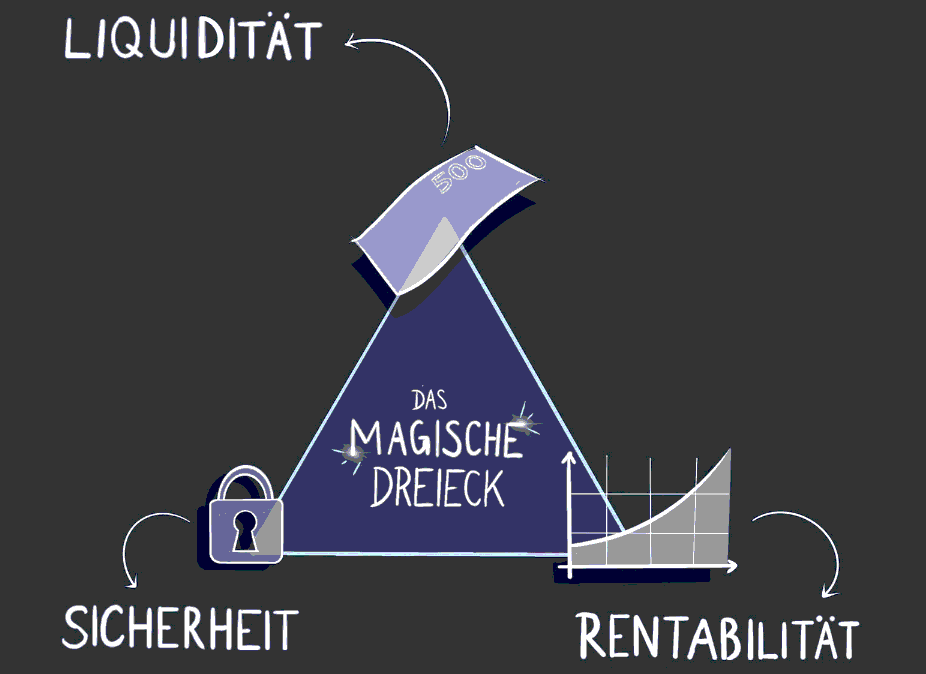

Das magische Dreieck der Geldanlage ist ein nützliches Hilfsmittel, um verschiedene Geldanlagen miteinander vergleichen zu können. Die drei Aspekte des magischen Dreiecks der Geldanlage beinhalten:

- Liquidität: Wie schnell kann eine Kapitalanlage zu Bargeld gemacht werden? Ist das ein langwieriger Prozess wie etwa beim Verkauf eines seltenen Kunstwerks?

- Rendite: Wie viel Rendite erwirtschaftet die Geldanlage? Bei einem Sparbuch ist das der Zins, bei einer Aktie der Kursgewinn und die Dividenden.

- Sicherheit: Besteht ein erhöhtes Risiko, dass das Investment langfristig an Wert verliert oder sogar wertlos wird?

Vergleich der Geldanlagen im Magischen Dreieck

Diese drei Aspekte sind auch bekannt als die drei Kriterien für Geldanlagen:

Das magische Dreieck der Geldanlage: Liquidität, Sicherheit und Rentabilität.

Werfen wir einen Blick auf verschiedene Anlagemöglichkeiten und wie sich diese im magischen Dreieck der Vermögensanlage verhalten:

- Aktien

- Bitcoin/Krypto

- Immobilien

- Anleihen/Sparbücher

Aktien im Magischen Dreieck

Aktien und das magische Dreieck.

Rendite: 2/3

Die Rendite eines Aktieninvestments hängt stark von der Auswahl der einzelnen Werte ab. Als Referenz kann der S&P500 dienen: Seit Gründung 1957 lag die jährliche Durchschnittsrendite bei etwa 8%, also deutlich über der durchschnittlichen Inflationsrate von ca. 2%.

Sicherheit: 2/3

Ein breitgestreuter Indexfonds (ETF = Exchange Traded Fund) sorgt für relativ hohe Sicherheit, ein Investment in eine Einzelaktie ist hingegen deutlich riskanter.

Liquidität: 3/3

Eine Aktie kann an der Börse zu den Öffnungszeiten jederzeit abgestoßen werden, sofern es Käufer am Markt gibt. Bei mittleren und großen Unternehmen kein Problem, bei Micro-Caps mit geringer Marktkapitalisierung schwierig. Letzteres ist aber sicherlich nicht der Regelfall, daher drei von drei möglichen Punkten.

Immobilien im Magischen Dreieck

Immobilien und das magische Dreieck.

Rendite: 3/3

Die Eigenkapitalrendite von Renditeobjekten kann 20% und mehr erreichen und liegt damit mehr als doppelt so hoch wie bei Aktien! Hinzu kommt ein manchmal schon ab dem ersten Tag positiver Cashflow der Immobilie nach Zins und Tilgung.

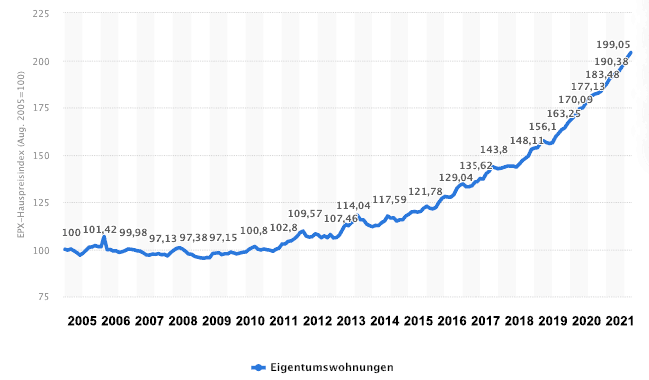

Sicherheit: 3/3

Langfristig gehen die Immobilienpreise in Deutschland immer weiter nach oben. Als führende Industrienation hat sich Deutschland dem Wachstum verschrieben. Die niedrige Geburtenrate wird seit jeher durch Zuwanderung mehr als ausgeglichen.

Zuletzt hatten wir Ende 2023 eine Berichtigung, die deutlich war, aber letztlich nur die exorbitante Wertsteigerung in den Jahren zuvor etwas reduziert hat. Innerhalb von Monaten sollte dieser Rückgang wieder ausgeglichen sein.

Von einer Blase und dem Platzen derselbigen konnte man bislang in Deutschland nicht sprechen. Auch in Zukunft wird es in Deutschland nach unserer Einschätzung aus politischen, kulturellen und wirtschaftlichen Gründen nicht zu einer echten Immobilienblase kommen, wie es in angelsächsischen Ländern und Asien möglich ist.

Zu beachten ist auch, dass sich Statistiken zur Wertsteigerung bei Immobilien fast immer auf Durchschnittswerte beziehen. Objekte in schlechten Lagen und für den Selbstbezug sind mit eingerechnet und senken den Durchschnittswert. Bei Renditeobjekten besteht natürlich der Anspruch, eine bessere als nur durchschnittliche Wertsteigerung zu erzielen.

Liquidität: 3/3

Richtig ist, dass eine vermietete Immobilie als Kapitalanlage nicht so günstig und schnell abgestoßen werden kann wie ein Aktien. Die Immobilie ist dennoch nicht so unflexibel, wie es auf den ersten Blick scheint, denn:

- Die Liquidität des Anlegers wird bei einer fremdfinanzierten Immobilie von Anfang an geschont. Werden beim Kauf der Renditeimmobilie nur die Kaufnebenkosten eingebracht und der Kaufpreis über ein Bankdarlehen finanziert, ist nur wenig Eigenkapital gebunden. Ganz anders bei Aktien oder einem Sparbuch.

- Benötigt ein Immobilienanleger schnell Liquidität, so kann jederzeit eine Hypothek auf die Renditeimmobilie aufgenommen werden. Das ist in wenigen Tagen möglich und sorgt für sofortige Liquidität.

- Wird ein großer Betrag benötigt, so führt kein Weg am vorzeitigen Verkauf vorbei. Renditeobjekte werden stark nachgefragt, sodass ein zeitnaher Verkauf innerhalb weniger Wochen möglich ist.

Das Sparbuch im Magischen Dreieck

Sparbuch und das magische Dreieck.

Rendite: 1/3

Die Rendite für ein Sparkonto ist niedrig und entspricht etwa dem Tagesgeld oder Festgeld. In der Verfügbarkeit liegt das Sparbuch irgendwo dazwischen: Nicht täglich kündbar wie Tagesgeld, aber auch nicht so langfristig gebunden wie Festgeld.

Sicherheit: 3/3

Zwar keine Zinsen, dafür schnelle Liquidierbarkeit und hoher Sicherheitsgrad: Immerhin in puncto Sicherheit ist auf das Sparbuch Verlass.

Liquidität: 3/3

Ein Sparbuch ist in der Regel schnell auflösbar. Man kommt als Anleger also recht schnell an die Mittel heran.

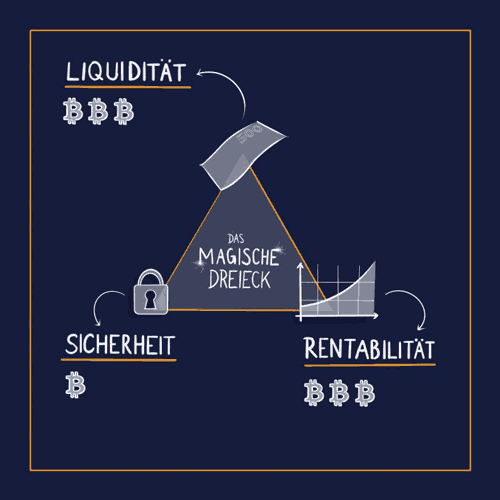

Bitcoin im Magischen Dreieck

Das magische Dreieck und Bitcoin.

Rendite: 3/3

Bitcoin steigt mitunter stark im Wert, aber Anleger müssen das Renditepotenzial mit geringerer Sicherheit und hoher Volatilität bezahlen.

Sicherheit: 1/3

Sicherheit und Bitcoin in einem Satz – schwierig. Einerseits ist Bitcoin etabliert und anderen Kryptowährungen vorzuziehen. Andererseits sind jederzeit staatliche Eingriffe und ein Absturz möglich.

Liquidität: 3/3

Die Marktkapitalisierung und das Handelsvolumen von Bitcoin sind mittlerweile recht hoch, sodass es leicht ist, Bitcoin wieder zu verkaufen. Immer vorausgesetzt, Staaten beginnen nicht, den Tausch zurück in USD und EUR massiv zu erschweren.

Zielkonflikt zwischen Rentabilität und Sicherheit

Eine Geldanlage kann nicht sehr sicher und gleichzeitig sehr renditestark sein. Das Verlustrisiko steigt mit höherer Rendite immer weiter.

Am nähesten kommt noch die Immobilie: Immobilien sind recht rentabel, wenn ein hoher Anteil des Kaufpreises durch ein Bankdarlehen abgedeckt wird. Andererseits sind sie relativ sicher – nicht umsonst spricht man seit jeher von „Betongold“.

Die Wertentwicklung von Immobilien in den letzten Jahren spricht für sich. Doch auch schon vor dem Boom seit dem Jahr 2010 waren Immobilien äußerst wertstabil und eine gute Methode, sich gegen Inflation abzusichern.

Die Wertentwicklung von Immobilien in Deutschland ist beträchtlich.

Zielkonflikt zwischen und Rentabilität und Liquidität

Je länger die feste Laufzeit einer Geldanlage ist, desto schlechter stehen die Chancen, vorzeitig an das gebunden Geld heranzukommen. Bei Kryptowährungen kann man zwar von hoher Rentabilität und sehr guter Liquidität sprechen. Doch der Anleger bezahlt dafür mit geringer Sicherheit und hoher Volatilität.

Fazit: Das magische Dreieck der Vermögensanlage und wie Sie es nutzen können

Wer eine nachhaltige Geldanlage sucht, sollte auf folgende Punkte achten:

- Die perfekte Geldanlage mit hoher Liquidität, Rentabilität und Sicherheit gibt es nicht. Nur die Immobilie als Kapitalanlage erfüllt viele Kriterien, jedoch müssen bei der Liquidität Abstriche gemacht werden

- Diversifikation lautet die Schlußfolgerung: Wer mehrere Anlagearten kombiniert, streut sein Risiko und erfüllt jedes der Kriterien des magischen Dreiecks in der Addition aller Anlagen.

- Beispiel: Ein Anleger kauft eine Renditeimmobilie mit Fremdkapitalhebel (Sicherheit + Rentabilität hoch, aber Abschläge bei Liquidität); zusätzlich investiert er in ein Aktienportfolio (z.B. ein breit gestreuter ETF), welcher zwar weniger sicher ist, dafür aber schneller verkauft werden kann.

- Zuletzt könnte noch ein kleinerer, sehr risikobehafteter Bestandteil integriert werden, welcher aber viel Potenzial für hohe Gewinne verspricht, z.B. ein Krypto-Investment, sowie Gold als eine Anlage, die sich üblicherweise gegenläufig zu den anderen Geldanlagen entwickelt und somit hilft, Verluste auszugleichen.