Aktien oder Immobilien: Am besten beides

Sowohl Immobilien als auch Aktien, insbesondere ETFs, sind als langfristige Geldanlagen empfehlenswert. Aktien schwanken mehr im Wert und sind nicht so steuerbegünstigt wie Immobilien. Andererseits können Anleger schneller und mit weniger Geld in Aktien investieren als in Immobilien.

Gemeinsamkeiten von Aktien und Immobilien

Inflationsschutz

In beiden Fällen handelt es sich um Sachwerte. Der Wert von allgemein stark nachgefragten Sachwerten wie Aktien oder Immobilien steigt mit der Inflation.

Bei exotischeren Sachwerten wie Wein, Uhren oder Legosteinen ist das weniger sicher. Daher eignen sich sowohl Aktien als auch Immobilien, um Vermögensverluste durch Inflation mindestens auszugleichen.

Zwei oder drei Renditearten

Aktien, die Dividenden abwerfen, ähneln – im Gegensatz zu reinen Wachstumsaktien ohne Dividendenzahlung – auch in dieser Hinsicht Renditeimmobilien:

In beiden Fällen erwirtschaften Anleger sowohl eine laufende Rendite als auch – hoffentlich – Wertsteigerung über einen längeren Zeitraum.

Bei Immobilien stellen die Mieteinnahmen die laufende Rendite dar. Bei Dividenden-Aktien entspricht die Dividende der laufende Rendite.

Die Mieteinnahmen erhält der Immobilieninvestor monatlich. Dividenden werden in Deutschland meist jährlich und bei US-Aktien quartalsweise ausbezahlt.

Dritte Renditeart bei Immobilien: AfA

Immobilien haben im Gegensatz zu Aktien eine dritte Renditeart, nämlich das AfA-Potential. Bei jedem Kauf einer Immobilie entsteht das Abschreibungsvolumen des Gebäudeanteils der Immobilie von Neuem und erzeugt für den Käufer Rendite durch Steuererparnis.

Diese Steuerersparnis durch AfA als dritte Renditeart hat üblicherweise den kleinsten Anteil an der Gesamtrendite eines Immobilieninvestments.

Je höher das zu versteuernde Einkommen, umso bedeutender wird diese dritte Rendite. Doch auch bei sehr hoher Steuerlast bleibt diese Renditeart mit vielleicht 10-25 Prozent Anteil an der Gesamtrendite auf Platz 3.

Mit Gutachten zu einer verkürzten Restnutzungsdauer lässt sich das AfA-Volumen schneller nutzen, statt es, je nach Baujahr des Gebäudes, über 33 bis 50 Jahre strecken zu müssen.

Solche Restnutzungsgutachten geben wir, wo es zur Situation und den Zielen unseres Kunden passt, regelmäßig in Auftrag.

Langfristiger Anlagehorizont

Sowohl Aktien oder ETF als auch Immobilien sind vor allem bei langfristigem Anlagehorizont empfehlenswert. Für die kurzfristige Anlage eignen sich Aktien aufgrund ihrer Volatilität nicht, da nicht absehbar ist, ob der Kurs oben ist, wenn man verkaufen will.

Immobilien sind weniger volatil, eignen sich aber aufgrund von Transaktionsdauer und -kosten ebenfalls nicht für die kurzfristige Geldanlage.

Niedrige, monatliche Sparrate möglich

Es gibt ETF-Sparpläne mit nur 50 EUR monatlicher Sparrate. Auch Renditeimmobilien können mit geringen, monatlichen Beiträgen finanziert und betrieben werden.

Das wäre dann ein geringfügig negativer Cashflow, wie er bei Direktinvestments in Immobilien entstehen kann, aber nicht muss. Ein negativer Cashflow spricht keineswegs gegen Immobilieninvestments.

Negativ bedeutet hier lediglich, dass die Mieteinnahmen der Anlageimmobilie die monatlichen Kosten (Kreditrate und sonstiges) nicht komplett abdecken. Es könnte sich beispielsweise ein monatliches Minus von 50 EUR ergeben.

Auch hier würde der Anleger also 50 EUR monatlich ausgeben bzw. investieren. Beim ETF-Sparplan gehen die 50 EUR an den ETF-Herausgeber, bei Immobilien an die kreditgebende Bank.

Bei einem klassischen Direktinvestment in ganze Immobilien, wie es Meine-Renditeimmobilie anbietet, ist allerdings in der Regel Eigenkapital in Höhe der Kaufnebenkosten erforderlich. Diese Kaufnebenkosten liegen bei 5 bis 16 Prozent des Kaufpreises der Immobilie.

Nachhaltigkeit

Sowohl Immobilien als auch Aktien und ETFs können nachhaltig sein. Bei Aktien können Anleger sich auf Unternehmen beschränken, deren Geschäftsgebaren sie als nachhaltig bewerten.

Beim Immobilienkauf können Anleger auf energetische Sanierung sowie nachhaltige Baustoffe und Einrichtungsgegenstände achten.

Klumpenrisiko

Das Klumpenrisiko betrifft sowohl Aktien als auch Immobilien, aber auch jede andere Geldanlageform. Anleger sollten idealerweise sowohl innerhalb der Anlageklasse als auch zwischen unterschiedlichen Anlageklassen diversifizieren.

Bei Immmobilien kann aufgrund der höheren Anlagesummen ein Klumpenrisiko prinzipiell eher entstehen als bei Aktien. Um mittels eines zweiten oder dritten Renditeobjekts zu diversifizieren, benötigen Anleger entsprechendes Kapital für die Kaufnebenkosten.

Die Kaufnebenkosten werden üblicherweise nicht fremdfinanziert, sondern müssen als Eigenkapital eingebracht werden. Ab der zweiten Immobilie ist eine Vollfinanzierung inklusive Kaufnebenkosten machbar. Dazu muss das erste Objekt weitgehend abbezahlt sein und als Sicherheit eingebracht werden.

Das Klumpenrisiko bei Aktien und Immobilien kann gesenkt werden, indem in beides investiert wird. Wir empfehlen eine Kombination von Immobilien und ETF oder Aktien, sowie eventuell eine oder mehrere weitere Anlageformen.

Unterschiede zwischen Aktien und Immobilien

Aktien und Immobilien als Geldanlage unterscheiden sich in einigen Aspekten:

Volatilität ist ein Problem

Aktien oder ETFs sind unbestreitbar deutlich volatiler als Immobilien. Volatilität möchte niemand; sie wird lediglich in Kauf genommen und ist bei Aktien der Preis für gutes Wachstum, insbesondere bei Technologiewerten. Die Werte, die langfristig am besten wachsen, sind meist auch die volatilsten.

Volatilität ist ein Problem, da sie den Aktieninhaber daran hindert, sein Portfolio zum Wunschtermin oder durch Umstände nötigen Zeitpunkt wirtschaftlich vernünftig zu liquidieren.

Liegen die Kurse zum Wunschzeitpunkt am Boden, müssen Anleger Verluste in Kauf nehmen oder versuchen, das Depot zu beleihen. Doch auch das Beleihen ist bei fallenden Kursen problematisch, da eben der Wert der Sicherheit am Sinken ist.

Standardisiertes „Produkt“

Aktien und ETFs sind standardisierte Finanzprodukte, während ein Direktinvestment in Immobilien ein sehr individuelles Investment ist.

Die Standardisierung hat den Vorteil, dass Aktien und ETFs besser untereinander verglichen werden können und besser mit ihnen gehandelt werden kann.

Andererseits bietet die Individualität eines Immobilieninvestments Gestaltungsspielraum, um die Rendite weiter zu verbessern.

Transaktionsdauer und -Kosten

Beim Immobilienkauf fallen Nebenkosten in Höhe von 5 bis 16 Prozent an. Die genaue Höhe hängt vom Bundesland und davon ab, ob ein Makler beteiligt ist. Zudem dauert der ganze Prozess inklusive Grundbuchumschreibung circa drei Monate.

Der Kauf von Aktien oder ETFs kostet hingegen, je nach Depotanbieter, nur circa 1 bis 10 Euro und dauert nur Sekunden, sowie einmalig zwei oder wenige Tage, um ein Wertpapierdepot zu eröffnen und eine erste Überweisung zu tätigen.

Langfristigkeit: München oder Microsoft?

Immobilien eignen sich besser als Aktien für die sehr langfristige Geldanlage über Generationen hinweg.

Was wird länger bestehen und noch dazu in guter Verfassung sein – München oder Microsoft? Die Antwort lautet zweifellos München. Gewiss ist Microsoft ein großes, prosperierendes Unternehmen, und MSFT ist eine sehr empfehlenswerte Aktie, die voraussichtlich weitere Jahrzehnte wachsen und bestehen wird.

Doch wie steht es in 50 Jahren um Microsoft, und wie in 100 Jahren? Um München machen wir uns diesbezüglich keinerlei Sorgen, um Microsoft dafür umso mehr. Es gibt Restaurants, Hotels und Brauereien, die Jahrhunderte bestehen; in der Technologiebranche halten wir das für praktisch ausgeschlossen.

Regionale Wertschöpfung

Bei Aktien und ETF investieren Anleger in nationale und, vor allem bei ETFs, in zumeist US-amerikanische Großkonzerne wie etwa Apple, Google und Microsoft.

Beim direkten Immobilienkauf investieren Anleger regional; auch, indem sie Handwerker vor Ort beschäftigen und Einrichtung und Baustoffe vor Ort kaufen.

Transparenz für Anleger

Beim Kauf einer kompletten, einzelnen Immobilie gibt es nichts, was dem Käufer verborgen bleibt.

Auch Laien können die Vorgänge rund um den Erwerb und Betrieb eines Renditeobjekts gut verstehen. Bei Aktien haben Anleger realistischerweise nur wenig Einblick in das Unternehmen, dessen Aktien sie halten.

Möglichkeit der Einflussnahme

Bei Immobilien kann der neue Eigentümer auf vielfältige Art laufend auf die Wertanlage Einfluss nehmen und damit die Wertentwicklung und die laufende Rendite optimieren.

Bei Aktien gibt es für Privatanleger keine Möglichkeit, derart direkt und umfassend einzugreifen.

Laufender, zeitlicher Aufwand

Vermieter zu sein ist aufwendiger als Aktien oder ETFs zu halten. Immobilieneigentümer können die Verwaltung des Objekts allerdings zu relativ geringen Kosten an eine Hausverwaltung abgeben.

Die Verwaltungskosten werden bei der Rentabilitätsrechnung eingepreist, so wie beispielsweise auch die Kosten für Instandhaltung. Mit einer Hausverwaltung ist ein Anlageobjekt nur noch wenig aufwendiger als ein Aktiendepot.Bei Einzelaktien (statt ETFs) muss man das Argument des geringen Aufwands ohnehin etwas einschränken. Striktes Buy-and-Hold, ohne jemals ins Depot zu gucken, ist theoretisch möglich, aber unwahrscheinlich.

Im Laufe der Jahre kann es zu größeren Einbrüchen aller oder der eigenen Aktien kommen. Das wirft dann die Frage auf, ob man reagiert, indem man innerhalb des Aktienportfolios oder sogar innerhalb der Assetklassen umschichtet. Das bedeutet zeitliche und nervliche Belastung.

Steuerliche Gestaltungsmöglichkeiten

Bei Immobilien gewährt das Finanzamt viele Steuererleichterungen, insbesondere beim Vermögenstransfer durch Erbschaft und Schenkung.

Für den Vermögensaufbau über Generationen hinweg ist die Immobilie daher geradezu prädestiniert.

Langfristige Sicherheit der Eigentümerschaft

Wenn Sie nach 20 Jahren Aufenthalt in einem Gefängnis im Ausland, auf einer Insel verschollen, im Koma oder unter Gedächtnisverlust leidend wieder auftauchen und Ihr Eigentum einfordern, sind die Erfolgsaussichten bei einem Grundbucheintrag voraussichtlich besser als bei Aktienbesitz.

Das Grundbuch gibt es in Deutschland seit Ende des 19. Jahrhunderts. Die Verwahrung im deutschen Rechtssystem würden wir als hundertprozentig sicher bezeichnen. Bei Aktien kann es über so lange Zeiträume sein, dass das Unternehmen insolvent und gelöscht wurde. Eventuell gab es in der Zwischenzeit Handlungsbedarf, vielleicht hätten Sie auf ein Angebot des Unternehmens oder des Insolvenzverwalters innerhalb einer Frist reagieren müssen.

Vielleicht hat sich Ihr Depotanbieter kriminell verhalten oder wurde gehackt, und Sie waren nicht anwesend, um sich um Ihre verlorenen / entwendeten Aktien zu kümmern.

Bei einer so wichtigen und langfristigen Sache wie dem persönlichen Eigentum sind obige, vielleicht abstrus wirkende Überlegungen nicht unangebracht.

Soziale Aspekte

Durch Sanierung, Dachgeschossausbau oder Teilung schaffen Immobilieninvestoren neuen Wohnraum.

Der Immobilieninvestor verschafft dadurch Erleichterung in einem Problemfeld mit überragender gesellschaftlicher Bedeutung.

Bei Aktien ist die Auswahl beschränkt und die Rendite oftmals verringert, wenn nur in sozial agierende Unternehmen (bei börsennotierten Unternehmen ein Widerspruch in sich) investiert werden soll.

Rendite bei Immobilien und Aktien

Ein wichtiger Unterschied zwischen Immobilieninvestments und Aktieninvestments liegt in der Finanzierungsform:

| Immobilieninvestment | Aktieninvestment | |

|---|---|---|

| Finanzierung durch | Fremdkapital | Eigenkapital |

| Eigenkapitalrendite | Eher niedrig, da aktuell hohe Zinsen, aber die Zinsen sinken wieder (Stand Nov 2024) | Niedrig, da viel Eigenkapital eingesetzt wird |

- Wenn ich als Anleger nun 10.000 Euro Eigenkapital für ein Aktieninvestment einsetze, so kann ich mit einer Rendite zwischen 7% und zuletzt 10% p.a. rechnen (das sind die langjährigen Durchschnitte des MSCI-World ETF).

- Wenn ich als Anleger 10.000 Euro Eigenkapital für ein Immobilieninvestment einsetze, so kann ich damit eine Eigentumswohnung im Wert von ca. 100.000 bis 120.000 Euro kaufen (Annahme: Die Kaufnebenkosten werden durch Eigenkapital gedeckt).

Aufgrund der aktuell (Stand Juni 2024) im Vergleich zu den Vorjahren erhöhten Zinsen ist die Eigenkapitalrendite beim Immobilienkauf momentan bei einer 100%-Finanzierung eher gering.

Der mögliche Wertzuwachs sowie der Inflationsschutz werden hierbei noch nicht berücksichtigt.

Im Investmentbereich wird häufig vom Leverage-Effekt gesprochen. Damit ist der (renditesteigernde) Hebeleffekt gemeint, den die Aufnahme von Fremdkapital auf die Eigenkapitalrendite ausübt.

In der Praxis wird der Hebeleffekt bei Immobilien angewandt. Bei Aktien könnte man mit einem Lombardkredit hebeln. Ein solcher Kredit ist aber eher riskant und für Privatpersonen nicht so leicht zu erhalten wie eine Immobilienfinanzierung.

Der Fremdkapitalhebel ist ein Instrument, um einen geringen Eigenkapital-Betrag optimal nutzen zu können.

Bei einem Lombardkredit beleiht der Anleger sein Wertpapierdepot und erhält für den Aktienkauf Fremdmittel der Bank – zu entsprechend hohen Preisen.

Trading mit Hebelwirkung beinhaltet immer das Risiko eines Totalverlustes und ist daher nichts für Einsteiger.

Geld in Immobilien anlegen – die meisten denken, dass dafür eine Menge eigenes Geld notwendig ist.

Doch dem ist nicht so, denn in der Regel ergibt es für den Kapitalanleger Sinn, nur die Kaufnebenkosten mit Eigenkapital abzudecken. Der eigentliche Kaufpreis wird zu 100% finanziert.

Passives Einkommen mit Aktien und Immobilien

Um passives Einkommen zu generieren, eignet sich kaum etwas besser als der Erwerb und die Vermietung einer Immobilie.

Zwar ist der Aufbau von passivem Einkommen auch mit Aktien möglich, allerdings ist hier darauf zu achten, dass die Aktien Dividenden ausschütten. Dann aber steigt der Wert der Aktie nicht stark an.

Wachstumsaktien schütten in der Regel keine Dividenden aus, sodass sich Anleger entscheiden müssen, ob sie ein regelmäßiges Einkommen durch ihre Aktiengeschäfte einfahren oder auf eine Wertsteigerung spekulieren möchten.

Bei der Immobilie ist wiederum beides gegeben:

- Die Immobilie erwirtschaftet Mieteinnahmen. Diese stellen die monatliche Rendite der Kapitalanlage dar.

- Der Wertzuwachs der Immobilie, der beim Verkauf realisiert wird, entspricht dem Kursgewinn einer Aktie.

Die Immobilie könnte man somit als die bessere Aktie bezeichnen: Geringer Eigenkapitaleinsatz durch Fremdkapitalhebel, monatliche Dividende dank regelmäßiger Mieteinnahmen und Partizipation an Wertzuwächsen am Immobilienmarkt.

Historische Renditen bei Aktien und Immobilien

Historische Rendite MSCI World

Als Vergleichswert zum Immobilieninvestment eignet sich die Rendite, die eine Geldanlage auf den MSCI World erwirtschaftet hat. Wir betrachten den Zeitraum von 1987 bis heute.

In dieser Periode lag die durchschnittliche Rendite im Jahr bei 8,01 %.

Historische Rendite Immobilien

Bei einer vermieteten Immobilie als Kapitalanlage konnte man vor der Zinswende bei einem Fremdkapitaleinsatz von 100% mit einer Eigenkapitalrendite von 10 bis 25% rechnen.

Wollte der Anleger mehr Eigenkapital einsetzen – zum Beispiel 20% des Kaufpreises aus Eigenmitteln aufbringen und nur 80% finanzieren – dann konnte er mit einer Eigenkapitalrendite von 5 bis 10% rechnen.

Achtung: Bei diesen Werten ist die Wertsteigerung bei Immobilien in Deutschland nicht einberechnet. Diese wird in manchen Beispielrechnungen oft mit 1% pro Jahr angesetzt.

Für professionell ausgewählte Renditeobjekte halten wir das für zu pessimistisch. 1% entspricht eher der durchschnittlichen Wertentwicklung aller Wohnimmobilien über alle Lagen hinweg, schlechtere Lagen eingeschlossen.

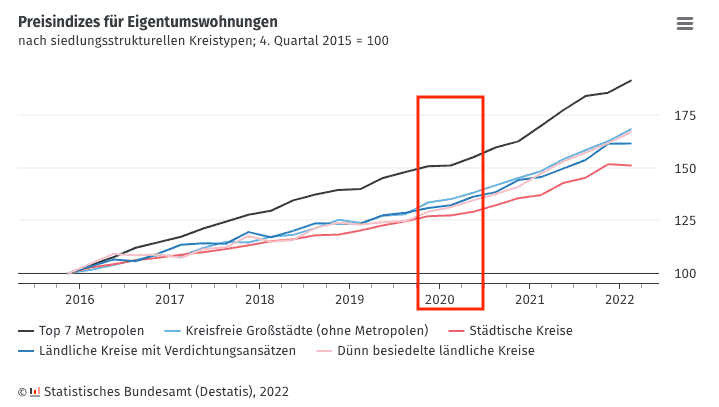

Wie wertstabil Immobilien im Gegensatz zu Aktien sind, zeigte im Jahr 2020 die Corona-Krise. Aktienmärkte brachen in der Spitze bis zu 30% ein, während sich Immobilien wie zuvor in einem stetigen Aufwertungs-Trend befanden.

Eigentumswohnungen verloren während Corona fast gar nicht an Wert.

Immobilien oder Aktien: Am besten beides

Beim Vergleich Aktien/ETF oder Immobilien geht nach unserer Ansicht die Immobilie bei größeren, langfristigeren Anlagen als Siegerin hervor, insbesondere wenn das Vermögen einst vererbt werden soll.

Zudem müssen Sie sich nicht zwischen regelmäßiger Rendite oder Wertsteigerung entscheiden.

Prinzipiell stellen Aktien und Immobilien ein sinnvolles Tandem dar:

- Im wirtschaftlichem Abschwung laufen Aktien schlecht, während Immobilien von niedrigen Zinsen profitieren (günstiger Aufnahme von Fremdkapital und Werterhöhung durch Ertragswertverfahren).

- Im Aufschwung steigen Aktienkurse und Zinsen. Da gleichzeitig Immobilienpreise mitsteigen, profitieren Anleger optimal von einer Kombination aus Aktien und Immobilien.

Gerne beraten wir Sie hinsichtlich der Kombination beider Anlageklassen. Unser 360-Grad-Paket ist unser Rundumservice für Renditeimmobilien. Wir begleiten Sie gerne auf dem Weg zu Ihrem ersten oder nächsten Immobilieninvestment.